Supply and demand order block trading strategy is a technique used in financial markets, particularly in forex and stock trading, to identify potential areas of significant supply and demand imbalances.

These imbalances often represent zones where the market is likely to react strongly, leading to potential trading opportunities. Here’s a basic outline of how this strategy works:

1. **Identifying Supply and Demand Zones:**

– Supply zones are areas where there is an excess of sellers over buyers, causing the price to fall.

– Demand zones are areas where there is an excess of buyers over sellers, causing the price to rise.

– These zones can be identified using various methods such as historical price levels, swing highs/lows, volume profile analysis, or specific price action patterns.

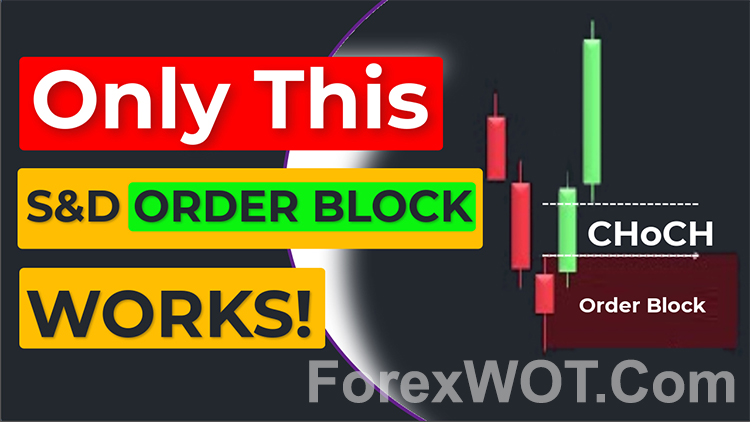

2. **Drawing Order Blocks:**

– Order blocks are specific price ranges within supply and demand zones where significant buying or selling activity has occurred.

– These blocks can be marked on the price chart based on factors such as price consolidations, strong volume, or rapid price movements.

3. **Confirmation Signals:**

– Once potential supply and demand zones and order blocks are identified, traders often look for confirmation signals to validate their significance.

– Confirmation signals may include candlestick patterns, volume surges, or other technical indicators aligning with the identified zones.

4. **Entry and Exit Points:**

– Traders typically enter positions at or near the edges of supply and demand zones, anticipating a reversal or continuation of the price trend.

– Stop-loss orders are placed beyond the opposite side of the zone to limit potential losses if the trade goes against expectations.

– Take-profit levels are often set based on the magnitude of the expected price move or the distance to the next significant support or resistance level.

5. **Risk Management:**

– Proper risk management is crucial in this strategy to protect capital.

– Position sizing should be based on the trader’s risk tolerance and the distance between entry and stop-loss levels.

– Traders may also adjust their position sizes based on the strength of the supply and demand zones and the overall market conditions.

6. **Monitoring and Adjustments:**

– Traders need to monitor their positions closely and adapt to changing market conditions.

– If new supply or demand zones emerge or if existing zones lose their significance, adjustments to the trading plan may be necessary.

Remember that like any trading strategy, supply and demand order block trading carries risks, and success depends on the trader’s ability to accurately identify these zones and effectively manage trades based on them. It’s essential to combine this strategy with thorough analysis and risk management techniques.