FREE DOWNLOAD Heiken Ashi EMA Proven Trading System and Strategy for Success – The Big Secret to Forex Trading Success. The Heikin-Ashi chart that came after the candlestick chart is one of the several different achievements of early Japanese traders. The visualisation of this type of chart is useful in spotting trends easily.

A Heiken Ashi trader looks for two particular signals, including a:

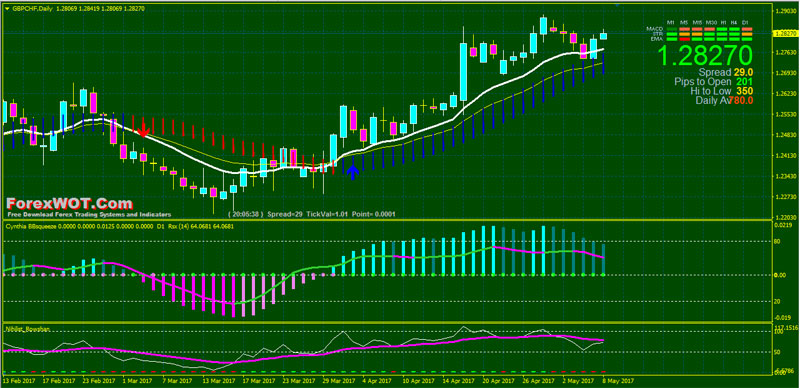

- Hollow (blue in the charts above) candle without a lower shadow, which is a particularly bullish signal.

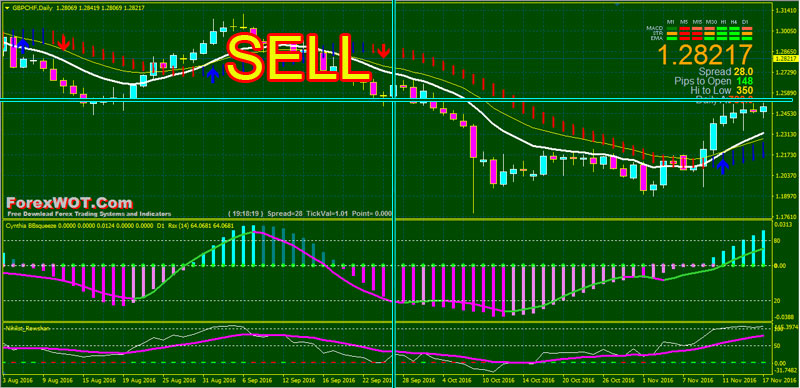

- Filled (red in the charts above) candle without an upper shadow, which is a particularly bearish signal.

Some traders use Heiken Ashi in conjunction with momentum indicators, to further confirm the trend.

ForexWOT Heiken Ashi EMA Trading Rules

ForexWOT Heiken Ashi EMA Trading is an forex strategy, trend following that you can use for intraday trading or for swing trading.

- Best Intraday Trading Time Frame : 30 min

- Best Swing Trading Time Frame : 4H or daily

- Recommended Currency pairs : Majors and Indicies

Metatrader Trading Indicators

- Nihilist Rowsan

- Signal Trend

- Exponential moving average 7 periods

- Exponential moving average 21 periods

- Skedon Trend (Heiken Ashi smoothed with Arrows)

- Bbsqueeze with RSX (14)

- SDX TZ Pivots ( only Time Frame 30 min and 60 min)

- Heiken Ashi Smoothed

General Rule : Tade only in the direction of the trend.

BUY Rules

- BUY Arrows Blue confirmed by:

- Heiken Ashi candles blue color

- Bband squeeze green bars and above 0 level

- EMA 7 > EMA 21

- RSX green line

- Nihilist Rowsan upward and above 50 level

- Signal Trend green color

SELL Rules

- SELL Arrows Red confirmed by:

- Heiken Ashi candles red color

- Bband squeeze magenta bars and below 0 level

- EMA 7 > EMA 21

- RSX magenta line

- Nihilist Rowsan downward and below 50 level

- SignalTrend red color

EXIT Rules

- At the opposite arrow.

- Initial Stop loss 30 min and 60 min Time Frame 16-24 pips depends by currency pairs.Profit Target on the pivots leves or ratio 1:2 stop loss.

- 240 min and Daily time frame stop loss on the previous swing and profit target ratio 1:3 stop loss.

TRADING Notes

Because of the volatility often seen in the forex market, a trader without a sound money management component to their trading plan could be likened to a skydiver without a parachute.

In the event of a string of losing trades, the trader’s account balance will drop much like the ill-fated skydiver without the benefit of a parachute to break the fall.

A large percentage of people that begin trading in the forex market fail mainly because of lack of discipline and poor money management.

Without knowing how to deal with losing trades, many novice traders start “chasing money out the door” by committing a range of typical money management mistakes.

Eventually they can end up losing a lot of money, perhaps even their whole trading account.

[sociallocker]

[/sociallocker]

Please could you provide the zip, for download.

thanks.