With $100, it would be best to stay out of the markets. You’ll either lose all of it via trading losses and/or get eaten alive by fees.

Also keep in mind that there are many brokerages that require more than $100 to open an account.

The market isn’t a get rich quick scheme and should be treated as a business.

I would suggest getting a summer job, saving money, then buying a car. Use the extra funds from that job to invest in a proper market education, paper trade, and then open an account.

There is no investment in the world that can yield enough returns off of $100 that would allow you to buy a car. Keep your expectations of the market realistic.

NOTE:

There is no easy get rich routes. Hardwork, education, and perseverance is the way to go. Winning traders in any financial market all basically do the same things.

1) They have a trading plan in place-they trade with strict rules which they never deviate from

2) They keep a trading journal to record trade information so they can review it and make improvements in their strategy

3) They keep abreast of world financial news which affects the currencies of the countries whose currency pairs they trade

4) They continue to learn and improve their strategy and system always making refinements even small ones which over time add up to better results

5) They focus on risk management and proper execution and not profits

6) The keep their emotions like fear and greed in check and never break their rules because of their trading results

7) They study the habits of Market Makers and Banks and other traders to figure out who is winning consistently and why and who is losing consistently and why

8) They trade on their own information/analysis using their own strategy and they never rely on the opinion of others

9) They keep their losses small and hold their winners as long as possible to maximize their equity curve

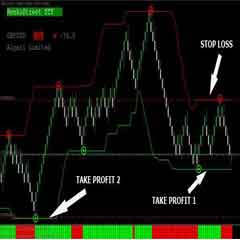

Most Forex traders take trades based upon minimal information and what they see visually on their charts using indicators like the MACD, RSI, stochastics, Bollinger Bands, etc. This is trading the “surface” of the Forex market and if they don’t get to a deeper level of understanding of the Forex market and how money is made and lost and nothing is changed the results of this way of trading will never change.