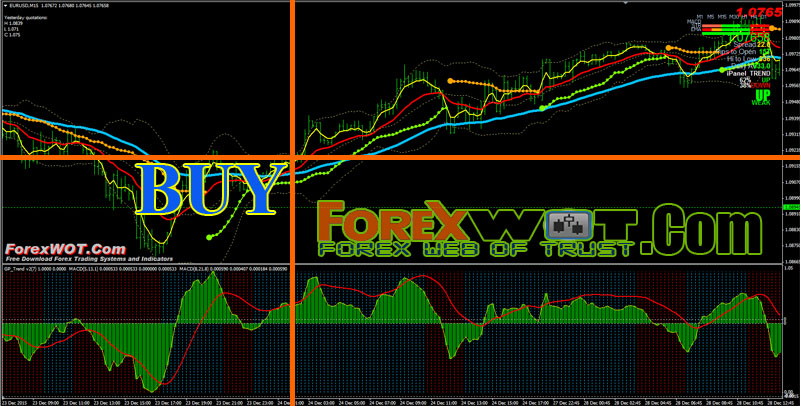

Very Easy Successful Forex MACD Scalping Trading System and Strategy – Choose This MACD Scalping Methodology And Be Consistent.

Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices.

The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the “signal line“, is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

There are three common methods used to interpret the MACD:

- Crossovers – As shown in the chart above, when the MACD falls below the signal line, it is a bearish signal, which indicates that it may be time to sell. Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum. Many traders wait for a confirmed cross above the signal line before entering into a position to avoid getting getting “faked out” or entering into a position too early, as shown by the first arrow.

- Divergence – When the security price diverges from the MACD. It signals the end of the current trend.

- Dramatic rise – When the MACD rises dramatically – that is, the shorter moving average pulls away from the longer-term moving average – it is a signal that the security is overbought and will soon return to normal levels.

Traders also watch for a move above or below the zero line because this signals the position of the short-term average relative to the long-term average.

When the MACD is above zero, the short-term average is above the long-term average, which signals upward momentum. The opposite is true when the MACD is below zero.

As you can see from the chart above, the zero line often acts as an area of support and resistance for the indicator.

The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Traders can look for signal line crossovers, centerline crossovers and divergences to generate signals.

Because the MACD is unbounded, it is not particularly useful for identifying overbought and oversold levels.

- MACD above zero line;

- MA 4 above MA 16;

- MA 16 above MA 60;

- GP Tren Blue;

- BBands Stop green;

- Signal Direction green;

- iPanel Tren Strong UP.

- MACD below zero line;

- MA 4 below MA 16;

- MA 16 below MA 60;

- GP Tren Red;

- BBands Stop red;

- Signal Direction red;

- iPanel Tren Strong DOWN.

The MACD’s forecasting ability makes it one of the most popular indicators. But watch out for attributing too much to it.

A shock can come along and cause the price to vary wildly from the trend, whereupon the tendency to converge or diverge becomes irrelevant.

A new price configuration develops, and because the MACD is comprised of moving averages, the indicator still lags the price event like any other moving average.

Thank you for sharing this information. should all the sell rules or buy rules be met before taking the trade? Can the trade be taken if any one of the rules is met?

Hi Joe,

Yes, you are right, discipline to the trading rules is your key to success.

discipline, discipline, and discipline

Thank you Linda. That’s an important reminder. I appreciate that.

what pair and time frame should i trade? Major pair? 15m above?

Best Time Frame : M15 above

Currency Pairs : EURUSD and GBPUSD