Forex trading strategy based on Chikou Span. The high accuracy 5 Chikou-Span Trading with Adaptive Gann High Low Activator.

5 Chikou Span is very important and easy to use.

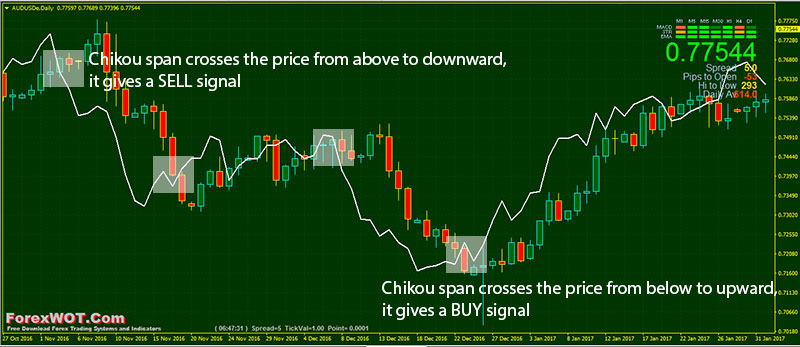

When Chikou Span crosses the price from below to upward direction, that is a BUY signal.

And when Chikou Span crosses the price from above to downward direction, that is a SELL signal.

In the below one picture there are 2 signals from the history :

- When 5 Chikou Span crosses the price from below to upward, it gives a BUY signal.

- And when 5 Chikou Span crosses the price from above to downward, it gives a SELL signal.

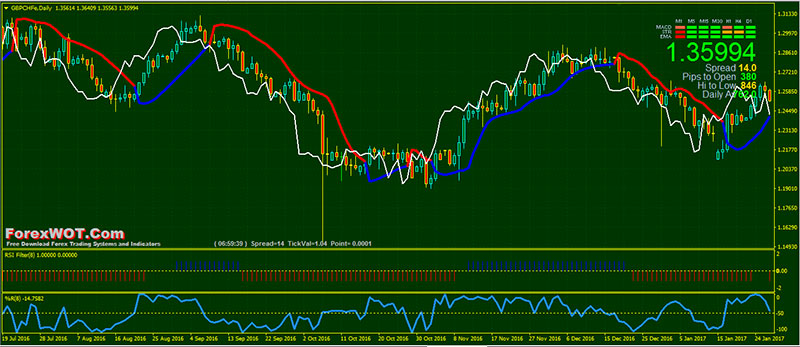

We can search for SELL signals if the 5 Chikou Span is below the price and search for BUY signals if the 5 Chikou Span is above the price.

The advantage of this forex trading strategy is very simple and clean.

This idea of trading can be improved with a filter system because of the Chikou-Span and Adaptive Gann High Low Activator are very good indicators.

- Best Time Frames: H1, H4, and Daily

- Most Recommended Currency Pairs: GBPUSD, EURUSD, AUDUSD, USDJPY, USDCAD, GBPJPY, EURGBP

- Chinkou Span

- Adaptive Gann High Low Activator

- RSI Filter

- Williams’ Percent Range

- 5 Chikou Span crosses the price from below to upward

- Adaptive Gann High Low Activator blue color

- RSI Filter blue color

- Williams’ Percent Range line upward and above -50

- 5 Chikou Span crosses the price from above to downward

- Adaptive Gann High Low Activator red color

- RSI Filter red color

- Williams’ Percent Range line downward and below -50

Another popular use of the 5 Chikou Span line is to help confirm points of possible SUPPORT or RESISTANCE.

The juxtaposition of the current trend against past price trends allows for an easier comparison of peaks and troughs.

Traders can then combine the Chikou with other momentum indicators (RSI and Williams’ Percent Range) to exit or enter positions for potential breakouts.