Understanding Price Action is a must read for both the aspiring and professional trader who seek to obtain a deeper understanding of what is commonly referred to as “trading from the naked chart“.

With hundreds of examples commented on in great detail, Volman convincingly points out that only a handful of price action principles are responsible for the bulk of fluctuations in any market session—and that it takes common sense, much more than mastery, to put these essentials to one’s benefit in the trading game.

The Power of “Understanding Price Action” Book

The power of the book lies in the exceptional transparency with whi

ch the concepts and trading techniques are put forth.

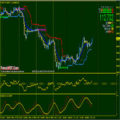

Besides offering the reader a comprehensive study on price action mechanics, included within is a series of six months of consecutive sessions of the eur/usd 5-minute. Containing nearly 400 fully annotated charts, this section alone harbors a massive database of intraday analysis, not found in any other trading guide.

Written with a razor-sharp eye for practical detail, yet in a highly absorbable manner, Understanding Price Action breathes quality from every page and is bound to become a classic in the library of any trader who is serious about his education.

About the Author

Bob Volman (1961) is an independent trader working solely for his own account. He is the author of Forex Price Action Scalping, a book widely acclaimed by active scalpers for its ingenuity and practical usefulness, and in steady demand since its first publication in 2011. Understanding Price Action is his second volume on price technical trading, containing all the insights and practicalities any trader could ever hope to find within a single trading guide.

A most lucid, thorough, engaging, and useful book on short term technical trading with actionable ideas.

Bob Volman’s work stands out like a diamond in the rough amidst trading literature. For half the price of the usual offerings in this category, Volman not only delivers valuable discretionary technical trading ideas, but presents them in a way that is both responsibly thorough and extremely comprehensible – a tough challenge with any discretionary method.

Key points:

- A handful of technical strategies are presented: breakouts (including from sloping trend lines), breakout pullbacks, classic pullbacks, and range reversals (breakouts back inside of a range). The only technical tools used are trend lines and a 25 pd moving average.

- Critical technical context is given for each setup in numerous well articulated examples, separating good trades from bad, without cherry picking.

- Setups are designed for ‘all-in, all-out’ trading: a bonus for all one contract traders out there.

- Plenty of helpful notes are given to describe the psychological issues of dealing with particular setups and their management.

Key improvements that weren’t in the prior book, Forex Price Action Scalping:

- The key time frame is 5 minute candles as opposed to the 70 tick chart, the former of which is much more popular (a number of tick chart examples are nonetheless included).

- There are extensive examples of sloping trend line breakouts as opposed to the classic horizontal line approach.

- A consecutive day by day analysis is given over the course of six months – something I have yet to see in any trading book.

- Volman discusses more extensive exit strategies including modifying profit taking positions, providing numerous examples thereof.

- An entire section is devoted to adjusting to low volatility conditions – another thing I have yet to see properly addressed in a trading book.

- The influence of different sessions is discussed (Asian vs Europe vs US).

- While the bulk of the focus is the EUR/USD currency pair, several other currency pairs are also presented in the low volatility section, as well as six examples from stock index futures (YM, NQ, ES).

Regardless of how good this book is on a first pass, it’s critical to understand that it’s not made for reading, but for re-reading. You’re going to have to go out there and do your own research to make the approach yours, but that is necessary with any trading approach you read about – unless you’re copying the code of an automated strategy.

Even if you don’t follow all of Volman’s technical ideas (for example I tend to be more of a counter-trend, failed breakout trader while Volman is more trend and breakout oriented), the most valuable thing this book and its predecessor can teach is the skill of reading into technical details properly and asking yourself the right questions as you design your own approach. This alone makes this book considerably more valuable than its numerous overpriced competitors. This is a book that is as much about concept as it is about content.

If you’re a fan of Volman’s work, you may also want to check out Forex Price Action Scalping. However, I suggest this book first, as it is a bit more rounded and provides an easier point of departure. Also, at the time of this writing there is an active group of Volman followers on the trade2win forum where one of the users posts Bob’s annotated 70 tick charts every Sunday evening.