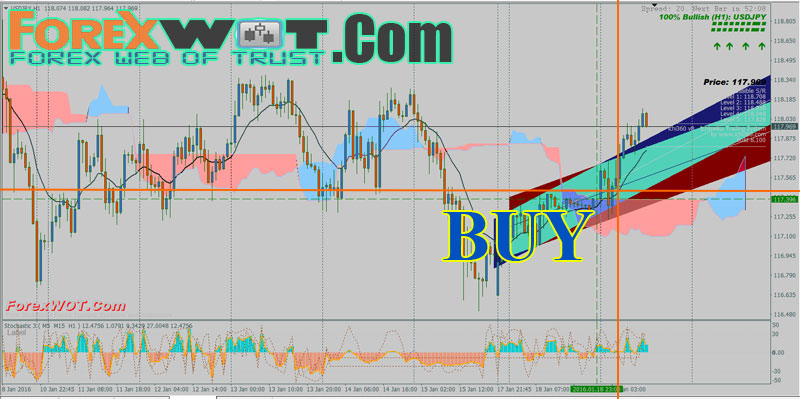

Win Consistently with Forex Moving Average, Stochastic Oscillator and Ichimoku Trading Strategy – There are two trading system the first intraday, the second is swing trading.

Moving Average, Stochastic Oscillator and Ichimoku is an intraday profitable Trading System is based on Ichimoku 360 V.8. This Forex strategy is trend following.

- Price must above moving average (13, period),

- Price must above ichimoku cloud,

- Stochastic Oscillator green bars,

- Ichimoku 360 V.8 indicate a bullish trend.

- Price must below moving average (13, period),

- Price must below ichimoku cloud,

- Stochastic Oscillator red bars,

- Ichimoku 360 V.8 indicate a bearish trend.

- at the levesl of the pivot points,

- Ichimoku 360 V.8 indicate opposite trend.

- The alert Buy on the screen of the Ichimoku 360 V.8 indicator

- Price must above ichimoku cloud,

- MJ Regression that indicate and bullish trend,

- Stochastic Oscillator green bars,

- the price is above of the moving average (13 period).

- The alert Sell on the screen of the Ichimoku 360 V.8 indicator

- Price must above ichimoku cloud,

- MJ Regression that indicate a bearish trend,

- Stochastic Oscillator green bars,

- the price is below of the moving average (13 period).

NOTE:

Test this “Forex Moving Average, Stochastic Oscillator and Ichimoku Trading Strategy” to see if it works on a consistent basis and provides you with an edge.

If your system is reliable more than 50% of the time, you will have an edge, even if it’s a small one. If you backtest your system and discover that had you traded every time you were given a signal and your profits were more than your losses, chances are very good that you have a winning strategy.

Test a few strategies and when you find one that delivers a consistently positive outcome, stay with it and test it with a variety of instruments and various time frames.

[sociallocker]

[/sociallocker]

thank you for the great systems you provide..you are such a blessing..In the above strategy is it 13SMA or 13EMA?