For hundreds of years stocks have been a popular investment. Companies issue stocks to raise capital for expansion and new projects.

Each share of the stock represents a partial ownership in the company. When the company makes a profit, the value of the stocks rise.

Stock owners can sell their shares for a profit, or hold on to the stock for even more gain in the future. Sometimes companies will issue dividends ? that is part of the profits that are distributed to share holders.

Stock Exchanges

Stocks are traded on stock exchanges. Most stocks are bought and sold through brokers who charge a commission or fee for this service.

United States stock exchanges include the New York Stock Exchange (NYSE), the American Stock Exchange, and the National Association of Securities Dealers Automated Quotation System (NASDAQ). Most stocks are listed only on 1 exchange.

Long-Term Trading Vs. Day Trading

Stocks were traditionally seen as long-term investments. So-called “blue chip” stocks, those having proven value over many years, often formed the basis of an investment portfolio.

Short-term trading is a relatively new phenomenon in stock trading, made possible by the advent of the internet. Day traders attempt to take advantage of large daily fluctuations in the market by buying and selling many times in a single trading day.

This is relatively risky, and any profits are reduced by the broker commissions charged on each transaction.

The Foreign Exchange Market

The Foreign Exchange Market (Forex) is quite different from the stock exchange. Forex is primarily a short-term market. Most traders enter and exit deals within a 24 hour period – sometimes within a few minutes.

Many Forex trades can be made in 1 day without building up a large brokerage fee, because Forex trades are commission-free. Brokers earn money by setting a spread – the difference between asking and selling prices.

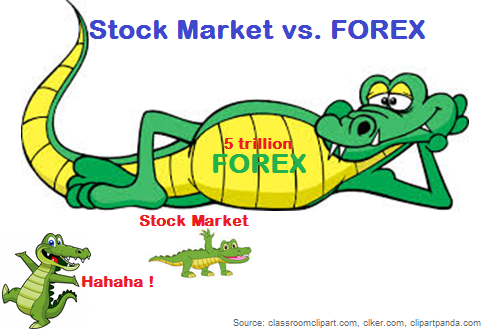

The Forex is the largest financial market in the world, with transactions worth $1.9 trillion every day. By comparison, all the American stock exchanges combined handle about $100 billion.

The huge volume of Forex allows it to be one of the most liquid markets in the world. Liquidity is a business or economics term that refers to the ability to quickly buy or sell a particular item without causing a significant movement in the price.

There is always a buyer and seller for any type of currency, because the world economy relies on the movement of goods from country to country. The stock market is less liquid because participants may choose to hold their investments indefinitely or move on to other markets.

Five Days A Week Non-Stop Trading

The Forex is not based in any one location. Trading markets are located worldwide and, due to time zone differences, trades can be made 24 hours a day, 5 days a week.

Trading begins in Sydney, Australia on Monday morning (Sunday afternoon New York time) and continues non-stop until Friday afternoon New York time.

Stock exchanges have more limited trading hours. While it is possible to trade on exchanges worldwide, each exchange is independent and operates for just 7 hours a day.

It is not possible to buy or sell a certain stock that is listed only on one stock exchange when that exchange is closed.

Other Forex Advantages

- It is more predictable than stocks; it follows well-established trends.

- It allows high leverage; leverage is using given resources in such a way that the potential positive outcome is magnified. Typical Forex leverage figures are a 100:1 as opposed to 2:1 on the stock market.

- It doesn’t require a large investment – mini accounts as small as $250 can get you started in the Forex.

As a point of conclusion, it must be mentioned that Forex trading is not without risk. Neither is the stock market. Either trading vehicle requires education, planning, discipline, and some disposable income.