Decided to share how I trade. Few things about me.I was a degenerate sport gambler for 5years betting from collage hoops,football,baseball mostly. I would be up one week in thousands and be down next week in thousands.Had no real understanding of % wagered vs account size until I lost all my money.

Stopped completely. As faith would have it I somehow end up trading forex. Made all the rookie mistakes blown few accounts and my 3rd year finally started to make money.

Before I continue I like to emphasize knowledge and experience are important. Reading trading books helps on weak areas specially on psychology subjects like unable to take a small loss and letting it to become massive loss,unable to let profits run,moving stops etc.

This is critical because without work on one’s self no system irregardless of profitability will make you money because you are dealing with not just the market but your own demons.

- All Market Wizards books by JACK D. SCHWAGER (This is to open your eyes what is possible in Trading)

- REMINISCENCES OF A STOCK OPERATOR (Read it twice 2nd time got lot more out of it)

- Harmonic Trader by Scott Carney (anything by him)

- Bird watching in Lion Country by Dirk du Toit (implemented lots of ideas from him)

- Trading in the Zone (classic on psychology of trading)

- Van Tharp – Super Trader (Even if you absorb 20% of the book you’ll improve by huge margin)

- A.J. Frost, Robert Prechter – Elliott Wave Theory (must read)

Most know me as classic counter trader and I did well with it however not taking obvious trades going with the trend was a handicap in my view hence I designed 2 system in 1 Trend following and CT.

This part is based on Raghee Horner’s 34 EMA (she has ton of videos on youtube for further knowledge)

Simply brilliant concept.Why 34? Well it works best in my view and Raghee’s and its a Fib number.

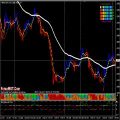

Trades are taken when PA is above Wave green color candles and below wave red candles,blue candles are neutral best not trade.

1hr 4hr and daily must be in sink

PA inside 2nd 3rd Deviation

RSI 70/30 and above WR% above -20 below-80 These are exhaustion levels

We will wait for RSI and WR% to hook opposite direction before entering CT trade H4 Daily.

This is to assure trend/swing is reversing.This is important since BB and Oscillators can remain OB/OS prolong period of time.

When trading with the trend be mindful BB levels for exit the trades

1st TP BB middle level 2nd TP should PA go in your way further other side of BB 2nd 3rd dev.

1.RSI WR% Stoch etc can stay OB OS on prolonged period of time.

True and this is why following fundamentals are important news releases etc.I have uploaded news indi that always keeps you informed.

Keep in mind no system is loss free.I judge healthy system by series of trades not just few dozen.

2. BB can over stretch on strong trend

True and that is why system1 allows trend following

3.Stop loss

Up to you I trade without hard stop but do have one.Be mindful 20-30 SL will get hit on spikes and this is how brokers make their money.

My average profit target is 50-100pips.

Example of CT trade that even though its inside BB zone but RSI WR% don’t agree NOT good to go long

See the difference on my 1st chart where RSI and WR% clearly hooking down.