FREE DOWNLOAD 4 Best Forex London Session Trading System – just before the Asian trading hours come to a close, the European session takes over in keeping the currency market active. This FX time zone is very dense and includes a number of major financial markets that could stand in as the symbolic capital.

However, London ultimately takes the honors in defining the parameters for the European session. Official business hours in London run between 7:30 a.m. and 3:30 p.m. GMT. Once again, this trading period is expanded due to other capital markets’ presence (including Germany and France) before the official open in the U.K.; while the end of the session is pushed back as volatility holds until the London fix after the close. Therefore, European hours are typically seen as running from 7 a.m. to 4 p.m. GMT. Bellow are 4 Best Forex London Session Trading System;

London Session Forex CCI Fibonacci Retracement Trading System and Strategy

Forex CCI Fibonacci Retracement Trading – The commodity channel index (CCI) is an oscillator originally introduced by Donald Lambert in 1980.

Since its introduction, the indicator has grown in popularity and is now a very common tool for traders in identifying cyclical trends not only in commodities, but also equities and currencies. The CCI can be adjusted to the timeframe of the market traded on by changing the averaging period.

Forex Easy M15 Trading the London and New York Session With Moving Average and ADX

Trading the London – New York Session With Moving Average and ADX. The open of the London session at 3:00 AM is when many consider this type of behavior to be starting for the day in the FX Market. By many accounts, London is the heart of the FX market with approximately 35% of daily volume transacted during this session.

As the US (New York) session begins 5 hours later, the environment can change quite a bit as even more liquidity is entering the market; and this time it is coming from both sides of the Atlantic. For the purposes of this article, we are going to focus on the London session, before the US opens for business (3-8 AM Eastern Time).

The slower Tokyo market will lead into the London session, and as prices begin to come from liquidity providers based in the United Kingdom, traders can usually see volatility increase. As prices begin to come in from London, the ‘average hourly move’ on many of the major currency pairs will often increase.

Forex GBP-USD London Session Trading System and Strategy

Forex GBP-USD London Session Trading Strategy – Installation instructions Forex GBP-USD London Session Trading System :

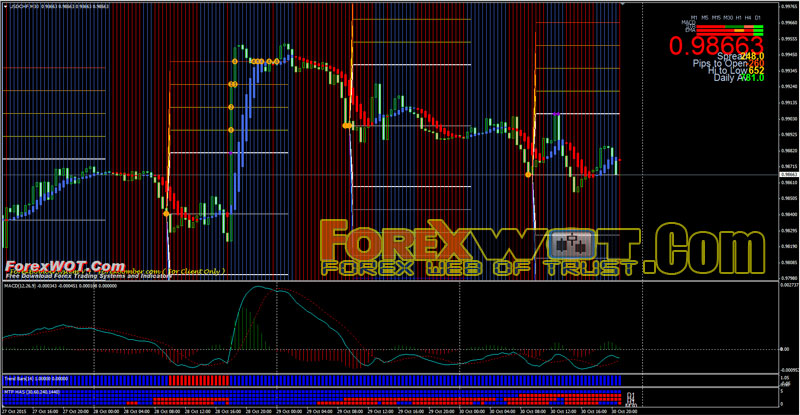

Forex MACD Pip Pirate Trading System – High Profit Trading During the London and US Sessions

Forex MACD Pip Pirate Trading System or Forex Pip Pirate™ works on all timeframes. That’s right, it’s pretty much universal. Well, within reason, I mean don’t go off and start scalping the 1-minute right from the start (it’s damn tricky!).

<

<Make it easier for yourself and stick to higher timeframes.

I’ll give you two tips for trading intraday:

- Stick to 15-min and above.

- Try and only trade during the London and US sessions – you’ll win more trades that way (although, the Asian session is good for AUD, NZD and JPY pairs!).

Let’s setup our charts!

BONUS : Lower risk, stress free TDI system

I tried this system for some months but I gained 40% success from their system. I tried to modify the system to find out higher potential entries. Following I will explain my strategy which can be used for newbies of TDI system.

I personally prefer to use method 1 for daily chart, as I need to only check the charts at the start of the day and open possible positions and leave it until the end of the day. So it is stress free strategy. However, both method 1 and 2 can be used for 4H if you like to monitor graphs during the day.

Method 1 :

At the beginning of the day, I will check all 28 pairs for possible entries based on the following rules:

BUY:

1) Stochastic : Should be over 80

2) TDI : a) Green should cross above the red line or show a rebound b) prefer that cross or rebound happened above the yellow line.

Sell:

1) Stochastic : Should be bellow 20

2) TDI : a) Green should cross bellow the red line or show a rebound b) prefer that cross or rebound happened bellow the yellow line.

Method 2:

If I want to look at 4H charts for more entries, ( usually when I do not have any entries from method 1 at the beginning of the day), during the day , I will follow the bellow rules:

1) Check method 1 for possible entries on chart 4H

or

2) BUY:

2-1) Stochastic : near or above 50

2-2) TDI : a) looking for cross or rebound but where it is near or above yellow line b) cross or rebound upward

3) SELL:

3-1) Stochastic : near or BELLOW 50

3-2) TDI : a) looking for cross or rebound but where it is near or BELLOW yellow line b) cross or rebound DOWNWARD

I will add charts to clarify the strategy.

These methods provided 80% successful entries for me !!!!! You can back test from history data to check the possible entries.