High Accuracy Forex Scalping Trading System – Zero Lag Stochastic Oscillator Scalping Trend Momentum Trading Strategy. The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals. This indicator measures momentum by comparing closing price to the trading range over a given period.

Stochastic is a simple momentum oscillator developed by George C. Lane in the late 1950’s. Being a momentum oscillator, Stochastic can help determine when a currency pair is overbought or oversold. Since the oscillator is over 50 years old, it has stood the test of time, which is a large reason why many traders use it to this day.

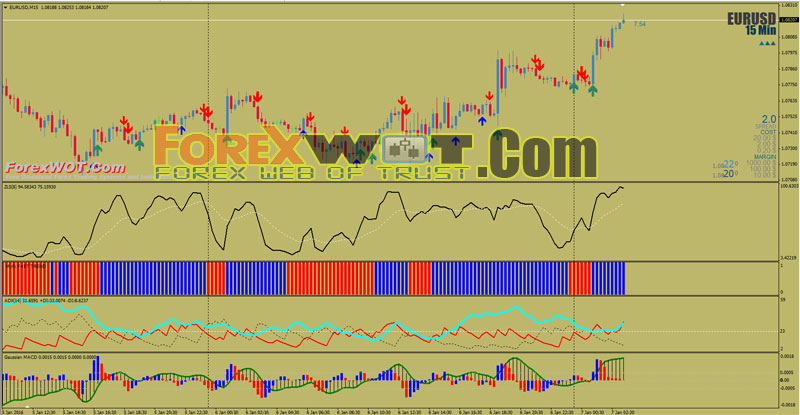

Best Time Frame : 15 min.

Best Currency Pairs : EUR/USD, GBP/USD, AUD/USD

Trading Sessions London And NewYork ( Best NewYork).

I recommend a 10 pip s/l and 10 pip t/p for this strategy but you can make changes to the script especially the lot size by right clicking on the “BUY” or “SELL” script in your navigation window and left clicking on modify. Then you can change the lots size that you want to trade.

It is set at 0.1 which is 1 mini lot $1. per pip. You can change this to 0.2 or more accordingly or if you feel you want to trade a standard contract as I do 1.0

You can also change the t/p and/or s/l which I don’t really recommend. Also the script is set for 4 digit brokers.

If you have a 5 digit broker, you need to add a 0 on each setting. Then before you exit, press the F7 key at the top of your computer and if everything is good to go you will see no errors.

NOTE: Always check that the script is doing the right thing on a demo account before using it live. This can save you some heartaches.

- Blue arrow;

- Trend indicator blue bar,

- Zero Lag Stochastic black line above white dot line,

- ADX line upward and above 23 line,

- Gaussian MACD green bars and above 0.0005 line.

- Red arrow;

- Trend indicator red bar,

- Zero Lag Stochastic black line below white dot line,

- ADX line upward and above 23 line,

- Gaussian MACD green bars and above 0.0005 line.

Before you enter any market as a trader, you need to have some idea of how you will make decisions to execute your trades.

You must know what information you will need in order to make the appropriate decision about whether to enter or exit a trade.

Remember that fundamentals drive the trend in the long term, whereas chart patterns may offer trading opportunities in the short term. Whichever methodology you choose, remember to be consistent. And be sure your methodology is adaptive. Your system should keep up with the changing dynamics of a market.