FREE DOWNLOAD Very Profitable Forex Heiken Ashi candles TDI Stochs Trading Method – I am a price action trader by nature and have always resisted indicators overall, but the reality is even a Japanese candlestick is an indicator.

The nice thing about Heiken Ashi candles is that you can apply price action analysis to them to get a good idea of where price may go. Price action for an Heiken Ashi chart is a little different but there are some similarities.

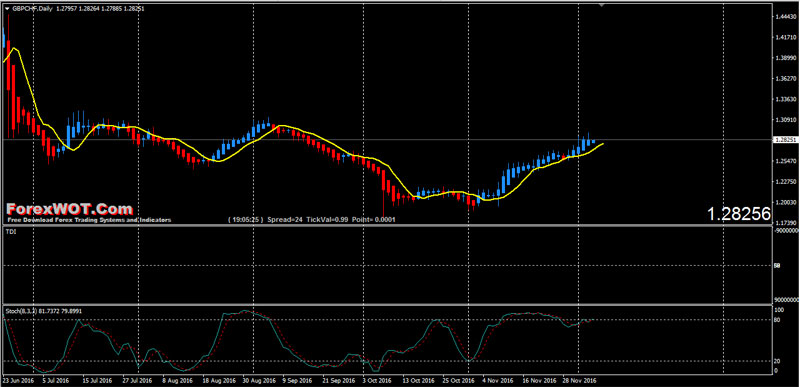

Forex Heiken Ashi candles TDI Stochs Trading Method

Timeframe: 4H or 1H (the original author trades 4H I prefer 1H)

Pairs: Any pair you are comfortable with

Indicators:This method uses Heiken Ashi candles + TDI +Stochs for conformation

I will attach a template file for MT4 to simplify things.

- Bottom line with this Heiken Ashi candles TDI Stochs method

It is very simple it can be used on any timeframe and with any pair but I feel reliability would be much lower on lower time frames.

What we are looking for first and foremost is a cross of the TDI indicator.

- If the green line crosses up through the red line we are looking to BUY.

- If the green line crosses down through the red line we are looking to SELL.

Also note where the TDI is. It is a much better signal to sell if the TDI is coming up from under the 50 line and a much better signal if the tdi is coming down from above the 50 line.

Second thing we look for is Stochastics. We are only using Stochs for confirmation.

- If they are oversold and pointing up than it confirms the BUY.

- If they are overbought and turning down it confirms the SELL.

Third we have a 5ema on the chart but that is just visual and not really used.