FREE DOWNLAOD 5 BEST Successful Forex Trading Systems and Top 7 Best Forex Trading Success Rules To Profit. Successful Forex traders have a plan dictated by strict rules. Sometimes they make up the rules themselves.

Sometimes they use rules provided by other successful traders (the fastest and most successful way). Most of the time it is a mixture of both. But make no mistake about it… you need rules and you must follow them if you want to be a Forex trader.

To help you get started, here are Top 7 Best Forex Trading Success Rules you can adopt to help you become a better trader:

Trading Is An Art, Not A Science

The systems and ideas presented here stem from years of observation of price action in this market and provide high probability approaches to trading both trend and countertrend setups, but they are by no means a surefire guarantee of success.

No trade setup is ever 100% accurate. Therefore, no rule in trading is ever absolute (except the one about always using stops!). Nevertheless, these 7 rules work well across a variety of market environments, and will help to keep you out of harm’s way.

Use Both Technical And Fundamental Analysis

Both methods are important and have a hand in impacting price action. Fundamentals are good at dictating the broad themes in the market that can last for weeks months or even years. Technicals can change quickly and are useful for identifying specific entry and exit levels.

A rule of thumb is to trigger fundamentally and enter and exit technically. For example, if the market is fundamentally a dollar-positive environment, we’d technically look for opportunties to buy on dips rather than sell on rallies. Below are 5 best forex trading systems to help you become a better forex trader.

- RSIOMA Trend Magic Trading System and Strategy

How to Immediately Become A Successful Trader – Becoming a successful trader is not as difficult or elusive as you probably think right now. I recommend reading this entire article through to the end because I believe the information I’m about to share might just be the ‘missing piece’ of the trading puzzle you have been trying to put together… With RSIOMA Trend Magic Trading System and Strategy you will be Immediately Become A Successful Trader.

RSIOMA Trend Magic Trading System and Strategy is intraday trading system with clear accurate trade signals. Be aware, most of the time you should be waiting patiently for high-probability trades to set up, in other words, you should trade like a sniper.

- Renko MACD Mirror Trading System

Learn about forex trading with Renko Trading System. To day we learn about How to Make Money Trading Forex Easily with Renko MACD Mirror Trading System. I chose this strategy because the tools involved in identifying trades are fairly intuitive even if you have never traded FX previously.

[sociallocker]

[/sociallocker]

A Renko chart is a type of chart. developed by the Japanese, that is only concerned with price movement; time and volume are not included. It is thought to be named for the Japanese word for bricks, “renga”.

A renko chart is constructed by placing a brick in the next column once the price surpasses the top or bottom of the previous brick by a predefined amount. Green bricks are used when the direction of the trend is up, while red bricks are used when the trend is down.

- Forex Trend Channel Trading System

How to maximize profit and minimize loss in forex trading – Today we will learn how to use Forex Trend Channel Trading System with Momentum indicator to maximize profit and minimize loss.

It doesn’t matter what type of currency trading system you use these high profit Forex Trend Channel Trading System and 3 simple tips will help you increase your profit potential dramatically. These tips and trading system are easy to understand, easy to apply and even better will increase your profits dramatically.

Firstly we talk about “Forex Trend Channel Trading System with Momentum Indicator“. If you’re a new trader who is trying to find the best method for trading, you may benefit from staying away up-front from reversals. Instead, trading can better be learned by first, identifying the major trend and second, finding trading opportunities within the overall trend. By finding trading opportunities in the overall trend, you can still have great Risk: Reward ratios without needing a rare sequence of event s are for a reversal to occur.

Finding trading opportunities within the overall trend is easy with Forex Trend Channel Trading System.

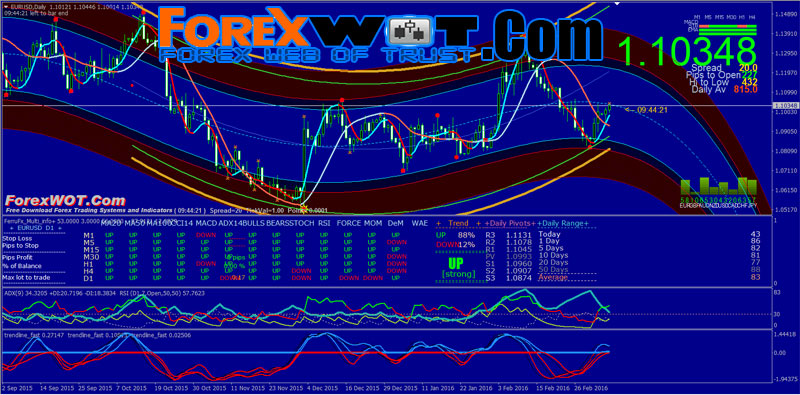

- Trend Multi Info Trading System

How to Become A Profitable Forex Trader In Easy Steps with Trend Multi Info Trading System. It doesn’t involve any fancy or complicated indicators nor does it involve any complex methodologies.

[sociallocker]

[/sociallocker]

Making money through Forex trading is not as hard and complicated as what novice traders think. I always emphasize on this fact that making money through Forex trading is not as hard and complicated as what novice traders think.

- Hull Moving Average Trading System

Forex Trading Advices and Tips – How to Become a Successful Forex Trader with Hull Moving Average Trading System. Statistics show that for new forex traders, profitable trading is hard to achieve. Improve your chances of success by studying currency trading tips and rules with Hull Moving Average Trading System.

Moving averages are often the best way to eliminate data spikes, and those of relatively long lengths smooth data as well. However, moving averages have a major flaw, in that their long lookback periods introduce lag. The solution is to modify the moving average formula and remove the lag.

Doing so minimizes the possibility of the moving average overshooting the raw data when predicting the next interval’s activity and thus introducing errors.

The Hull Moving Average (HMA), developed by Alan Hull, is an extremely fast and smooth moving average. In fact, the HMA almost eliminates lag altogether and manages to improve smoothing at the same time.

Never Let A Winner Turn Into A Loser

The FX markets can move fast, with gains turning into losses in a matter of minutes, making it critical to properly manage your capital. There is nothing worse than watching your trade be up 30 points one minute, only to see it completely reverse a short while later and take out your stop 40 points lower. You can protect your profits by using trailing stops and trading more than one lot. For more on this, see Trailing Stop Techniques.

Never Risk More Than 2% Per Trade

This is the most common and most violated rule in trading. Trading books are littered with stories of traders losing one, two, even five years’ worth of profits in a single trade gone terribly wrong. By setting a 2% stop-loss for each trade, you would have to sustain 10 consecutive losing trades in a row to lose 20% of your account.

Always Pair Strong With Weak

When a strong army is positioned against a weak army, the odds are heavily skewed toward the strong army winning. This is the way you should approach trading. When we trade currencies, we are always dealing in pairs – every trade involves buying one currency and shorting another.

Because strength and weakness can last for some time as economic trends evolve, pairing the strong with the weak currency is one of the best ways for traders to gain an edge in the currency market.

Risk Can Be Predetermined; Reward Is Unpredictable

Before entering every trade, you must know your pain threshold. You need to figure out what the worst-case scenario is and place your stop based on a monetary or technical level. Every trade, no matter how certain you are of its outcome, is an educated guess. Nothing is certain in trading. Reward, on the other hand, is unknown. When a currency moves, the move can be huge or small.

No Excuses, Ever

The “no excuses” rule is applicable to those times when the trader does not understand the price action of the markets. For example, if you are short a currency because you anticipate negative fundamental news and that news occurs, but the currency rallies instead, you must get out right away.

If you do not understand what is going on in the market, it is always better to step aside and not trade. That way, you will not have to come up with excuses for why you blew up your account. It’s acceptable to sustain a drawdown of 10% if it was the result of five consecutive losing trades that were stopped out at a 2% loss each. However, it is inexcusable to lose 10% on one trade because the trader refused to cut his losses.