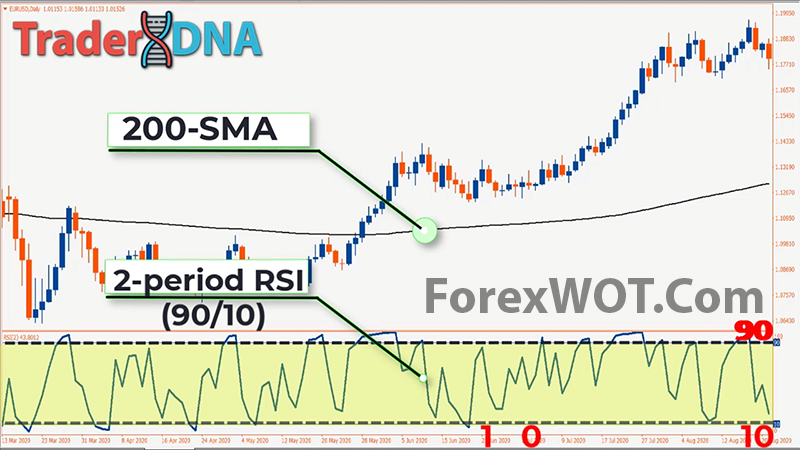

2-period RSI (90/10) – This RSI trading strategy was developed by Larry Connors and the idea is to find periods when the short term trend is deeply oversold within an overall price uptrend or when the short term trend is hugely overbought in an overall downtrend.

Because it is intended for entry point within a trend, Connors uses a much more sensitive lower timeframe – 2 periods on the RSI. Because 2 is such a short timeframe, Connors attempts to filter out the false signals by using the 90 and 10 levels instead of the 70 and 30 levels for overbought and oversold. In essence this a trading method to buy the dip and sell the rip.

- Download “ForexWOT-LarryConnorsSystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-LarryConnorsSystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-LarryConnorsSystem” trading system and strategy.

- You will see the “Larry Connors 2-period RSI System” is available on your Chart.

Here are the steps to using this RSI strategy:

- Plot a 200-period simple moving average (SMA) to determine the overall price trend.

- Add the RSI indicator and change the settings to 2 periods.

- Adjust the levels for overbought and oversold to 90 and 10.

RSI Buy signal when;

- Price above the 200 SMA

- 2-period RSI below level 10 (oversold)

RSI Buy signal when;

- Price below the 200 SMA

- 2-period RSI above level 90 (overbouught)

The RSI is one of the most popular indicators for forex traders, cryptocurrency traders, stock traders and futures traders. But it is not the indicator itself that makes users of the RSI successful in trading.

Traders must spend the time to back test an RSI trading strategy to make sure it has worked in the past and then test that strategy in a live trading environment with good trading discipline to have the best chance for a profitable trading strategy that works in the future.