Which is the best strategy to trade EURUSD in forex?… Euro (EUR)traders speculate on the strength of the Eurozone economy, compared to its major partners.

The relationship between the Euro and US Dollar (USD) marks the most liquid forex signals pair in the world, with tight spreads and broad price movement that supports a continuous flow of profitable opportunities.

While THERE ARE MANY WAYS TO TRADE THE EUR-USD PAIR, three simple strategies have been consistently effective. These can be executed by forex traders at all skill levels, with newer participants reducing position size to control risk while experienced players increase size to take full advantage of the opportunities.

Equity traders can apply these techniques with CurrencyShares Euro Currency Trust (FXE), which tracks the forex pair in real-time.

Leveraged and inverse ETFs can also be traded if you have the skills needed to manage the additional risk. ProShares Ultra Euro (ULE) offers double long side exposure, but it is thinly traded, at just 24,283 shares per day on average.

ProShares UltraShort Euro (EUO) offers equal leverage to short sellers and greater liquidity, trading more than 700,000 shares per day on average.

Buy Or Sell The Pullback

The EUR-USD trend thrusts in both directions and carries the price from one level to another in a positive feedback loop that can generate considerable momentum.

However, this rapid movement tends to fizzle out when the supply/demand equation shifts, often trapping latecomers in positions that will be excited for losses when the currency pair reverses and heads in the opposite direction.

The pullback strategy takes advantage of this countertrend movement, identifying significant support or resistance levels that should end the price swing and reinstate the initial trend direction. These levels often come at prior highs or lows as well as key levels defined by Fibonacci retracements, moving averages and the inception point of the original thrust.

Buy The Breakout/Sell The Breakdown

The pair often grinds back and forth within confined boundaries for extended periods, setting up well-defined trading ranges that will eventually yield new trends, higher or lower.

Patience during these consolidation phases often pays off with low-risk trade entries when support or resistance finally breaks, giving way to a strong rally or selloff.

Good timing is needed to take full advantage of this simple strategy.

ENTER TOO EARLY and the range could hold and trigger a reversal. ENTER TOO LATE and risk escalates because the position will execute well above new support or well below new resistance.

It’s often a good idea to reduce timing risk by opening a partial position when the pair breaks out or down and adding to it on the first minor retracement.

Below we can find a great example using the EURUSD daily chart. It has been trending lower for the last two months, and has declined as much as 867 pips since February. As the pair threatens to move lower, traders can then prepare to implement a BREAKOUT TRADING STRATEGY.

Now that a strong downtrend has been identified on the EURUSD, traders can now plan on trading a breakout towards lower lows.

To begin we first need to identify the current low at 1.2845. This point is currently acting as a price floor or level of support which is holding up the pair.

Breakout traders plan to enter the market only after price has been driven below this value. Traders will then look to sell with the expectations of the price of the EURUSD moving down to create lower lows.

One of the easiest methods of trading breakouts is with ENTRY ORDERS.

An entry order is a great way to trade BreakOuts because you can set a preset price where you wish to enter into the market.

If the price you select becomes available for trading your order will then be executed.

This can be a huge benefit to traders that can’t monitor the market 24Hrs a day. Even if you’re away from the trading screen, if the price you select becomes available, your trade will be executed.

Enter Narrow Range Patterns

The pair will often rise or fall into a significant barrier and then go to sleep, printing narrow range price bars that lower volatility and raise apathy levels.

Coincidentally, this quiet interface often marks a powerful entry signal for a breakout or breakdown.

This strategy enters the position within the narrow range pattern, with a tight stop in place in case of a major reversal

This setup often prints an NR7 bar, which marks the narrowest range price bar of the last seven bars.

Originally observed in the U.S. futures markets in the 1950s, this powerful but simple pattern predicts that price bars will expand in a sizable breakout or breakdown.

It’s also a low-risk entry because the stop loss can be set very close to the entry price.

FREE DOWNLOAD FOREX TRADING SYSTEM

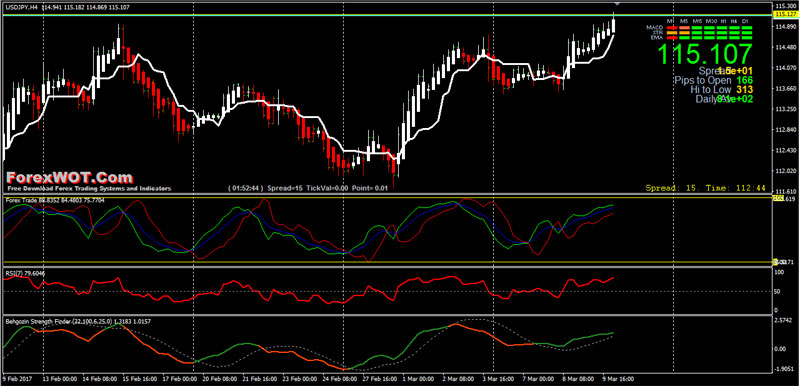

Super Effective H4 USD/JPY Forex Trading System and Strategy – The USD/JPY pair is well-known as the instrument that often moves in a range before this continuous range is broken and the price finally goes for a trend.

This happens because of the interest of fund managers from Japan to the short-term trends.

This is a Super Effective Foreign Exchange Low Risk Trading System for USD/JPY.

Japanese traders tried to make the technical analysis and price prediction easier and faster.

Heikin-Ashi chart, that came after the candlestick chart, is one of the several different achievements of Japanese traders.

You can predict faster using the Heikin-Ashi charts. Furthermore, they are easier than candlestick charts to understand and trade.