When people think of the stock market, they usually only think of options. The foreign exchange market also, has a lot of opportunity to make money. This article will give you some tips on how to make money with forex and what steps must be taken to make sure you succeed.

The Direction of Market Trends

Understanding the direction of trends will greatly improve your profitably on the Forex market. Be current with general trends and which currency is stronger, or even perceived as stronger. Read news releases and follow the direction of the market trends. Keep in mind to not trade after a huge news release though, as you may want to wait and see what the market does.

Focus on a Single Currency Exchange

Focus on a single currency exchange to build up your Forex skills. Concentrating on the interplay between two currencies – ideally, perhaps, with one of them being your home country’s currency – will build your understanding of the Forex market. Learning how two particular currencies interact helps you build a fundamental understanding of how Forex interactions work in general.

Trade in the Long-term

The best way to earn profits in forex trading is to trade in the long-term. It’s easy to get suckered in to short-term or day trading, but the biggest profits are seen over weeks and even months. Currency trends depend the trends of large economies, and large economies don’t change quickly.

Careful and Not Get Reckless When Trading

A great forex trading tip is to always remain careful and not get reckless when trading. If you’re not confident and your opinions aren’t backed by advisors you trust, then it’s a good idea not to trade. Only trade when you feel that you are well informed of both the positive and negative consequences of a deal.

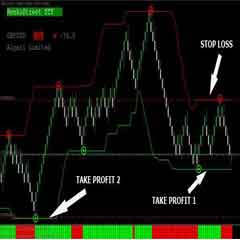

Understanding How to Read the Charts

Understanding how to read the charts and analyze the financial data in forex signals can be the difference between success and failure. If you do not understand the numbers, you will not understand a good trade when you see one. This means you will ultimately fail, so make sure you’re studying up on the numbers.

Economic Indicators to Predict Trends

Keep an eye out for economic indicators to predict trends. The value of a currency depends on the general economic situation of the country: this can be measured by factors such as the Gross Domestic Product, the trade balance or inflation indicators. Learn as much as possible about economy and what kind of factors can influence an exchange rate.

Set up a Mini-account and Do Small Trading

First set up a mini-account and do small trading for a year or so. This will establish you for success in Forex. It is vital that you understand the good and bad trades, and this way is the easiest thing that you can do to understand them.

The Foreign Exchange Market is more than capable of supplying you with a decent living, but this is really the wrong reason to invest in Forex. Wanting to make your living solely as a trader will cause you to put all of your eggs into one basket. This basket is too large to carry and too fragile to hold, so start out trying to supplement instead of trying to replace.

Manage Your Money

Every Forex trader, both experienced and not, should take the time and learn how to manage their money. Once you have made profits from the marketplace, you should take the time and learn how to keep those profits growing. There are a wide selection of money management books out there.

Watch Carefully for Fake-outs on the Market

This occurs when you are watching a currency that makes a movement in a direction and makes it look as if it is beginning a new trend. Then suddenly it takes a dive in the opposite direction in which you thought it was going to go.

If you are trying to make money fast in the Forex market, it is important that you embrace the constant instability of the Forex market. If you are not prepared to tackle a market that is constantly changing, then you should not even step foot into the Forex trading world.

Keeping Track of The Market Trends

Keeping track of the market trends is one thing, but you should also pay attention to buying and selling trends from other traders. Their perception of the market will influence their decisions, and also influence the value of a currency. A currency might have a high value only because there is a high demand for it.

Withdraw Your Profits From Your Broker Account Frequently

You are not obligated to reinvest your profit in the broker account. Take all or most of your profit and enjoy it as you please. Don’t get greedy and reinvest everything in hope to double it. It may not happen and you can lose all your money.

Do not Trade With Emotion

Stick to the trading plan that you have developed to assure that you are not going to make any detrimental mistakes and lose all of your money. If you try to hold on to your position until it turns around, you are surely going to be out of the game quite quickly.

Have a Trading Strategy for Various Market Conditions

Markets can be loosely classified as trending higher, trending lower, or range bound. In a rising market, buy on the dips, and in a falling market, sell on the bounces. Don’t sell into a flat period in a bull market or buy during a flat period in a bear market. These strategies will help you maximize profits by buying low and selling high, while lowering risk by not fighting the market trend.

The tips that you have read about may seem on the hard side, but it will be worth it. Take the time to really gain a large understanding of the market and make sure you take the time to practice, as much as you possibly can. Gain all the knowledge you need before making any large decisions.