The reasons are huge surplus from trading /Foreign investment plus strict controlled money exchanging system by China government.

I will try to make a very easy understandable description to let ordinary people understand it. I am an amateur too.

- As we know, China attracted huge foreign investments because it had low production cost and very good infrastructures. The foreign investors need to exchanged from US$ to RMB to build factories, pay salaries and etc.

- The huge Chinese exporting factories received US$, and they also need to exchange US$ to RMB to pay the rents, salaries and etc, to keep their profits.

- But in China, the exchange of US$, speical the capitals, were under strict control, the US$ holders could only go to the designated banks to exchang the money. At first it was only Bank of China who had the right of exchange.

- As China’s import was far behind the outport, the banks needed to use its current RMB reserve to exchange, that would cause reduction of RMB in the banks, and led to RMB’s shortage.

- It would cause appreciation of RMB, means one RMB will exchange more US$ than before, every US$ holder needed the RMB urgently for his job.

- The Chinese government did not want the appreciation of RMB to push China’s export and attract more investment, it decided it will issue corresponding money (RMB) to exchange so much US$. It gave RMB to the banks, the banks returned US$.

- Finally it is the government who owned the huge US$, it even used this money to buy American bonds of treasury as it could not do anything else.

- As China had huge surplus from trading year by year, it had to issue more RMB to exchange US$, and own such huge US$ conserve.

We should know this US money is owned by all Chinese as it was exchanged by issued new RMB money. Chinese had to bear the soaring price of assets, such as real estate.

How has China managed to consistently maintain a positive BOP through the years?

Foreign Direct Investment and the development of China’s export sector.

Part of China’s early development strategy was to foster the development of a robust export sector. They encouraged foreign multi-nationals to setup factories around several Special Economic Zones (SEZs), notably the Pearl River Delta and Yangtze Delta regions.

China was lucky that export expertise and trade links had already developed in ethnic Chinese enclaves such as Hong Kong and Taiwan.

These Hong Kong and Taiwanese factory owners were encouraged to take their existing business models and scale rapidly in China, taking advantage of a massive stream of inexpensive labor pouring out of the countryside.

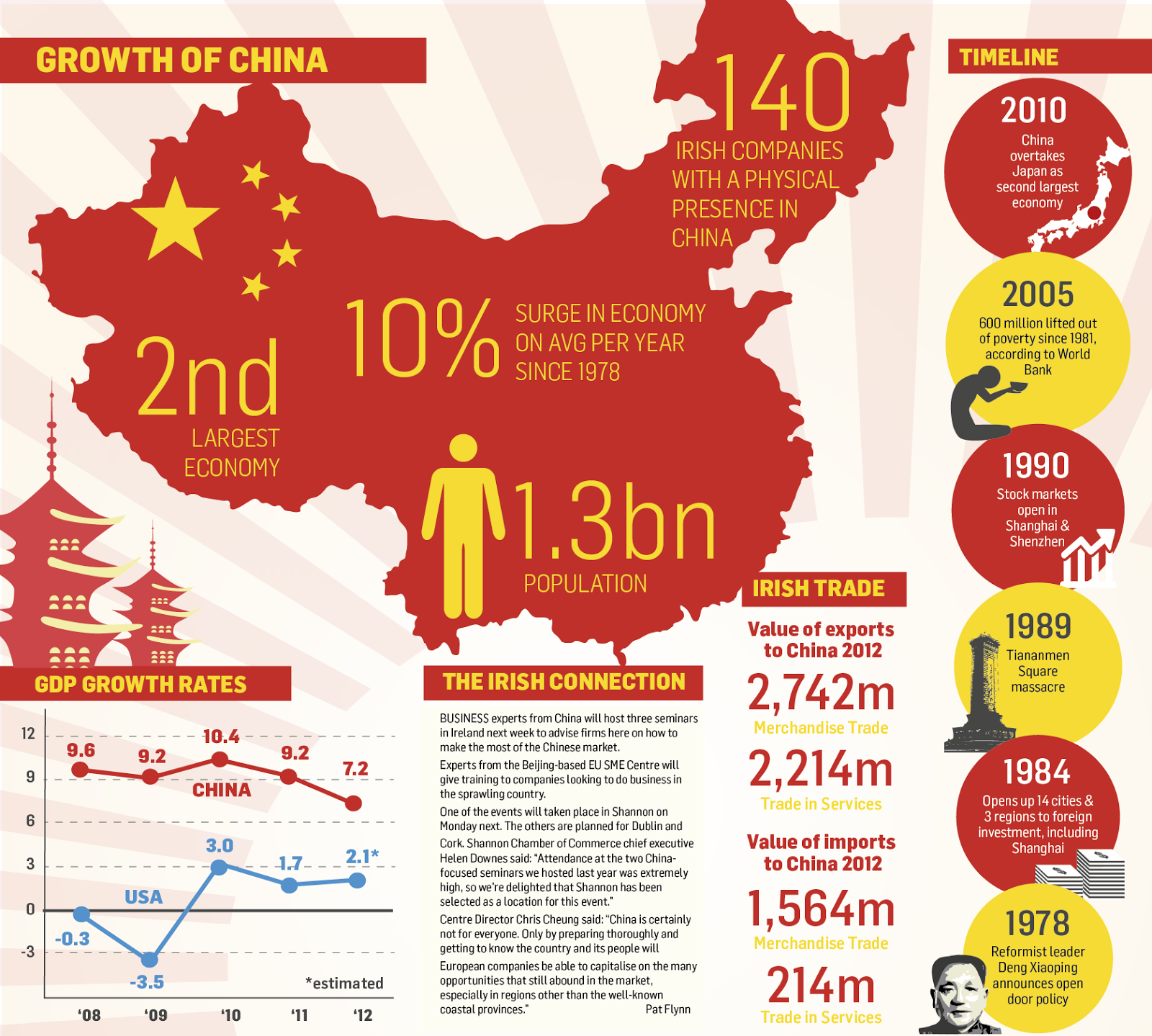

In the early years of development (1980s), these two were a major source of Foreign Direct Investment (interestingly crude oil exports were another source of hard foreign currency).

These multi-nationals helped integrate China into the global supply chain, at a time when the world was undergoing massive globalization following the fall of the Soviet Union and Communism, and the integration of former Communist countries into the global economy.

Notably, China joined the WTO in 2001, which provided a further boost to their trading activities and subsequently exports skyrocketed.

Trade surpluses and repression of a financial nature.

A key tenet in Economics is the theory that large positive trade surpluses are a sign that a country’s currency is under-valued. Normally market forces (Adam Smith’s “invisible hand) would start to put pressure on the currency to appreciate over time until the trade surpluses are reduced.

However, China exercised a policy of strict capital control and pegged the RMB to the U.S. dollar, allowing these trade surpluses to persist.

In the early 2000s, China’s policymakers started putting in place extremely repressive financial policies through the state-owned banking system.

For example,….

they controlled credit by setting interest rates on loans, which were disproportionately directed at State-Owned Enterprises (SOEs), at artificially low rates.

At the same time, interest rates paid on deposits were also artificially low, often several percentage points below inflation, resulting in the gradual erosion in the real value of household savings. Because of the strict capital controls, savers (i.e. the household/consumer sector) did not have any other options to park their savings safely.

The net effect of this was an annual transfer of wealth from the household to the State — the simplest way to think about it was a tax on savings.

Moreover, because wealthy households were often able to circumvent traditional capital restrictions and access financial products outside of China, this was a fairly regressive tax to boot.

The principal effect of this was the suppression of middle class consumption, which widened the Trade Surplus by holding down the Import side of the ledger. This “financial repression” tax was also directly related to the investment/infrastructure

In the early 2000s, the U.S. dollar also started to fall against the world’s major currencies. Because the Chinese RMB was pegged to the dollar, the RMB was also depreciating against the world’s major currencies.

This continued for a while even after China started to allow the RMB to appreciate in 2006 because for a period of time the U.S. dollar was depreciating faster than the RMB was appreciating. This further boosted Chinese exports and resulted in huge trade surpluses leading up to the Global Financial Crisis in 2008.

Chinese people love to speculate.

The announcement by China that they would let the RMB appreciate against the U.S. Dollar in mid-2005 was pretty big news. It came after years of diplomatic pressure from principally the United States to allow its “under-valued” currency to appreciate.

This also started a big movement by Chinese businesses and individuals to start speculating on further appreciation of the U.S. Dollar. They did this in a variety of ways, including trying to bring back all of their export earnings into RMB and by borrowing billions of dollars in U.S. Dollar-denominated debt. These types of activities largely show up in this “Other Investments” category that I promised earlier I would get back to.

The reason this is important is because for most of the last two decades, this “Other Investments” category has been mildly positive. From 1998 to Q3 2011, the accumulated amount was $35 billion of inflows. Then, as China’s currency was no longer appreciating against the U.S. Dollar, this category started going negative. Then starting in Q2 2014, it started to go really negative — just in the past 18 months, this category accounted for $601 billion in outflows.