Forex ADX Moving Average Trading System – This is an extremely low risk, high reward strategy which can and will change your life if you use it properly.

The only thing that could make this system fail over the long term is you not sticking to the rules…….that’s it!

If you stick to the rules of the system, you’re going to be smiling from ear to ear as you watch your account grow at an astonishing rate every month from now on.

Trading in the direction of a strong trend reduces risk and increases profit potential. The average directional index (ADX) is used to determine when price is trending strongly. In many cases, it is the ultimate trend indicator. After all, the trend may be your friend, but it sure helps to know who your friends are. In this article in this article, we’ll examine the value of ADX as a trend strength indicator.

ADX is used to quantify trend strength. ADX calculations are based on a moving average of price range expansion over a given period of time. The default setting is 14 bars, although other time periods can be used.

ADX can be used on any trading vehicle such as stocks, mutual funds, exchange-traded funds and futures. (For background reading, see Exploring Oscillators and Indicators: Average Directional Index and Discerning Movement With The Average Directional Index – ADX.)

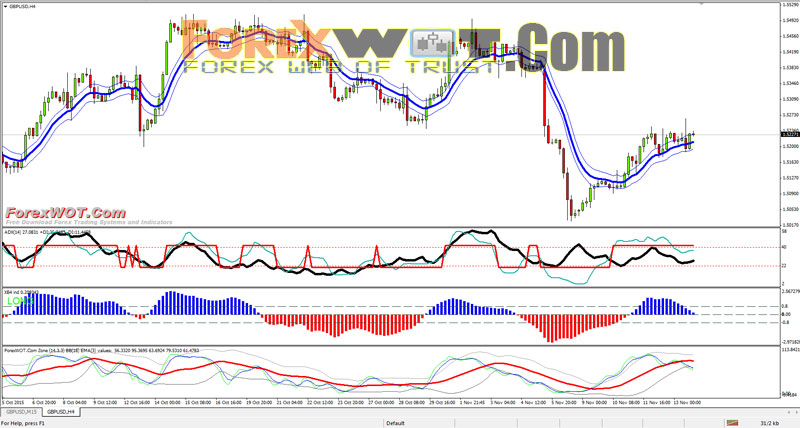

ADX is plotted as a single line with values ranging from a low of zero to a high of 100. ADX is non-directional; it registers trend strength whether price is trending up or down. The indicator is usually plotted in the same window as the two directional movement indicator (DMI) lines, from which ADX is derived (Figure 1).

For the remainder of this article, ADX will be shown separately on the charts for educational purposes.

Figure 1: ADX is nondirectional and quantifies trend strength by rising in both uptrends and downtrends.

When the +DMI is above the -DMI, prices are moving up, and ADX measures the strength of the uptrend. When the -DMI is above the +DMI, prices are moving down, and ADX measures the strength of the downtrend.

Figure 1 is an example of an uptrend reversing to a downtrend. Notice how ADX rose during the uptrend, when +DMI was above -DMI. When price reversed, the -DMI crossed above the +DMI, and ADX rose again to measure the strength of the uptrend.

This is a mechanical system, which means you will be getting fixed entry and exit signals which tell you exactly what to do and when. So there is nothing left open for you to “interpret” or make mistakes with.

This is very much a case of “when A meets B, do C”. Pure simple instructions of what to do and when to do it!

So please sit back and get comfortable as you read through the manual.

This is a very easy system to use, but it’s worth taking your time as you read this just to be sure everything sinks in and you understand it fully before going away and testing it out.

- If the ADX average line is above the 22 dotted line, and is moving in an upwards direction, we have everything aligned as far as ADX is concerned to signal a valid entry to the market.

- Price above upward Moving Averages Area

- MACD blue above 0.8 line

- ForexWOT Zone is upward -> stochastic line above 3 EMA red Line.

- If the ADX average line is above the 22 dotted line, and is moving in an upwards direction, we have everything aligned as far as ADX is concerned to signal a valid entry to the market.

- Price below downward Moving Averages Area

- MACD red below -0.8 line

- ForexWOT Zone is downward -> stochastic line below 3 EMA red Line.

Well this is very simple and straight forward. We do not enter trades on a Friday!

More false or bad trade signals are generated on a Friday than any other day of the week, so it just makes sense to stay out of new trades at the end of the week.

The reason for this is because of the way the market behaves at the end of the week and over weekends.

How do you exit using this strategy. Good strategy i must say

You said that it is clear where to exit the trade.. But you didnt mention it in the article. Why?