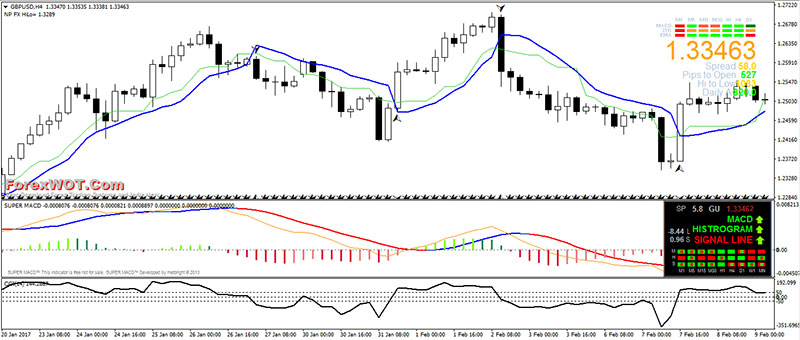

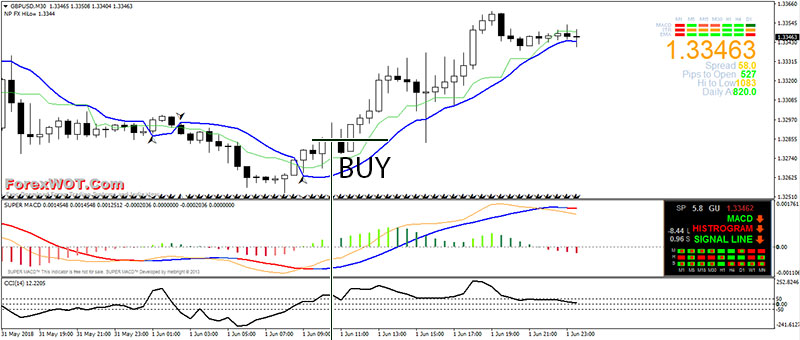

High Probability NPFX Hilo Trading Strategy with CCI MACD Indicators – How to gets high probability trading setups?… The answer is to trade in the direction of the market trend.

When the price is in an uptrend, you should STAY LONG. When the price is in a downtrend, you should STAY SHORT.

- Time Frame: M30 or higher

- Currency Pairs: EURUSD and GBPUSD

MetaTrader Trading Indicator

- NPFX Hilo

- NPFX Clock

- Gann Hilo Activator

- Signal Trend

- Ichimoku Kinko Hyo

- Super MACD

- Commodity Channel Index

BUY Rules

- The Tenkan-Sen line of Ichimoku Kinko Hyo upward and above NPFX Hilo

- Super MACD bullish

- Signal Trend green color bars

- CCI line above 50 level

SELL Rules

- The Tenkan-Sen line of Ichimoku Kinko Hyo downward and below NPFX Hilo

- Super MACD bearish

- Signal Trend red color bars

- CCI line below -50 level

Trading NOTES

- This trading system is basic but good

- This method gives the trader higher than 1:1 Risk Reward Ratio