FREE DOWNLOAD EMA Vortex System – The Best Forex Trading System To Greatly Increase Your Trading Performance. The trading system below you can easily start implementing today, RIGHT NOW…

Moving average is very effective in Forex market and in this strategy we have used 21 Exponential Moving Average with Vortex and Williams’ Percent Range indicator.

The combination of these 3 “POWERFUL” trading indicators indicate about market trend and help to identify trend direction easily.

This strategy can be used for both short term and long term.

The 21 Exponential Moving Average is my preferred choice when it comes to short-term swing trading (H4 or Daily Chart trading).

Most H4 and Daily chart traders use it to ride medium short-term trends because it’s the ideal compromise between too short and too long term.

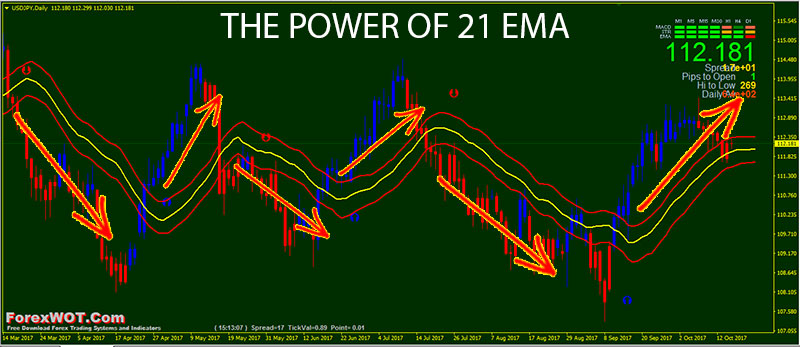

In the above USDJPY Daily chart, price cross below 21 EMA, then market price started falling. When price cross above 21 EMA, then market price started growing.

With high accuracy momentum and trend filter indicators, this 21 EMA Vortex System works well in almost all currency pairs and all time frames.

Risk Warning: For intraday trading, you should apply this strategy on London and US session.

On slow market condition, you can’t gain from this system.

So practice this strategy on demo and if you can satisfied with this, then you can use this strategy on your real account.

- Best Time Frames: H4 and Daily

- Recommended Currency Pairs: GBPUSD, GBPAUD, EURUSD, GBPJPY, USDJPY

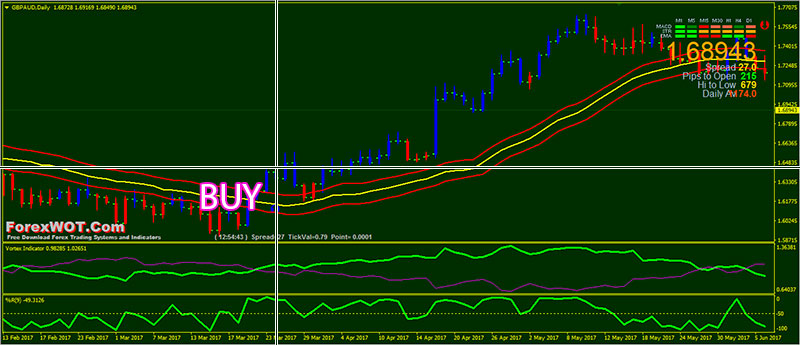

- Price cross above 21 EMA

- MA Candles blue color

- Vortex lime color line upward and above magenta color line

- WPR line upward and above -50 level

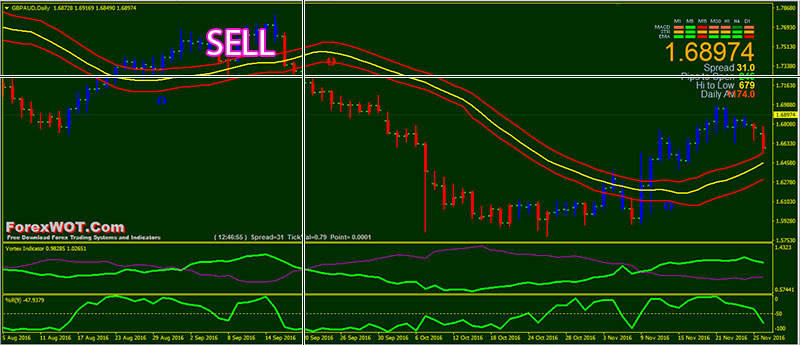

- Price cross below 21 EMA

- MA Candles red color

- Vortex lime color line downward and below magenta color line

- WPR line downward and below -50 level

How To Greatly Increase Your Trading Performance?…

- The answer is: Decrease Your Risk

This is high accuracy trading system.

But from what I have seen over the past few years working with amateur traders, I can guarantee you that 99% of retail traders (that is YOU!) are risking way too big a portion of their account/net worth and are hugely over leveraged.

The general rule which people can find on the internet is that they should never risk more than 3% or 2% of their account.

I think that is way TOO MUCH for beginners and for most experienced traders, as well.

The more you risk, the more emotionally involved you will be, the more your judgment will be clouded, and the higher your account volatility will be.

Risking anywhere from 0.1% to 0.5% is a sensible approach and will make trading MUCH more fun for you as thinking clearly and making sound decisions without pressure and anxiety is indeed a lot of fun.

I am convinced that a lot of people reading this would magically turn into profitable traders if they simply turned down their risk.