H4 – D1 Forex Major Trend Trading Strategy with Adaptive Laguerre Filter and Double CCI EMA Indicator. Trading can better be learned by first, identifying the MAJOR TREND and second, finding trading opportunities within the overall trend.

For traders looking for a MAJOR TREND following strategy, there is nothing better and simpler than using the Exponential Moving Average. One of the commonly used indicator, the Moving Averages form the basis for many different trend following strategies.

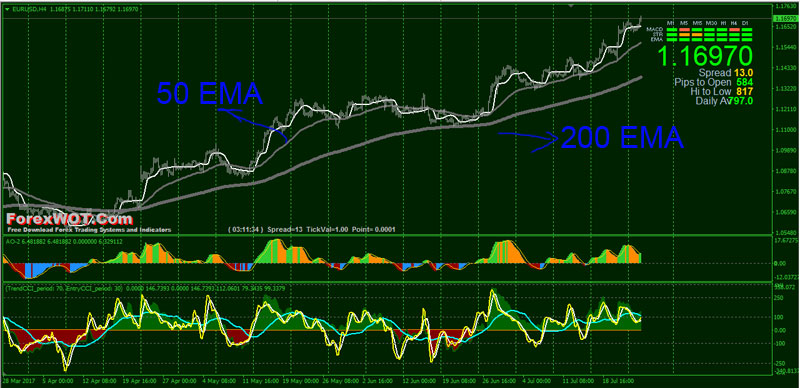

In this Forex Major Trend Trading with Adaptive Laguerre Filter and Double CCI EMA Indicator, we make use of the 200 and 50 periods exponential moving average applied to the 4-Hour and Daily charts.

- 200 EMA applied to closing prices on the H4 charts: This forms the main basis of our bias. Because the H4 chart interval closely follows the daily charts, trends are well reflected in this time frame.

- 50 EMA applied to closing prices on the H4 charts: This moving average will be the key towards managing risks in our trade.

The chart below shows the set up for this strategy.

- Best TimeFrames: 4 Hour

- Recommended Currency Pairs: EURUSD, GBPUSD, USDJPY, and All Major Pairs

- 200 ExponentialMoving Average

- 50 Exponential Moving Average

- Signal Trend

- Awesome 2

- Double CCI with EMA

- 50 EMA line upward and above 200 EMA line

- Price upward above Adaptive Laguerre Filter line

- Awesome 2 green color histogram and above 0 level

- Double CCI with EMA uptrend

- 50 EMA line upward and above 200 EMA line

- Price upward above Adaptive Laguerre Filter line

- Awesome 2 green color histogram and above 0 level

- Double CCI with EMA uptrend

The advantage of using this trading strategy can be summarized into the following:

- Using the two moving averages and entering after the trend is established offers a low-risk trading strategy

- All the trades come with a minimum of 1:2 risk/reward trading strategy

- Because the strategy is based on H4 chart interval, the average holding period for the trades can be between a few days to a week at the most

- The trading strategy is very objective but requires a bit of practice to identify the trade set ups