How To Become A Successful Forex and Binary Options Trader with Trend Direction Higher Time Frame Trading Strategy. One of the main concepts behind the beginner strategy is multiple time frame analysis – using a higher time frame to determine the overall market direction and executing trades on a lower time frame.

Anyone can make money in the forex market, but this requires patience and following a well-defined strategy.

However, if you approach forex trading via a careful, medium-term strategy with Trend Direction Higher Time Frame, you can avoid becoming a casualty of this market.

So, why are we focusing on medium-term forex trading? Why not long-term or short-term strategies?

- Medium-term, a trader typically looking to hold positions for one or more days, often taking advantage of opportunistic technical situations.

- A medium term trading need lowest capital requirements of the three because leverage is necessary only to boost profits.

The framework of the strategy covered in this article will focus on one central concept: trading with the odds.

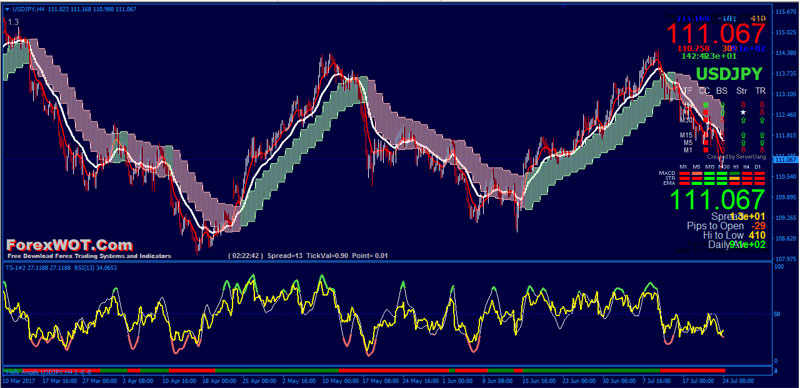

To do this, we will look at a variety of techniques in multiple time frames to determine whether a given trade is worth taking. CC Direction Higher Time Frame Indicator is highly effective solution for multiple time frames trend analisis.

Keep in mind, however, that this is not a mechanical/automatic trading system; rather, it is a system by which you will receive technical input and make a decision based upon it.

The key is finding situations where all (or most) of the technical signals point in the same direction. These high-probability trading situations will, in turn, generally be profitable.

- Best Time Frames: H1, H4, and Daily

- Recommended Currency Pairs: EURUSD, GBPUSD, USDJPY, and all Major Pairs.

- CC Direction Higher Time Frame Indicator

- Spread

- Exponential Moving Average

- Market Price

- TS-1 #2

- Hells Angels

- CC Direction Higher Time Frame Indicator Green color

- 5 EMA Red colorline upward above 10 White color line

- RSI upward line above 50 level

- Hells Angell indicator Green color

- CC Direction Higher Time Frame Indicator Red color

- 5 EMA Red colorline downward below 10 White color line

- RSI downward line below 50 level

- Hells Angell indicator Red color

It is a good idea to place exit points (both stop losses and take profits) before even placing the trade. These points should be placed at key levels, and modified only if there is a change in the premise for your trade (oftentimes as a result of fundamentals coming into play). You can place these exit points at key levels, including:

- Just before areas of strong support or resistance

- At key Fibonacci levels (retracements, fans or arcs)

- Just inside of key trendlines or channels

Anyone can make money in the forex market, but this requires patience and following a well-defined strategy. However, if you approach forex trading via a careful, this Trend Direction Higher Time Frame Trading Strategy, you can avoid becoming a casualty of this market.

[sociallocker]

[/sociallocker]