Key trend reversal indicator – High Accuracy Bulls and Bears Doji Transitional Candlestick Formation. A Doji is quite often found at the bottom and top of trends and thus is considered as a sign of possible reversal of price direction, but the Doji can be viewed as a continuation pattern as well.

A doji is a key trend reversal indicator. This is particularly true when there is a high trading volume following an extended move in either direction.

When a market has been in an uptrend and trades to a higher high than the previous three trading days, fails to hold that high, and closes in the lower 10% of that day’s trading range, there is a high probability of a downtrend in the ensuing days.

Likewise, when the market has been in a downtrend and trades to a new low that’s lower than the three previous trading days, fails to hold that low, and closes in the upper 10% of that day’s trading range, there is a high probability of an uptrend in the ensuing days.

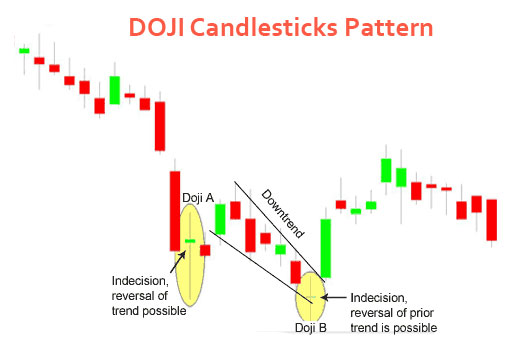

The chart below shows two examples of Doji’s:

In a Doji pattern, the market explores its options both upward and downward, but cannot commit either way. After a long uptrend, this indecision manifest by the Doji could be viewed as a time to exit one’s position, or at least scale back.

Similarly, after a long downtrend, like the one shown above of General Electric stock, reducing one’s position size or exiting completely could be an intelligent move.

It is important to emphasize that the Doji pattern does not mean reversal, it means indecision. Doji’s are often found during periods of resting after a significant move higher or lower; the market, after resting, then continues on its way.

Nevertheless, a Doji pattern could be interpreted as a sign that a prior trend is losing its strength, and taking some profits might be well advised.