The Best and Correct MACD Settings – Are you an indicator trader? If yes, then the MACD is a useful indicator in the identification of price trends and direction.

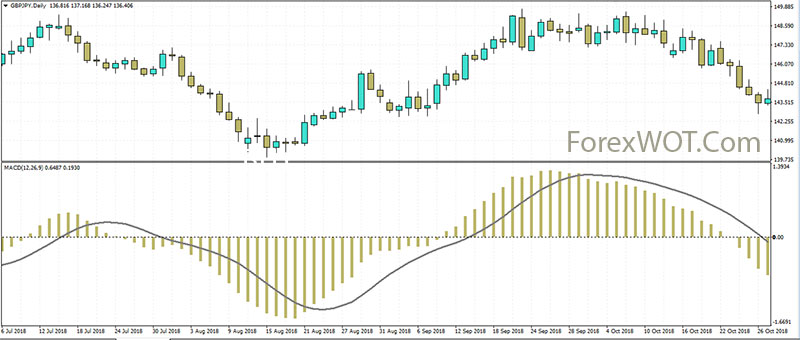

The Moving Average Convergence Divergence (MACD) calculation is a lagging indicator used to follow trends. It consists of two exponential moving averages and a histogram.

The MACD line is the heart of the indicator and by default, it’s the difference between the 12-period EMA and the 26-period EMA.

This means that the MACD line is basically a complete moving average crossover system by itself.

Day traders may want a faster indicator to cut down on lag time due to their short term trading style. The search for the best settings for any indicator is a trap many of us have fallen into at least once in our trading.

The reason I always start with the default settings is that there are so many different combinations that can be used for any indicator. When you look at the MACD values, you have 3 that can be altered.

The question should always be “will it make a difference”.

You must test any changes you make to ensure it actually adds to your trading plan.

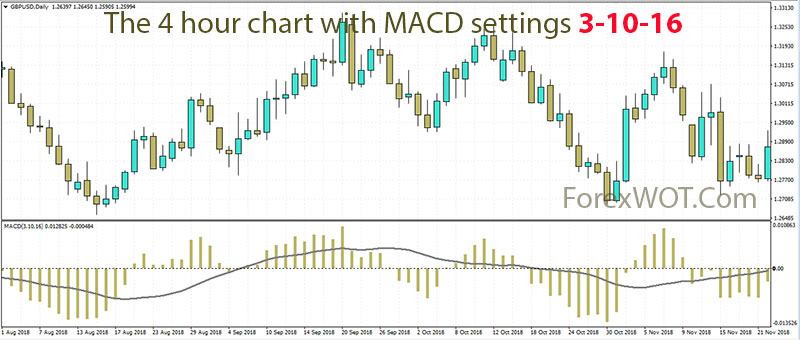

That said, one very popular combination of the MACD is 3-10-16 which is a variation of the 3/10 oscillator.

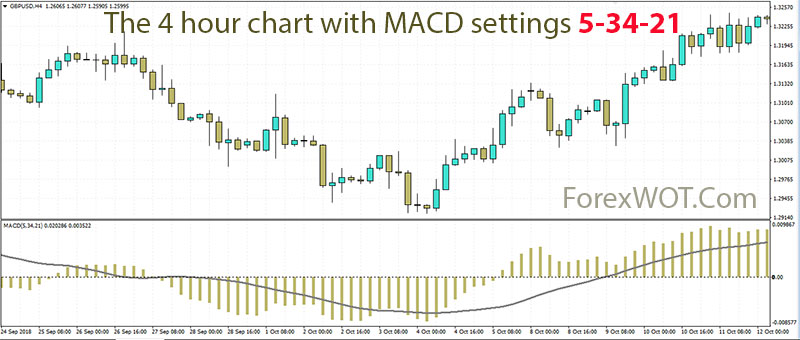

Or using the 4-hour chart with MACD settings 5-34-21.

I highly suggest that before you start crunching numbers and looking for short term MACD settings for faster signals, you know exactly how the MACD works and determine if it will benefit your own trading.

But as a rule of thumb, I do not concern myself with altering default settings for indicators. This can lead down a slippery slope of analysis paralysis.

Do not be fooled by those who say THERE ARE THE BEST SETTINGS FOR DAY TRADING.

Indicators are simply derivatives of price, not a perfect trading tool.

The only difference is how fast the indicator reacts to price changes. Most of us will probably be chopped to pieces if we rely only on a short term trading indicator as to the basis for a trading system.

There are three primary uses for the MACD indicator, each offering advantages, and disadvantages. Combing all three functions will help eliminate some losing MACD trade signals.

Below are how to use the MACD in conjunction with other indicators and price analysis.

[sociallocker]

[/sociallocker]

Forex Red-Green System: Double BBand Stop trading with the MACD2Line filter.

The BBands Stop indicator (Bollinger Bands Stop line) is a trend indicator. When the price is over the green curve, the trend is bullish or bearish if the price is below its red line.

[sociallocker]

[/sociallocker]

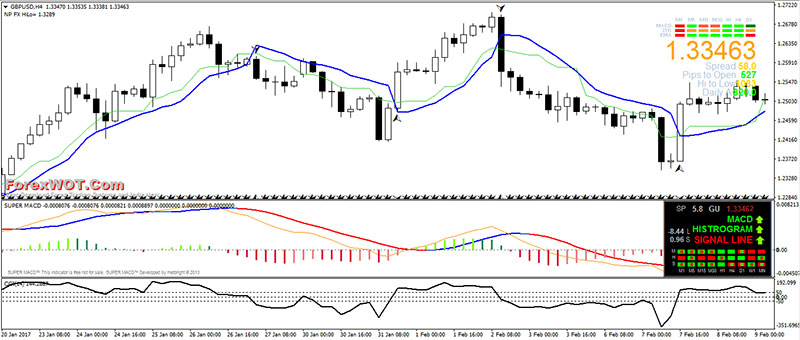

High Probability NPFX Hilo Trading Strategy with CCI MACD Indicators – How to gets high probability trading setups?… The answer is to trade in the direction of the market trend.

When the price is in an uptrend, you should STAY LONG. When the price is in a downtrend, you should STAY SHORT.

Wow Darren can we all have your autograph?

I do trading and i’m really good!