Alligator Hidden Divergence in Forex And Stock Market – Just like other high accuracy signals, this signal does not always appear all the time, but if it appears it means you have found the key to a treasure that you can immediately use to get as much profit as possible.

Therefore, you must understand this strategy perfectly because it can be the key to your success as a trader or investor.

So, let’s break it down step by step.

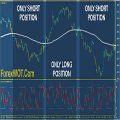

First, we need to identify the trend. the Alligator indicator simplifies this for us. If the price rises and is above the Alligator indicator, we focus on BUY trades exclusively.

Conversely, if the price falls below the Alligator indicator, we concentrate on SELL trades. These simple rules help simplify our trading decisions and maximize our chances of success.

The next thing you will look for once you have identified the trend direction is Hidden Divergences. and you will use RSI for this.

So price rises above the Alligator indicator, you will start looking for hidden bullish divergences. What this means is that the price sets a low and then a higher low, but the RSI indicator sets a lower low.

On this chart the price forms a higher low, but simultaneously, the RSI shows a lower value compared to the previous low. It is important to be patient at this stage, as future market movements are still unclear. Waiting for a clear entry signal is critical to making the right trading decisions.

Once you have pinpointed a valid bullish or bearish divergence, and all the necessary elements have been identified, it is time to wait for your entry signal. But what exactly is this signal?

You have several options to consider.

- 1st. The RSI has just crossed above the 50 line, indicating a potential entry point.

- 2nd. If you see a strong signal candle, such as Marubozu, Pin Bar, or Engulfing which is formed right around the Alligator indicator line. this could be further confirmation.

When these factors align, you get a confluence of signals, increasing the chances of a successful trade.

Once you have identified the entry signal, the next step is to set stop loss and profit targets. For a stop loss, you can set it just below the recent swing low or choose a method like twice the Average True Range (or ATR).

When using a wider stop loss, targeting 1.5 times the risk may be wiser. However, if you choose ATR twice, your stop loss will likely be closer, so you can target double or 3 times the risk. These decisions help manage risk and maximize profit potential in your trading strategy.

So, that’s the complete strategy laid out step by step.

- Download “ForexWOT-AlligatorHiddenDivergence” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-AlligatorHiddenDivergence.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-AlligatorHiddenDivergence” trading system and strategy.

- You will see the “ForexWOT-AlligatorHiddenDivergence” is available on your Chart.

Hopefully, this helps some of you out there in crafting your own system and shows you how to incorporate hidden divergences into your system.