High accuracy Forex QQE Pin Bar Price Action trading system and strategy – A simple trick to improve your Pin Bar trading results.

The Pin Bar price action pattern is a very powerful trading signal and one of my personal favourites.

My trading style is all about waiting for the best price action trade signals to form.

The Pin Bar is a Price Action formation that can be found on any timeframe in any markets.

The Pin Bar or full name Pinocchio Bar, is given its name because the signal is lying to the market or tricking traders that price is going one way when in fact it is reversing back the other way.

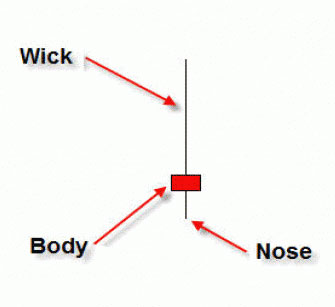

A Pin Bar must have:

- Open and close within previous bar

- Candle wick minimum 3 times the length of the candle body

- Long nose protruding from all other bars (must stick out from all other candles)

The BULLISH Pin Bar Example

The BEARISH Pin Bar Example

A pin bar pattern consists of one price bar, typically a candlestick price bar, which represents a sharp reversal and rejection of price.

The pin bar reversal as it is sometimes called, is defined by a long tail, the tail is also referred to as a “shadow” or “wick”.

The area between the open and close of the pin bar is called its “real body”, and pin bars generally have small real bodies in comparison to their long tails.

The tail of the pin bar shows the area of price that was rejected, and the implication is that price will continue to move opposite to the direction the tail points.

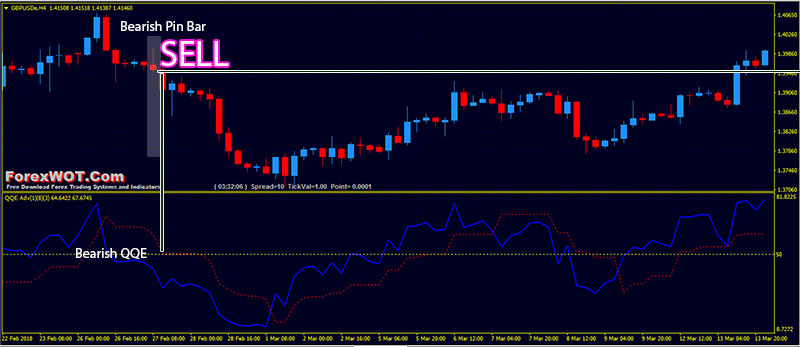

Thus, a BEARISH Pin Bar signal is one that has a long upper tail, showing rejection of higher prices with the implication that price will fall in the near-term.

A BULLISH Pin Bar signal has a long lower tail, showing rejection of lower prices with the implication that price will rise in the near-term.

How to Trade with Pin Bars..?

When trading pin bars, there are a few different entry options for traders. The first, and perhaps most popular, is entering the pin bar trade “at market”.

That simply means you enter the trade at the current market price.

Another entry option for a pin bar trading signal, is after QQE Signals.

In other words, you would wait for the original QQE indicator signals are generated.

- The BULLISH QQE – When the blue line crosses yellow line from below while blue line is above level 50

- The BEARISH QQE – When the blue line crosses yellow line from above while blue line is below level 50

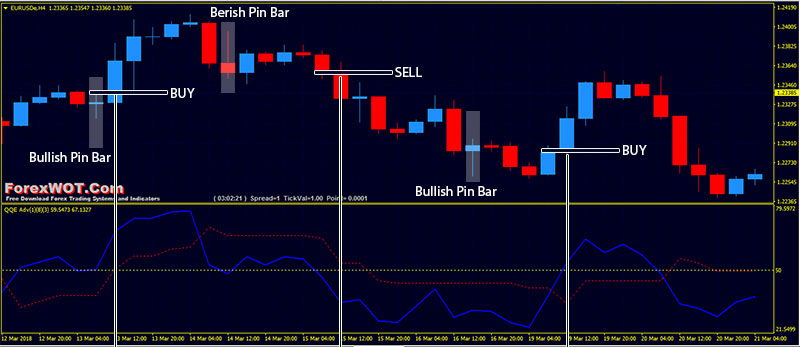

Below are the examples of the QQE Pin Bar entry options:

- Bullish Pin Bar

- Bullish QQE (the blue line crosses yellow line from below while blue line is above level 50)

- Bearish Pin Bar

- Bullish QQE (the blue line crosses yellow line from above while blue line is below level 50)

- As a beginning trader, it’s easiest to learn how to trade pin bars in-line with the dominant daily chart trend, or ‘in-line with the trend’. Counter-trend pin bars are a bit trickier and take more time and experience to become proficient at.

- Pin bars basically show a reversal in the market, so they are a very good tool for predicting the near-term, and sometimes long-term, direction of price. They often mark major tops or bottoms (turning points) in a market.

- Not every pin bar is going to be one worth trading. The best ones occur in strong trends after a retrace to support or resistance within the trend, or from a key chart level of support or resistance.

- As a beginner, keep your eyes peeled for daily chart time frame pin bars as well as 4 hour chart time frame pin bars, as they seem to be the most accurate and profitable.

- Longer tails on a pin bar indicate a more significant reversal and rejection of price. Thus, long-tailed pin bars tend to be a little higher-probability than their shorter-tailed counter-parts. Long-tailed pin bars also tend to see price retrace to near the pin bar’s 50% level more often than shorter-tailed pins, this means they are typically better candidates for the 50% retrace entry discussed previously.

- Pin bars will show up in any market. Be sure you practice identifying and trading them on a demo account before trading them with real money. Practice makes perfect.

I hope you’ve enjoyed this QQE Pin Bar Price Action Trading System and Strategy.