GBP JPY Forex Simple Trading Strategy – ( Works on All Time Frames and for all Pairs – Best used on 5Min/15min/ for short term Trades and 30min/1Hr/4hr/daily for Long term Trades ).

I am trading in GBP/JPY and other currencies using this Simple method for quite sometime now and its proven to be successful 90% of the times, the only times it has failed is when a spike up or down during news time, so I discourage anyone to stop using this 30 mins prior and after the news to escape from the whipsaws.

This method should work good on all pairs, but due to the high votality and movement, I love to work on GBP/JPY pair, gives very high Risk to Reward Ratio. For pairs apart from GBP/JPY, you may need to experiment with the TP and SL abit.

The most Important part in making this method a success is to stick to the rules at all times and get into the trade when uhave the indicators giving you the signal. Please study the rules properly and do not enter into trades just for the sake of entering, even waiting for the correct signal itself and staying out itself is a trade in itself. If you stick to the rules of entry, I assure you your winning rate will be as high as 90%.

I personally feel this works best from 7:00 GMT to about 20:00 GMT.

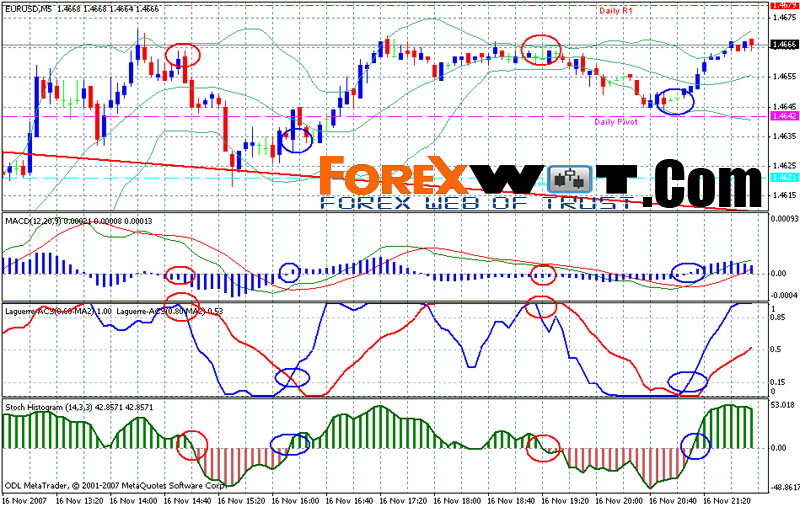

I have added the Pivot indicator as its very helpful to find the expected levels of support and resistance without too much of headache. As a thumb rule, you should look to Long the Currency if the price is above the Pivot Line and Short it if the price is below the Pivot Line. I will be explaining it more as we take this forward.

I am not going to explain in details about what all the indicators are , what are pivots , what are support and resistance, for that please visit www.babypips.com an excellent resource for learning about Forex.

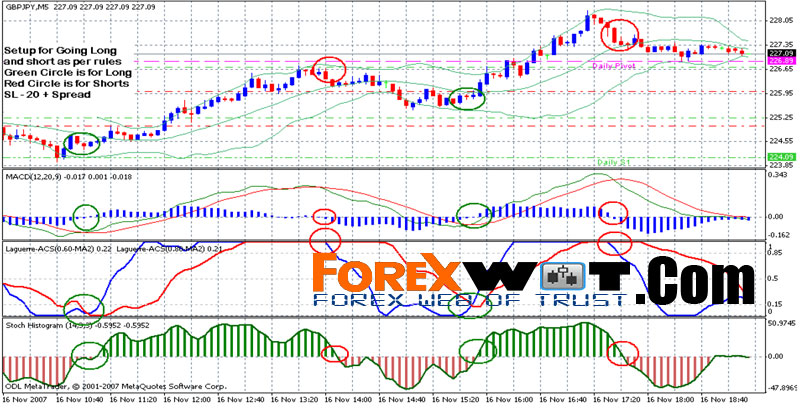

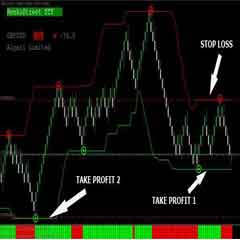

I) First Setup ( Best Setup – Maybe able to catch moves of +50 to 150 pips )

For Long : What you need to do is first look if price is above the Daily Pivot, and then look if the the LaGuerre 1 (henceforth called as Lag1 ) is above 0.15 and going upwards , StochHistogram ( Henceforth called as Stoch) is gone from negative to positive , MACD has made a crossover to positive ( Crossover above Zero Line ) and LaGuerre 2 ( Henceforth called as Lag2) is at the bottom ( for Extended Period of time ) or trending upwards above 0.15 .

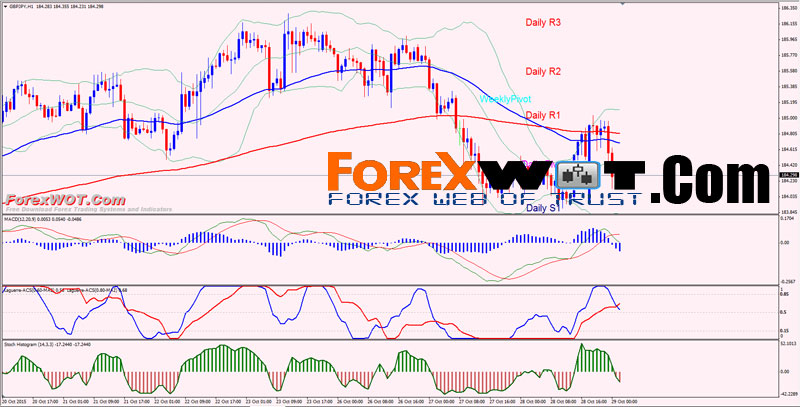

Example as below

II) Second Setup ( when Price is already climbing up ) – Maybe able to catch moves of +30 to +80 pips

For Long : What you need to do is first look if the the LaGuerre 1 ( henceforth called as Lag1 ) is at or above 0.45 and going upwards , StochHistogram ( Henceforth called as Stoch) is gone from negative to positive and climbing and LaGuerre 2 ( Henceforth called as Lag2) is at 0.45 or above and trending up.

I don’t recommend to take any other long setup apart from this unless all the indicators are pointing in that direction.

Check if 1min, 5min and 15min Lags are in agreement to take trades apart from the ones mentioned above.

Exits for Long ( Multiple Options – Choose whichever option as per your Take Profit Level )

- When Lag-2 crossed 1.00 and then starts to come down below 0.85

- When you get +50 pips

- Daily R1 – ( First Resistance above Daily Pivot )

- Daily R2 – ( Second Resistance above Daily Pivot)

- MACD crossover from Positive to Negative and Red lag is turning down

- When Stoch Histogram goes from Positive to Negative, and Red Lag is pointing Down ( both conditions have to be met , if not take 50% profit and let the trade run )

- When the Stop Loss is hit ( 20 pips + Spread ) – This is likely to happen only if you have not taken the trade as per rules or taken a trade 30 mins before or within 30 mins of news.

If anyone has more suggestions, kindly email me so I can look into it and add to the exits.

I) First Setup ( Best Setup – Maybe able to catch moves of +50 to 150 pips )

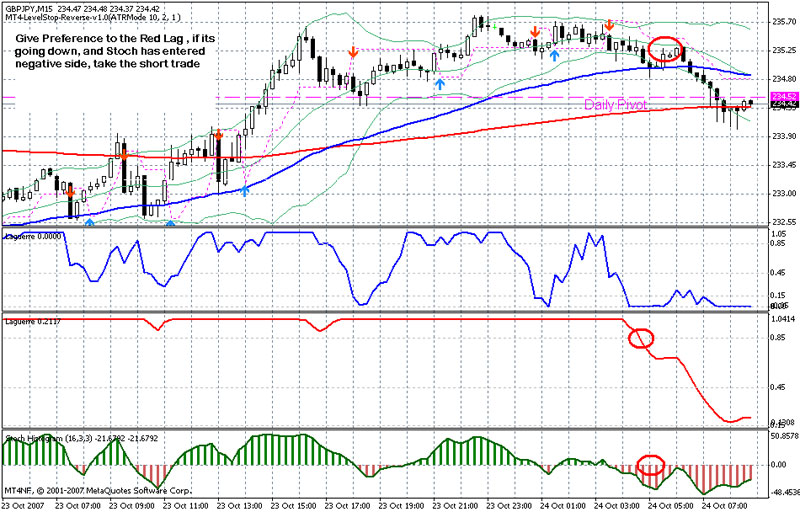

For Short : What you need to do is first look if the the LaGuerre 1 ( henceforth called as Lag1 ) is below 0.85 and going downwards , StochHistogram ( Henceforth called as Stoch) is gone from positive to negative , MACD has crossover to Negative from Positive ( Below Zero Lines ) and LaGuerre 2 (Henceforth called as Lag2) is at the top ( for extended period of time ) or trending downwards below 0.85

II) Second Setup ( when Price is already climbing up ) – Maybe able to catch moves of +30 to +80 pips

For Shorts : What you need to do is look if the LaGuerre 1 ( henceforth called as Lag1 ) is at or below 0.45 and going downards , StochHistogram ( Henceforth called as Stoch) is gone from positive to negative and climbing down and LaGuerre 2 ( Henceforth called as Lag2) is at 0.45 or below and trending down.

Exits for Short ( Multiple Options – Choose whichever option as per your Take Profit Level )

- When Lag-2 crossed 0.00 and then starts to come up to 0.15

- When you get +50 pips

- Daily S1 – ( First Support below Daily Pivot )

- Daily S2 – ( Second Support below Daily Pivot)

- MACD has crossed over to positive and red lag is turning up

- When Stoch Histogram goes from negative to positive, and Red Lag is pointing up ( both conditions have to be met , if not take 50% profit and let the trade run )

- When the Stop Loss is hit ( 25 Pips including Spread ) – This is likely to happen only if you have not taken the trade as per rules or taken a trade 30 mins before or within 30 mins of news.

Stop Loss for all the entries for Long and Short is 20 pips plus spread from the best setup as per rules.

If anyone has more suggestions, kindly email me so I can look into it and add to the exits.

This method should work good on all pairs, but due to the high votality and movement, I love to work on GBP/JPY pair, gives very high Risk to Reward Ratio. For pairs apart from GBP/JPY, you may need to experiment with the TP and SL a bit.

The most Important part in making this method a success is to stick to the rules at all times and get into the trade when u have the indicators giving you the signal. Please study the rules properly and do not enter into trades just for the sake of entering, even waiting for the correct signal itself and staying out itself is a trade in itself. If you stick to the rules of entry, I assure you your winning rate will be as high as 90%.

[sociallocker]

[/sociallocker]

Hi,

how can I download the system? I liked your site on facebook.

Thank you.

where is the the lag2?

hi

we have to look the trend or move in the large time frame such as Day h1 h4 or just looking for signal.

what about us in other timeframe

Hello, could you explain the Lag part? Normally the indicator has one line, doesn’t it? You have two lines and firstly they are in separate windows and the other time they are together. I can’t unlock the links as I don’t have social media accounts. Thanks!

Hi

I am new to trading and was wondering if your strategy is working also with the post brexit situation?