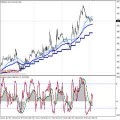

How to determine the market trend EASILY – This is the most recommended Multi Time Frame RSI Trading Strategy . Advanced Forex Multi Time Frame RSI Trend Trading Strategy filtered with Heiken Ashi and Bollinger Bands.

Multiple time frame analysis (MTFA) is the inspection of very basic trend indicators, starting with the largest trends and time frames, and working backwards down through successively smaller TFs to see how the smaller time frames and trends feed the larger TFs.

When the smaller time frames are in agreement with the larger trends you can enter a spot trade in the direction of the trend with very good safety.

If no trend exists on a particular currency pair the smaller TFs and trends will, at some point, build an uptrend or downtrend.

Forex Multiple time frame analysis (MTFA) RSI Trading is completely logical.

Forex MTF RSI Trading Rules

The principles of multiple TF analysis are also fairly simple and if used daily will help you to learn to trade the currency market and have a complete grasp of how it works.

When using multiple time frame analysis the smaller trends are used to enter the larger trends, if a trend is available, or to observe how the larger trends are built from the smaller TFs.

If a larger trend of Exclusive MTF RSI indicator is currently established on a particular currency pair you would enter the trade when the smaller MTF RSI trends and time frames are in agreement with the larger trends, the smaller TFs confirm the continuation of the established trend.

- Best Time Frame : 30 min , 60 min, 240 min;

- Recommended Markets : any

Metatrader Trading indicators

- Exclusive MTF RSI (5)

- TMA Bands

- Heiken ashi

- Signal Trend

- Bollinger Bands

- RSI (14)

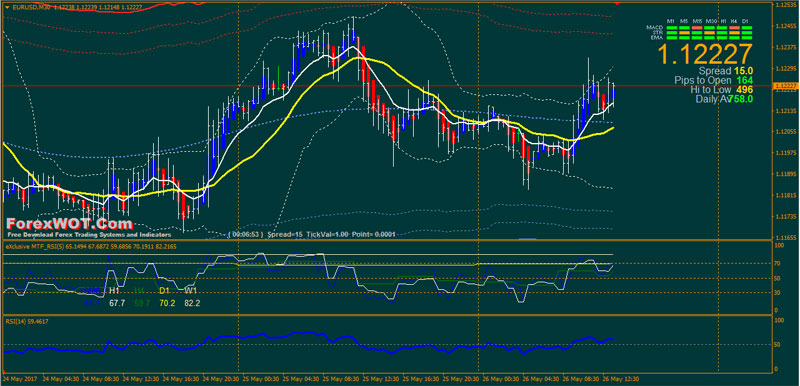

BUY Rules

- Exclusive MTF RSI (5) up trend and above 50 level

- RSI (14) up trend and above 50 level

- Heiken Ashi blue candles

- Price break upper band Bollinger Bands

- Signal Trend green bars

- EMA 10 upward above MA 20 midle Bollinger Bands

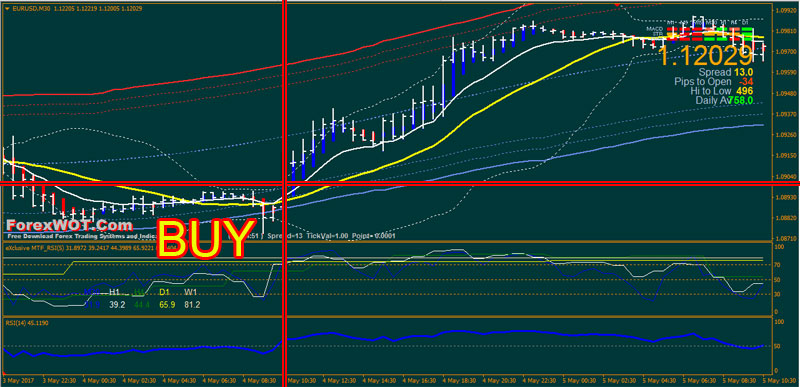

SELL Rules

- Exclusive MTF RSI (5) down trend and below 50 level

- RSI (14) down trend and below 50 level

- Heiken Ashi red candles

- Price break loweer band Bollinger Bands

- Signal Trend red bars

- EMA 10 down trend below MA 20 midle Bollinger Bands

EXIT Rules and Position

- Initial Stop loss 30 pips -50 pips depends by time frame.

- Profit Target 60 pips – 1000 pips.

Multi Time Frame RSI Trading Note

Every time frame has its own structure and is independent of the other TFs.

The higher time frames trends and the direction of the major trend always overrule the lower TFs.

The prices in the lower time frames tend to respect the energy points (support and resistance points) of the higher TF structure.

The support and resistance areas in the higher time frame can be validated by the action of lower TFs.