How to Choose Best Forex Broker – The retail forex market is so competitive that just thinking about having to sift through all the available brokers can give you a major headache.

Choosing which forex broker to trade with can be a very overwhelming task especially if you don’t know what you should be looking for.

How to Choose Best Forex Broker

In this section, we will discuss the qualities you should look for when picking a good forex broker.

1. Security

The first and foremost characteristic that a good broker must have is a high level of security. After all, you’re not going to hand over thousands of dollars to a person who simply claims he’s legit, right?

Fortunately, checking the credibility of a forex broker isn’t very hard. There are regulatory agencies all over the world that separate the trustworthy from the fraudulent.

Below is a list of countries with their corresponding regulatory bodies:

- United States: National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC)

- United Kingdom: Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA)

- Australia: Australian Securities and Investment Commission (ASIC)

- Switzerland: Swiss Federal Banking Commission (SFBC)

- Germany: Bundesanstalt für Finanzdienstleistungsaufs

icht (BaFIN) - France: Autorité des Marchés Financiers (AMF)

- Canada: Autorité des Marchés Financiers (AMF)

- Before even THINKING of putting your money in a broker, make sure that the broker is a member of the regulatory bodies mentioned above.

2. Transaction Cost

No matter what kind of currency trader you are, like it or not, you will always be subject to transaction costs.

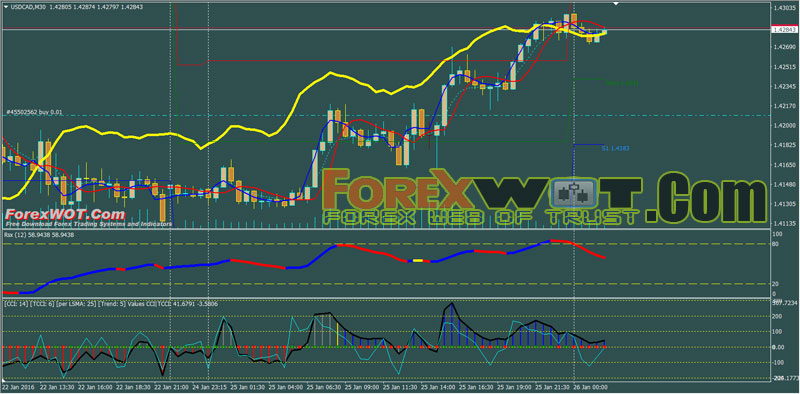

BONUS : FREE DOWNLOAD Very easy high accuracy Forex MA 5 Neuro Trend Trading with CCI and RSI Filter Indicator – Trading trends is fairly straight forward and can lead to profitable trading in the appropriate situation on the right pairs.

Today we will discuss Forex MA5 Neuro Trend Trading Strategy that identifies trend trading opportunities and can trade them effectively.

Every single time you enter a trade, you will have to pay for either the forex spread or a commission so it is only natural to look for the most affordable and cheapest rates. Sometimes you may need to sacrifice low transaction for a more reliable broker.

Make sure you know if you need tight spreads for your type of trading, and then review your available options. It’s all about finding the correct balance between security and low transaction costs.

3. Deposit and Withdrawal

Good FX brokers will allow you to deposit funds and withdraw your earnings hassle-free. Brokers really have no reason to make it hard for you to withdraw your profits because the only reason they hold your funds is to facilitate trading.

Your broker only holds your money to make trading easier so there is no reason for you to have a hard time getting the profits you have earned. Your broker should make sure that the withdrawal process is speedy and smooth.

4. Trading Platform

In online forex trading, most trading activity happens through the brokers’ trading platform. This means that the trading platform of your broker must be user-friendly and stable.

When looking for a broker, always check what its trading platform has to offer.

Does it offer free news feed? How about easy-to-use technical and charting tools? Does it present you with all the information you will need to trade properly?

Disclaimer: I am the CEO of Charts.io.

I think you should choose us, and here is why:

1. We don’t pad the spread or charge commission, which makes a huge difference in your profitability.

2. Our platform is the most advanced out there. Probably the only one built in the last decade.

3. We are always available for a conversation, so we can help with any roadblocks, and your feedback can greatly shape our product.

I could go on, but those are my favorites. Let me know if you have any questions!

When it comes to brokers, there are two especially important aspects you should pay attention to:

1) Regulation: Choose only such brokers that are registered in countries with proper financial regulation (avoid brokers that are located on exotic islands)

2) Trading costs: Trading cost is influenced by mainly spread and commissions, but you should also pay attention to swap mark-up and conversion loss. These cost types are less known, however they can raise your trading cost substantially.