Has anyone ever made money trading FOREX?…. Yes, but it took a year of trial and error. In order to be profitable you have to be highly disciplined, organized, and have a trading plan in place.

The reason why most people don’t make money in the markets is because of their mindset and not being organized. They open up a brokerage account, fund it, read a book, and start trading. Then they think they are going to become millionaires overnight.

Steps To Help You Become a Successful Forex Trader

Trading is all about identifying your bad mental habits and forming profitable habits to be consistently profitable.

In order to be successful as a trader, here are the steps:

1. Study, study, study, STUDY!

Learn a specific strategy and master it. Learn one trading setup at a time and demo trade it until you have had at least 30-40 successful trades with that setup then move to the next trading setup.

2. Have a trading journal.

Record all your trades, print out the chart, mark out the trade you made, then write about the trade. Writing out why you won or loss helps ingrain what you should and shouldn’t be doing. You’ll learn not to make the same mistakes.

3. Have a trading plan.

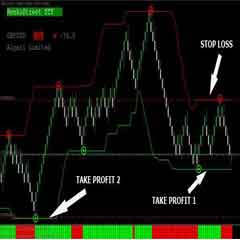

Make a list of parameters that a trade must meet in order for you to take the trade. For example:

- Is the market bullish, bearish, or sideways?

- If its sideways, STAY OUT! If bullish, are the EMAs diverging upwards? How far are the candlesticks from the EMAs? Does the market look overextended?

- Are there any key support and resistance levels? Is the setup right under a resistance level? If so, wait for a break of the level and a retrace to enter.

4. Make sure you are mentally prepared to enter the markets.

Have a clear head and be focused on the trade. Don’t get angry and vengeful if you lose a trade, it’s part if the game. That’s why so many people lose money, their emotions cloud their judgements. If the trading setup looks kinda good but not ideal, don’t take it. People have the tendency to convince themselves to take a trade that isn’t worth taking. Be objective and trade based on what the market is telling you and not what your emotions are telling you.

5. Demo trade for as long as possible to master setups THEN open up a SMALL account.

Another problem with people is that they demo trade and are very successful but open up a real account and lose all their money. The difference is psychology. When you aren’t risking real money, you don’t feel the intense greediness or pain of losing money. When you open a real account, trade with money you don’t mind losing and only trade a small amount. As you get a handle over your emotions, gradually start adding more money and making bigger trades.

6. Don’t change your own rules and follow them ruthlessly.

I can guarantee you that if you follow the advice I just gave you, don’t give up, and master your mind/trading strategy, you will be a successful trader.

NOTE:

Forex is not a gambling/casino you are dealing with where you will definitely will lose in the long run no matter how much experience you have, rather in Forex trading if you have proper knowledge you will certainly make profit