BEST 3 Long Run FOREX TRADING SYSTEMS How to Be a Successful and Profitable Forex Trader on The Long Run – In order to be a successful and profitable forex trader on the long run, there are three important factors you must take into account.

1. Use a Good Forex Trading System

The trading system should be profitable for a long time and must be simple and easy to apply. It should be of a mechanical nature, allowing very little or even no discretion or judgment from the trader’s part, especially if you are just a beginner trader, it is very important that you follow mechanical hard-and-fast rules: if X=Y then do Z. Below are best 3 forex trading systems you should know…

Forex High Probability Trading System – ATR ratio often reach high values after the prices quick and strong movements. Low indicator values often correspond with long periods of flat that can be observed on the market top and during consolidation. It can be intepreted according to same rules as other volatility forex trading indicators.

Forecasting method using ATR ratio is as follows: the higher is the indicator value, the higher is the probability of a trend change; the lower is the value, the weaker is the trend movement. In case the indicator value climbs above the blue horizontal line, it is time to buy or sell.

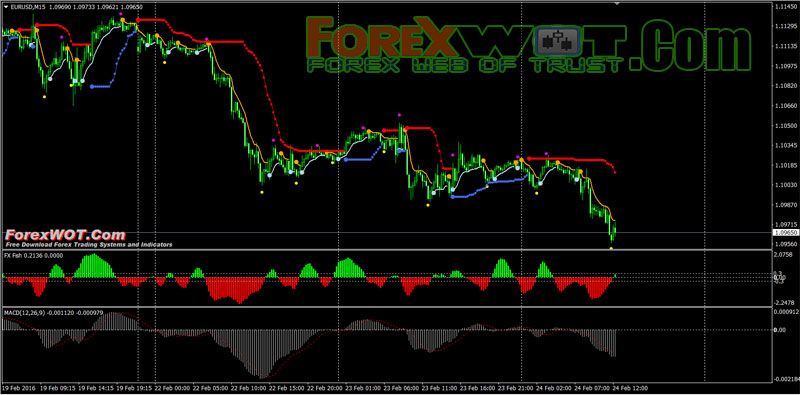

This is Highly Effective Forex TOPTREND Trading System you have to know – TopTrend or also known as BBands Stop indicator default settings (20, 2). TopTrend indicator can be your helping hand in confirming a trend, identifying trend change and setting stops.

TOPTREND appearance is pretty much self explanatory. What should be added is that TOPTREND if used alone won’t be able to save traders from losing in the Forex market. While it performs outstandingly well during good trends, it faces a fiasco during sideways channeling market.

- How to Maximize Your Forex Profits with Step Moving Average Trading and Momentum System

Advanced forex – How to Maximize Your Forex Profits with Step Moving Average Trading and Momentum System. Forex trading is the most popular way to earn extra money from home this century, but people rarely know how to maximize its benefits and limit its risks effectively enough to achieve a success rate of 80%.

Step Moving averages (Step MA) smooth the price data to form a trend following indicator. They do not predict price direction, but rather define the current direction with a lag. Step Moving averages lag because they are based on past prices. Despite this lag, step moving averages help smooth price action and filter out the noise.

2. Have a Solid Money Management Strategy

Throughout my trading career I have come to learn that success in trading is not only about using a profitable forex trading system (of course that is VERY important) but also about having a good and solid money management strategy. Trading without a clear and precise money management plan is a sure way to fail.

Also, you have to work on getting high probability trades, like using at least 1:2 risk reward ratio, trading only in the direction of the general trend and more based on your trading system rules.

3. You Must Control your Emotions

The best enemy of trader is his emotion. You have to face the emotion of Greed once you started to profit. Because of Greed, you are more likely to open more trades and increase lot sizes, without paying attention your risk exposure is increased too.

The emotion of fear most likely happened when you are in losing situation where your fear of losing push you to add more positions to cover up, neglecting the multiplied risk involved.

Statistically because of this type of emotions, only 5% – 10% of traders are profitable. Therefore, you should have the gut to discipline yourself on this.

O Love This Website :))) Thanks SOOO Much…I’m Trying My First Strategy From You Tomorrow . On Demo

Yes, it is possible to make constant profits in Forex.

Though, it should not be a secret for you that only 5-10 % of all the traders around the world validate this statement. The rest of them are still on their way to reach stability and profits.

In order to avoid the situation of being on the way all of your life, you should come with clear actions and big changes in your behavior as a trader.

Think about building a home – you cannot do it without a clear architectural project, without choosing a good place, without paying some professional workers, without being attentive to details. You see: there are actions, it cannot come out of nothing.

This is why you should not follow the general idea among traders that Forex is a way of making profits just so, out of nothing.

You should start with actions: learning trading skills by attending some courses, training on demo account, reading the recent market news, watch experienced traders, and control your emotions.

We are sure that with some effort and confidence everyone ca do well.

All the best to you!

Before you even start thinking about trading and risking your hard earned money and if you feel you want to explore trading as a means of growing your income and wealth portfolio you need to enter the market with the right mindset.

Discipline

The first thing you need to understand is that trading is a discipline. It is a long-term game of probabilities so you will win some trades you will lose on some trades but as long as you a disciplined enough to stick to your trading strategy to not be emotionally attached to your losses or worse your wins you will tend to make more winning trades than losing trades and nett a profit.

Mastery

You need to know what your trading strategy is and you need to master it. You have to know it inside and out and have absolutely no doubts or questions about that the market needs to look like before you risk your money in a trade. You have to become a “sniper.” Once the market conditions match your strategy criteria you place your trade without the fear holding you back.

Risk Management

You ALWAYS manage your risk on EVERY single trade. The moment you loosen your control over your trades, you allow emotion to creep in and before you know it you are in a downward spiral of emotional forex trading and losing trades. Only risk the money you are prepared to lose in every trade. In fact you should go in expecting to lose on any given trade so that you are constantly aware of the very real possibility of it happening.

Plan

You need to be very organized. Have a trading plan and journal to track your trades consistently. Think of forex trading as a business rather than placing a bet in a casino. Invest with your calculator and not your heart stay calm in your dealings with the market.

Again keeping your forex trading mindset right is the outcome of always taking a conscious effort to practice manage and control your emotions when it comes to trading.