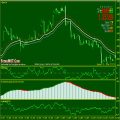

Momentum Heiken Ashi Forex Trading Systems – HOW DO I USE THE VERIFIED TRADER SYSTEM.

- The white Candlesticks are ABOVE the 2 EMA lines (Yellow and Gold). (Section 1)

- The momentum line is BELOW 100 BUT positively starting to move UPWARDS. (Section 2)

- Stoch Blue line starts to climb ABOVE the red line, at a sharper angle. (Section 3).

- The white Candlesticks are BELOW the 2 EMA lines (Yellow and Gold). (Section 1)

- The momentum line is ABOVE 100 BUT positively starting to move DOWNWARDS. (Section 2)

- Stoch Blue line starts to fall BELOW the red line, at a sharper angle. (Section 3)

Stop levels and Take Profit levels depend on the timeframe you are using. If you wish to scalp (highly effective). Then I suggest the M5 chart with a TP of 10 pips and a stop of 7 pips.

I, like many others, have been searching for the perfect trading system, and I believe I have found it. I’m writing to ask you to examine this system and provide any constructive feedback that you might have.

When I say “perfect” trading system, I do not mean to imply that it has no losses, but what I mean is that it is “perfect” for my trading style and my 3 requirements.

Here is a list of the requirements that I had set out for the system, followed by the system itself, and then I will attach the only indicator I use:

- Must be “set it and forget it” system, as I am in the air 3-4 days a week and cannot monitor the markets intraday.

- Must catch all major trends.

- Must handle ranging markets acceptably.

Indicator: Heiken-Ashi Smoothed set to 2-6-3-2.

Entry: 0000 GMT (7:00 PM Eastern time).

Enter in direction of previous Heiken-Ashi candle (blue=long, red=short)

Stop Loss: 50 pips

Take Profit: 55 Pips

Start with .10/pip (1000 units at Oanda) or micro lot for every $3,000.00.

double up on every loss, maximum 9 losses

I have backtested this system for the months of June through October 2006, and am continuing to backtest for Novemer and December. I will post the results in a spreadsheet on the next post down.

Summary: Out of the 5 months backtested this system produced the equivalent of 3414 pips. I say the “equivalent of” because when I would “double up” on a loss I had to put twice the number of pips actually one, so the spreadsheet would equal the dollar amount won correctly.

Concern: Many people say that doubling after a loss is dangerous and risky. To alleviate some of the risk I start with very minimal lot sizes. Obviously this has the adverse affect of not growing the account very rapidly when you get a string of all winners. But this adverse affect seems to be offset by the reality that you really never have a losing trade because all losses are more than offset by the doubling up of the winners.

Any feedback you have would be appreciated, or if anyone is able to test this system back several years with backtesting software, please let me know.