High accuracy “ATR Stops & Projections Forex Trading Strategy” – Average True Range (“ATR”) was introduced by J. Welles Wilder in his 1978 book New Concepts In Technical Trading Systems.

ATR is a measure of volatility for a currency pair and is explained in detail at Average True Range.

Wilder experimented with trend-following Volatility Stops using the Average True Range. The system was subsequently modified to what is commonly known as ATR Trailing Stops.

- Time Frame: H1 or higher

- Currency Pairs: Any

- ATR Stops

- ATR Projection

- LURCH SRv5

- Trend Signal

- CCI NUF

- Profitable Strategy

- Relative Strength Index

Signals are used for exits:

- Exit your long position (SELL) when price crosses below the ATR Stops line.

- Exit your short position (BUY) when price crosses above the ATR Stops line.

While not conventional, they can also be used to signal entries — in conjunction with a trend filter.

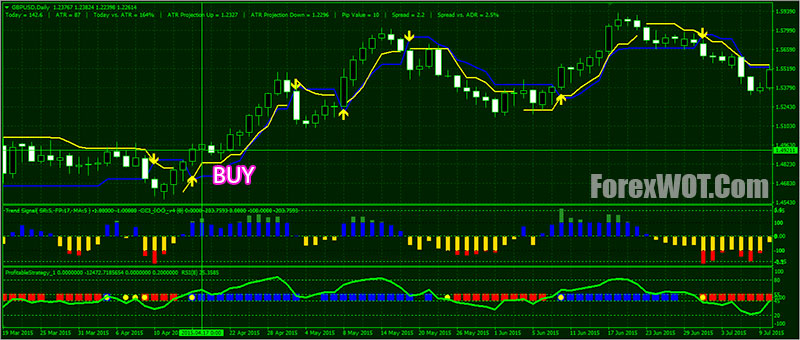

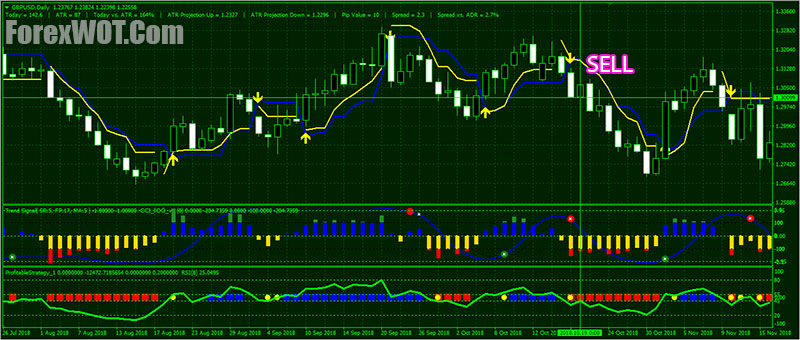

Example

Below is the GBPUSD H4 TF is displayed with Average True Range Trailing Stops indicator

- Go short [SELL] when price closes below the ATR stops, Exit [X] when price crosses above the ATR stops

- Go long [BUY] when price closes above the ATR stops, Exit [X] when price crosses below the ATR stops

Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend.

That is why it is important to use a trend filter.

Average True Range Trailing stops are more adaptive to varying market conditions than Percentage Trailing Stops, but achieve similar results when applied to stocks that have been filtered for a strong trend.

- Download “ForexWOT.Com-ATRStopProjectionSystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT.Com-ATRStopProjectionSystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT.Com-ATRStopProjectionSystem” trading system and strategy

- You will see “ATR Stops & Projections Trading System” is available on your Chart

- ATR Stops: Below the candles

- LURCH SRv5: Below the candles

- CCI NUF: Blue histogram

- Profitable Strategy: Blue signals

- Relative Strength Index: Upward and above the level 55 line

- ATR Stops: Above the candles

- LURCH SRv5: Above the candles

- CCI NUF: Yellow histogram

- Profitable Strategy: Red signals

- Relative Strength Index: Downward and below the level 45 line

The ATR may be used by market technicians to enter and exit trades, and it is a useful tool to add to a trading system.

It was created to allow traders to more accurately measure the daily volatility of an asset by using simple calculations.

It is possible to use the ATR approach to position sizing that accounts for an individual trader’s own willingness to accept risk as well as the volatility of the underlying market.

[sociallocker]

[/sociallocker]

How come the download link didn’t show up after I did the 2 required tasks ???

I tried again and again many times !

it’s possible add email and push alerts?