Forex Profits Guard is a manual trading strategy that you can use to generate profits from forex market every month. It was designed to be very simple and very powerful at the same time. And unlike most trading systems all over the market, this system is tested for a long time and proved to be profitable even in the worst market conditions.

The reason for that, is that was designed based on the most powerful trading methods like trend following and wave trading.

At the same time, the system was meant to be very simple. You don’t have to be an experienced trader to be able to use it. In fact, even if you have no trading experience at all you would still make a lot of money from it just like pro traders.

There are many people that sign up to trade Forex that don’t understand or take the time to learn how and why to trade Forex. There are many risks involved in trading any kind of asset, whether it is stocks, bonds or currencies. If you are interested in trading, make sure you understand Forex risks.

One of the biggest Forex risks is a leveraged buy. Some Forex brokerages allow you to hold a certain amount of money in your account but leverage that amount to up to 200 times its worth. While this can be good if you are on the winning side of a trade, this can be devastating if you lose your entire accounts worth plus many times more.

So please, before you start trading .. make sure that you understand and apply money management rules. No matter how powerful the trading system is, without money management .. it will become a time bomb!

This system is based on two price actions .. The first one is price’s trend. And the second one is price’s wave. To indentify the trend we’re going to use T3 Histogram indicator ( Green/Red Bars )…

Obviously, it provides visual trending signal for up/down trends.

Red bars = Down Trend

Green Bars = Up Trend

To identify wave’s direction, we will use two indicators:

- Super Signals Channel ( Green/Red Arrows )

- W.A Explosion ( Green/Red Bars ABOVE Yellow Line )

How to identify wave’s direction ?

- Red Arrow + Red Bar Above Yellow Line = Up Trending

- Wave Green Arrow + Green Bar Above Yellow Line = Down Trending Wave.

First step is to identify the trend. Second step, is to follow wave’s direction when both ( Trend/Wave ) match.

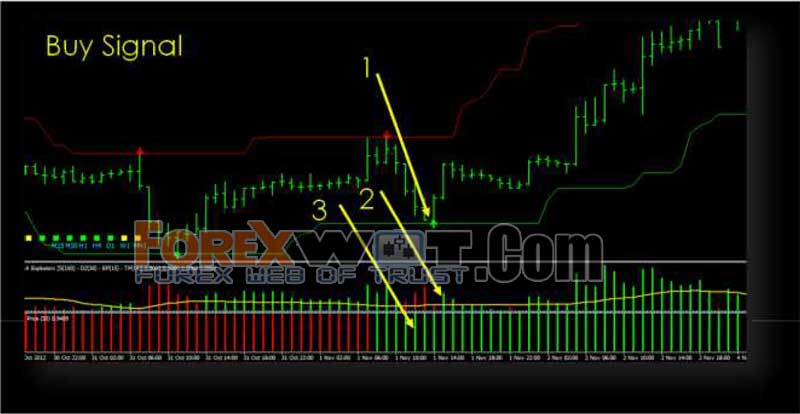

Example 1 …

- Green/Up Arrow

- Green Bar ABOVE Yellow Line

- Green Trend Bar

From the above conditions we would have a valid BUY Signal

Example 2 …

- Red/Down Arrow

- Red Bar ABOVE Yellow Line

- Red Trend Bar

From the above conditions we would have a valid SELL Signal. When one or more indicators are providing mixed signals, that means we shouldn’t trade.

Best Entry point is right after you see all rules and conditions are met. It doesn’t matter which one came first. You could see up arrow, then green bar, followed by up trend green bar. Or you could see up trend bar, then up arrow, followed by green bar above yellow line. All equally mean Buy signal.

Example…

The same is correct with all signals. Once all indicators provide the same signal ( buy/sell ) then you’re ready to open a trade.

For Targets, we’re going to use Pivots and support/resistance levels.

- Buy Signals : Price should be ABOVE pivot line, targets are resistance levels.

- Sell Signals : Price should be BLOW pivot line, targets are support levels.

Example…

- Stoploss for BUY Signals, 10 pips BELOW entry Arrow.

- Stoploss for SELL Signal, 10 pips ABOVE entry Arrow.

Example…

You can close the trade when price hits target level OR when you get opposite signal.

90% of the time, you won’t get opposite signal. But that could happen especially with important news releases that would cause trend reversals. That’s why it’s recommended that you avoid trading during important news release!

The system works with all pairs and all time frames. You can also use it to trade other markets – not only Forex – like stocks and metals for example.

Multi time frame ADX measures trend’s power and direction.

- Red bar = Strong down trend, Green bar = Strong up trend,

- Yellow bar = Flat/weak trend.

This is indicator’s signals are not part of the system’s rules, but it’s very helpful and allows you to check the “big picture” while you’re trading anytime frame.

If you traded in the Forex market before or if you’re still trading now, you may have heard the term Forex broker a lot of times. However, as an individual trader, you may want to know what is a Forex broker and what they do.

Forex brokers are individuals or companies that assist individual traders and companies when they are trading in the Forex market. These individuals can really give you that extra edge you need in order to be successful in the Forex market. Although they will be trading your funded account, all the decisions are still yours to make if you want to.

Forex brokers are there to assist you with your trading needs in exchange for a small commission from what you earn. Here are some of the services that a Forex broker can give you:

- A Forex broker can give you advice regarding on real time quotes.

- A Forex broker can also give you advice on what to buy or sell by basing it on news feeds.

- A Forex broker can trade your funded account basing solely on his or her decision if you want them to.

- A Forex broker can also provide you with software data to help you with your trading decisions.

Searching for a good Forex broker can prove to be a very tedious task. Since there are a lot of advertising in the internet about Forex brokers, Forex traders get confused on which Forex broker they should hire. With all the Forex brokers out there that offers great Forex trading income and quotations, you will find it hard to choose a good and reputable Forex broker.

With a little research, you can find the right Forex broker who can be trusted. If you lack referrals for Forex brokers, you can try and do a little research of your own. The first thing you need to find out about a particular Forex broker with the amount of clients they serve. The more clients they serve the more chances that these brokers are trusted. You should also know the amount of trades these brokers are conducting.

Knowing the broker’s experience in the Forex market is also a great way to determine if he or she is the right broker to hire. Experienced Forex brokers will increase your chances of earning money from the Forex market.

If you have questions or complaints, you should call or email the company and ask questions regarding their trading system. You should never be uncomfortable doing this. Besides, they will be the one who will manage your money. And, it is your right to know about what they are doing with your money.

When choosing a Forex broker, you should also consider their trading options. You should also know that Forex brokers are different from what they can offer you. They differ in platforms, spreads, or leverage. You have to know which of the trading options is very important to you in order to be comfortable when you trade in the Forex market.

Most online Forex brokers offer potential clients with a demo account. This will allow you to try out their trading platform without actually risking money. You should look for a demo platform that works just like the real thing and you should also determine if you are comfortable with the trading platform.

Look for the features you want in a trading platform in order for you to know what to expect if you trade with them. If you are comfortable with a trading platform, you should consider trading with them, and if you are not, scratch them off your list. This is a great way to test their trading platform and not risk your money.

If a Forex broker is not willing to share financial information about their company, you shouldn’t trade with them because they are reluctant to share company information. They should answer your questions regarding on how they manage their client’s money and how they trade that money.

Always remember that if you see an offer that’s too good to be true by Forex traders, it probably is too good to be true. The Forex market is a very risky place to trade and Forex brokers must tell you that there are certain risks involved when trading in the Forex market.

Avoid hiring a Forex broker who says that trading in Forex is easy and a very good money making market with very low risks.

These are the things you should consider when you look for a Forex broker. If you find that right broker, you can be sure that you can really earn money.