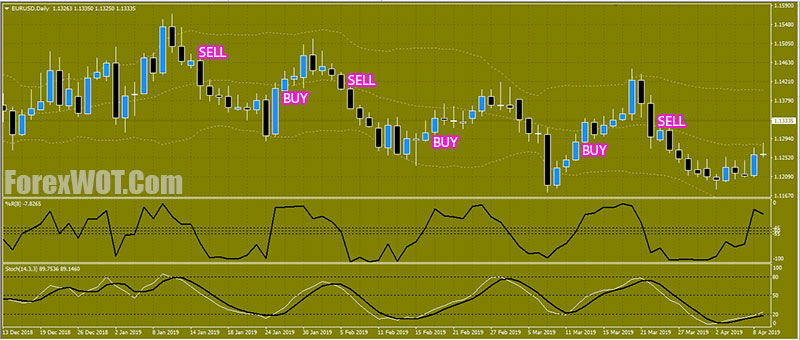

High accuracy trading “Bollinger Bands Scalping System With WPR and Stochastic Oscillator Filter” – Essentially Bollinger Bands are a way to measure and visualize volatility. As volatility increases, the wider the bands become. Likewise, as volatility decreases, the gap between bands narrows.

What is done with this information is up to the trader but there are a few different patterns that one should look for when using Bollinger Bands.

I’ll show you how to use Bollinger Bands effectively in the forex market.

- Time Frame:

- M5 (scalping trading)

- H4 AND d1 (Short term swing trading)

- Currency Pair: EURUSD and GBPUSD

- Bollinger Bands

- WPR

- Stochastic Oscillator

- Bollinger Bands: watch to see if the price goes down and touches the lower Bollinger Bands

- Stochastic Oscillator:

- wait for the Stochastic %K line (white moving average) to cross above the 20 level

- %K line (white moving average) above %D

- WPR: Upward and above -45 level

- Bollinger Bands: watch to see if the price goes up and touches the upper Bollinger Bands

- Stochastic Oscillator:

- wait for the Stochastic %K line (white moving average) to cross below the 80 level

- %K line (white moving average) below %D

- WPR: Downward and below -55 level

In general, the WPR is more useful during trending markets, and stochastics oscillator more so in sideways or choppy markets.

The primary limitation of the stochastic oscillator is that it has been known to produce false signals. This is when a trading signal is generated by the indicator, yet the price does not actually follow through, which can end up as a losing trade.

During volatile market conditions, this can happen quite regularly.

One way to help with this is to take the price trend as a filter, where signals are only taken if they (WPR and Stochastic Oscillator) are in the same direction as the trend.