The risks of trading the forex market – Every trade, no matter how much sure you are about its result is nothing but a well-informed guess. There’s nothing that is extremely certain in the trading market and there are too many external factors which can push the movement of a particular currency.

And below 5 highly effective forex trading systems to predict the movement of currencies in order to make a right decision.

1- Forex RSI Trend Reversal Trading System With Rainbow Multi Moving Average

High profits Forex RSI Trend Reversal Trading System – Relative Strength Index, or RSI, is similar to the stochastic in that it identifies overbought and oversold conditions in the market. It is also scaled from 0 to 100. Typically, readings below 30 indicate oversold, while readings over 70 indicate overbought.

RSI can be used just like the stochastic. We can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold.

RSI is a very popular tool because it can also be used to confirm trend formations. If you think a trend is forming, take a quick look at the RSI and look at whether it is above or below 50.

If you are looking at a possible uptrend, then make sure the RSI is above 50. If you are looking at a possible downtrend, then make sure the RSI is below 50.

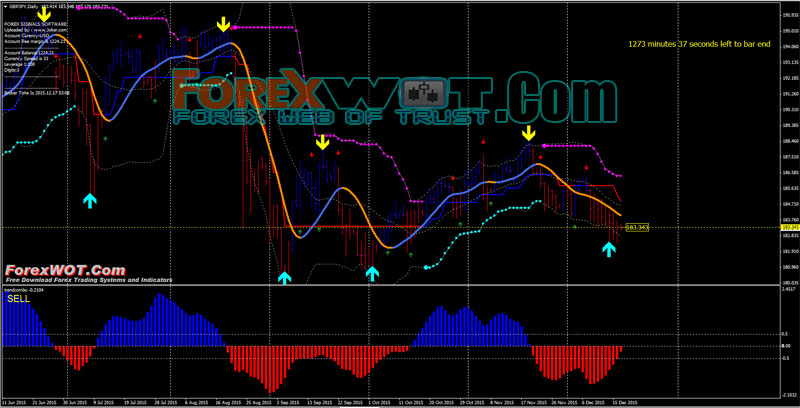

2- Trend Magic Simple and Effective Forex Intraday Trading Strategy

Forex Trend Magic Intraday Trading is a Simple and Effective Forex Intraday Trading Strategy Based on High Accuracy Different Signals.

[sociallocker]

[/sociallocker]

Trend Magic is a custom indicator that combines CCI and ATR in what turns to be quite similar to a moving average in the chart. Simple, the line turns red when CCI readings are below -50 (which points for a dominant bearish trend) and blue, when CCI is above 50, suggesting then a bullish continuation in the pair. The ATR indicator is added to step the line towards the price.

3- So Easy Forex Ichimoku Trading System with ATR Ratio and ADX Indicators

Forex Ichimoku Trading System with ATR Ratio and ADX Indicators – Ichimoku Kinko Hyo with ATR Ratio and ADX Indicators is a trend following trading system filtered with ATR Ratio and ADX. The signal alert is the Super Reversal Signal a indicator created for trading with forex and Binary Options high/low.

‘The Ichimoku Cloud’, also known as Ichimoku Kinko Hyo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals.

Ichimoku Kinko Hyo translates into “one look equilibrium chart”. With one look, chartists can identify the trend and look for potential signals within that trend.

The indicator was developed by Goichi Hosoda, a journalist, and published in his 1969 book. Even though the Ichimoku Cloud may seem complicated when viewed on the price chart, it is really a straight forward indicator that is very usable. It was, after all, created by a journalist, not a rocket scientist! Moreover, the concepts are easy to understand and the signals are well-defined.

Four of the five plots within the Ichimoku Cloud are based on the average of the high and low over a given period of time.

4- Super Easy High Profits Forex MACD Bollinger Bands Stop Trading System

Forex MACD Bollinger Bands Stop Trading System With Super Signal Indicator – Forex MACD Bollinger Bands Stop Trading System is for intraday trading and for scalping time Frame 5min, 15 min, 30 min, and 60 min. Currency pairs: Forex Majors.

[sociallocker]

[/sociallocker]

BBands Stops Custom Indicator. This custom version of Bollinger Band indicator is far simpler to trade with comparing to its original. Using this indicator you will easily get to know in which trend type is the market and opening position is fairly easy following few simple rules, while books could be written around tens of various examples occurring when you use original version.

While there are times when the fundamentals can shift the environment of trading, there are other times when there are some unaccountable factors like option barriers, central bank buying, daily exchange rate fixing. Ensure being prepared for the uncertainties by doing a comprehensive market research on the entire scenario.

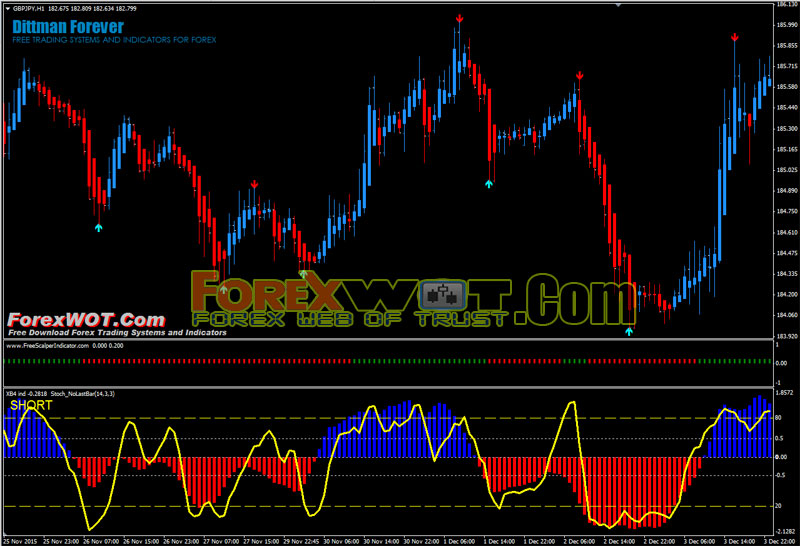

5- Easy Accurate Forex Trading With Heiken Ashi and Stochastic oscillator

Free Easy Accurate Forex ScalpingTrading System – Scalping indicator system is a trend following trading system for intraday trading. On line there are various setup of this system.

[sociallocker]

[/sociallocker]

Time Frame : 1 min, 5 min. 15Min.

Markets currency pairs (majors) and Indicies.

So….

What are the rewards of forex trading? Well, the rewards are all unknown. When there is a move in the currency, the move can either be small or big. Financial management is extremely vital in such cases.

Referring to the rule which says that you shouldn’t let a winner become a loser, you should trade multiple lots. This can easily be done on a way which can be handled with using mini-accounts. In this manner, you can lock in gains and then move your stop to the second lot.

Trading safely – Some tips

- Limit the forex trade: Experts usually recommend that small investors should not devote more than a few percentage points of their entire portfolio to forex trading and this way they can restrain their potential damage.

- Choose the right bet size: Amidst the risks that traders should be cautious of, overtrading is the first thing they should take into account. Only after you carefully check the live currency rates you should choose the perfect bet size. Don’t trade a position which is too large compared to the size of your account.

- Set some limits: One way in which you can limit the damage caused is to set a stop-loss order through which you exit a position when a specific price has been hit. Keep guessing and predicting the movement of currencies in order to make a right decision.

Therefore, if you plan to outsmart the forex market and make money, start working with the most appropriate strategies.

If you don’t think you know them, seek professional help. There are many forex professional companies who offer you enough help on currency trading. Also take into account the risks and rewards before taking the plunge. Also follow the trends and don’t move beyond them.