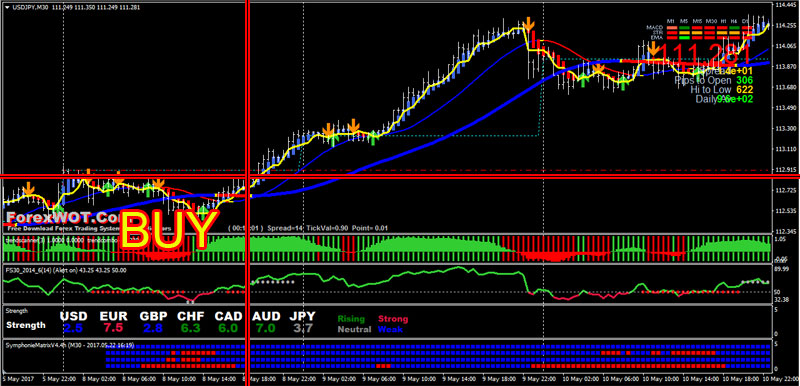

Super Simple 30 Minutes Time Frame Forex Trading Strategy. ForexWOT THV Coral TrendCombo M30 System : Best IntraDay Trading System for The ‘Best’ Time Frame to Trade. If you want faster results and are inclined to technical analysis, then day trading would be the best style for you – which means M30 and H1 would be the best time-frames.

THV Coral Indicator – This is a famous trend indicator in MT4 platform. Is this better than other MA based trend systems? I will let you decide that 🙂

Supported modes:

- Trend mode: This is the default. Draws a trend line (like MA) and colors them based on the trend.

- Ribbon Mode: Shown at the bottom pane. No trend lines are drawn.

- OverlayMode: Bars are colored based on the current trend. Trend line is also displayed (default color=gray).

ForexWOT THV Coral TrendCombo M30 Trading Rules

ForexWOT THV Coral TrendCombo M30 Trading system is a trend following strategy based on the THV Coral and TrendCombo indicators.

- Best IntraDay Time Frame : M30 and H1

- Best Short Term Swing Trading Time Frame : H4 and D1

- Recommended Currency Pairs : EUR/USD, USD/JPY, AUD/USD, GBP/USD, GBP/JPY, EUR/JPY, AUD/NZ, USD/NZ.

Metatrader Trading Indicators

- THV Coral

- TrendCombo

- Signal Trend

- Daily and Weekly open

- KH trade monitor

- Coral indicator

- Heiken Ashi professional

- RSI with Support and resistance

BUY Rules

- Buy when the price is above the daily and weekly open

- Blue THV coral (20 and 50)

- Heiken Ashi professional is blue

- RSI is green and above 50 level

- Magic Matrix blue color

- Signal Trend green color

SELL Rules

- Sell when the price is below the daily and weekly open

- Red THV coral (20 and 50)

- Heiken Ashi professional is red

- RSI is red and below 50 level

- Magic Matrix red color

- Signal Trend red color

Protective Stop Loss and Exit Options

As with any trading an initial protective stop loss should ALWAYS be entered no matter what.

The price at which the stop loss can be a set number of pips based on the pair being traded, the chart interval, and/or the range. On the 15-30-60 and 240 minute an 80 Pip stop loss and 80 pip profit target backtested well for us.

Placing a stop market order behind the SR Level (under it fora long trade, above it for a short trade) can be used instead of or in addition to a protective stop loss of a set number of pips.

Profitable Exit Options (More than one of these can be used at the same time, for any given trade. Again, it’s up to the user/trader to use discretion).

[sociallocker]

[/sociallocker]