Price Action Trading Forex – Super Simple and Super Easy Price Action Trading Strategy with auto zig-zag fibonacci indicator. In simple terms, price action is a trading technique that allows a trader to read the market and make trading decisions based on the actual price movement on the chart, rather than relying on lagging indicators.

Most indicators are derived from the actual prices on the chart, so they are in fact, giving them information on past price movements.

Why would traders want to base their trades on past information, when the most important factor in trading is what prices are doing right now, and what they are most likely to do in the very near future?

By using certain strategies, past information can help the trader to learn what prices are most likely going to do in the short term, rather than trying to guess using lagging indicators.

The Pin Bar Setup

I bet you have seen many pin bars on your Forex charts.

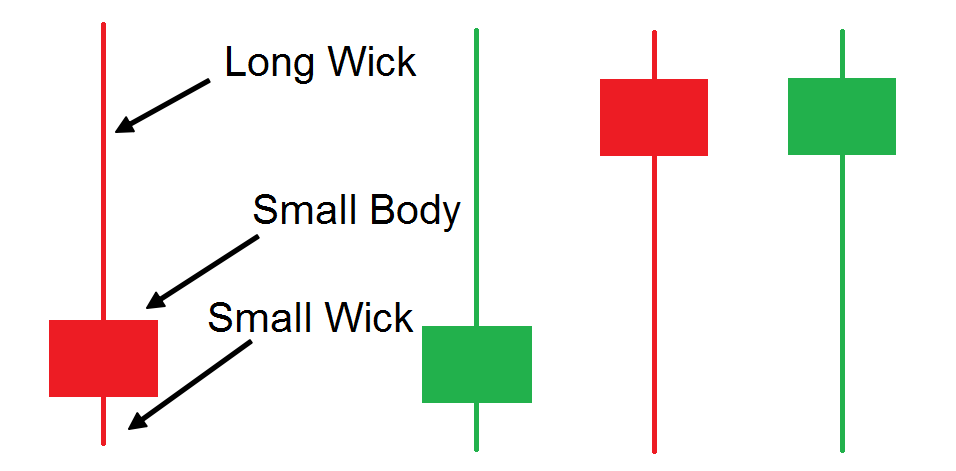

Maybe you haven’t been aware that you are looking at a pin bar formation per se, but you most likely have come across this candle:

Above you see the structure of the pin bar candlestick pattern and its four variations.

The candle’s unique structure includes a long candlewick, a small body, and a small candlewick opposite the long candlewick.

An important rule for identifying a pin bar is that the long wick should comprise at least 2/3 the size of the entire candle.

Some traders find it useful to program a Pin Bar indicator in Metatrader or their preferred trading platform to make it visually easier to spot on the chart.

50% Retracement Pin Bar Trading Strategy

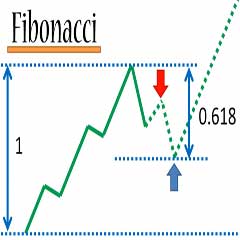

It is a widely accepted fact among chart technicians that most major moves, and many minor ones, will eventually retrace to around the 50% level of the move.

How to trade price action signals from 50% retrace levels

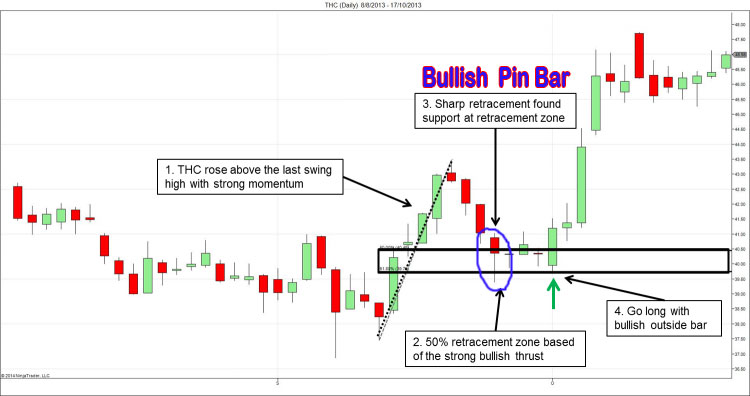

When you have a price action signal present on the daily chart, you then match up the fibonacci 50% retracement level if there is one present (see chart example below), if the price action candlestick signal matches up with the 50% swing retracement level then you’re good to go and potentially have a valid trade.

If you can also find a relevant horizontal level to match up here, its a ‘double whammy’ of confluence (a reason to get excited).

Bullish 50% Retracement Trade

- Look for a bullish price thrust that clears above the previous swing high with strong momentum.

- Mark out a “retracement zone” between 50% and 61.8% of the price thrust.

- After price falls down to the retracement zone, buy above bullish Pin Bar price action signal (When you have a Pin Bar price action signal present on the daily chart).

Bearish 50% Retracement Trade

- Look for a bearish price thrust that clears below the previous swing low with strong momentum.

- Mark out a “retracement zone” between 50% and 61.8% of the price thrust.

- After price rises up to the retracement zone, sell below bearish Pin Bar price action signal (When you have a Pin Bar price action signal present on the daily chart).

If you are not sure how to draw retracement zones, below are ready to use 50% Retracement Pin Bar Auto Zig-Zag Fibonacci Price Action Trading System and Strategy.