A Trailing Stop is a stop that moves with the price. For instance, you bought a share at $100 and you set a trailing stop 5 dollars below at 95. As the price of 100 moves up, the stop moves a well.

So if the price moves to 110, the stop moves to 105. It only moves up, the trailing stop doesn’t move down. (Recommended Article : How to Get 200 Pips A Week Easily Use Bollinger Bands in Forex and Stock Trading)

How A Trailing Stop Works

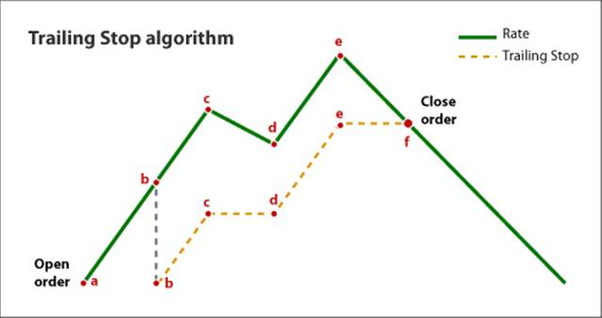

The picture below illustrates how a trailing stop works but I will describe a few of the details. You may set the stop to trail at a fixed percent or $ amount away from the price of the opening order.

For example, if I buy a share of Stock A at $100 and set a $5 dollar trailing stop here is what might happen.

- The price of stock A fall to $95 dollars and triggers a sell order.

- The price of stock A rises to $150 and the sell stop will be set at $145 and still move up with upward Stock A price movement.

- The price of stock A rises to $150 and then falls to $145 triggering a sell order.

What’s the most effective way to set a trailing stop in Forex?

This is completely dependant on the trading platform you use.

I use mt4 and I hate trailing stops… Let me tell you why.

Trailing stops on Meta Trader 4 gets set on the PLATFORM SIDE…not the brokers server!

This means that if you activate a trailing stop it will Only work when your mt4 platform is open and connected to the Internet.

It needs the Internet so that the platform can identify where price is and if adjustment of the stop-loss is needed.

Then only it sends the info through to the brokers server to do the adjustment.

For that reason, I PREFER MANUALY RETCHETING MY STOPS. This keeps me in control of. The trade and I can set things according to my rules.

Trailing stops also only activate on mt4 once your trade is in profit by the amount of points you have set it to.

So in other words, it only kicks in from your entry point.

This is why you should always use a HARDSTOP first and then activate a trailing stop, because your trailing stop might never actually get triggered.

I’ve seen many people lose a lot of money because they don’t understand how this feature actually works.

The best way to find out the appropriate level for your stops and way to manage them is dependent on your forex trading system and backtesting.

Trailing Stop Strategy

Most traders set their stop too tight at the start of the trade (being fearful of losing) and too loose at the end of the trade (being too greedy). If you think about it the opposite should be correct.

As a general proposition you ought to be greedy when others are fearful, and fearful when others are greedy.

Even backing your stop off a few pips at the start of the trade will increase win percentage markedly.

And at the end of the trade, you should be aiming to be out of the trade when the odds of further gains are balanced about 1:1 with the reduction in profit if your stop is hit. (Van K. Tharp’s idea actually)

What you need to do in a practical sense is do a “maximum favourable excursion” analysis of your trades, and see where it makes sense to start tightening your trail.

So for example, one of my systems I trail a very loose stop until the trade reaches 2R (2 times the distance from the entry point to the stop loss) and then trail a stop 1R from the maximum favourable excursion.

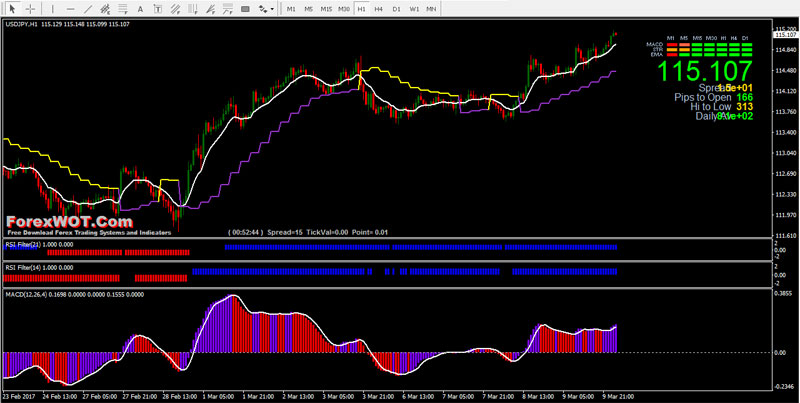

FREE DOWNLOAD High Accuracy Forex Moving Average Trading System for H1 Time Frame

ForexWOT.Com-H1MoVaTrendRSI is a Moving Average trading system for intraday trading based on Moving Average, RSI, and 3 Color MACD filter this is a momentum strategy with Low Risk trading approach and Buying/Selling on trend retracement in direction of trend.

Hope this helps