Volatility is your friend in trading, cause as soon as you enter a trade next thing you want will be to reach your target as soon as possible.

Traders make money on price moves. They either buy low and sell high or sell high and buy low in the case of short selling. If there is no price move there is no money to be made. As simple as that.

The direction of the move is not important but it’s imperative that there is a meaningful price move. Since no one can predict on a regular basis when the price is going to change, traders can capture only some part of the move. Therefore the move has to be wide enough for a trader to recognize the move, open a position and make a reasonable profit on that position before the direction of the move changes.

Trading non-volatile choppy markets is very difficult and requires a lot of patience and strict money management.

A bit more elaboration though. There are four ways for a trader to make money in the markets:

- buy low sell high

- sell high buy low

- buy high sell higher

- sell low buy lower

For these strategies, there are two kinds of price action that a typical trader looks at:

- Trending prices

- Prices in a range

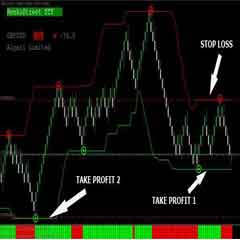

No one can predict price action correctly 100% of the time. Even if one is very good at predicting the direction of the move, one needs to test for confirmation that the idea is right before getting into the trade.

This means, if price action has low volatility as in either flat prices that don’t change much, or prices that trade in a very narrow band, there isn’t any strong confirmation of a signal in either direction, and no way a trader can put on a trade and take profit.

Careful money management will help the trader prevent big losses in choppy markets, but unfortunately a lot of the time, especially if this kind of a regime persists for a while, the small losses add up across a number of trades (sometimes referred to as “death by a thousand cuts“).

And especially if you are short high interest rate currencies, the longer you have a trade on waiting for a move, the more carry you bleed.

Being a trader not only requires that you enter trades carefully when the risk/reward is in your favor, it also (and this is the hard part) requires that you stand aside, and not put on any trades when the environment is unfriendly.

Bloomberg has several screens that show you volatility for various crosses, and you can see this using indicators like Bollinger Bands as well, so you can determine which securities are ripe for a pop and perhaps trade those.