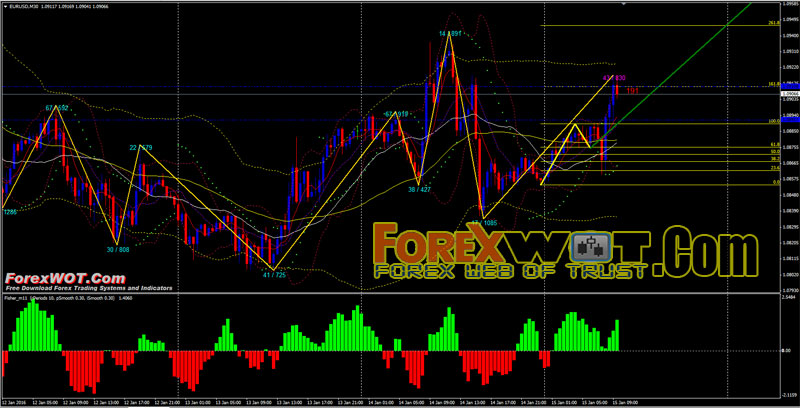

Price Action Forex Fibonacci Retracement Systematic Trend Following Trading Strategy – This intraday (M30) high accuracy forex trading system works also with higher time frame.

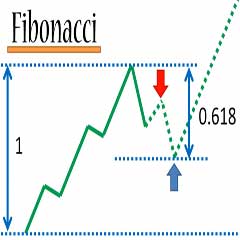

The Fibonacci retracement is the potential retracement of a financial asset’s original move in price. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction.

These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses.

The levels used in Fibonacci retracements in the context of trading are not numbers in the sequence, rather they are derived from mathematical relationships between numbers in the sequence.

The basis of the ‘golden‘ Fibonacci ratio of 61.8% comes from dividing a number in the Fibonacci series by the number that follows it.

The strategies forex traders employ using Fibonacci levels include:

- Buying near the 61.8% retracement level with a stop-loss order placed a little below the 38.2% level.

- Buying near the 100% level with a stop-loss order placed a little below the 61.8% level.

- When entering a sell position near the top of the large move, using the Fibonacci retracement levels as take profit targets.

- If the market retraces close to one of the Fibonacci levels and then resumes its prior move, using the higher Fibonacci levels of 161.8% and 261.8% to identify possible future support and resistance levels if the market moves beyond the high/low that was reached prior to the retracement.

NOTE : Don’t rely on Fibonacci alone…

Fibonacci can provide reliable trade setups, but not without confirmation.

Applying additional technical tools like MACD, Moving Average, Bollinger Bands, or stochastic oscillators will support the trade opportunity and increase the likelihood of a good trade. Without these methods to act as confirmation, a trader will be left with little more than hope of a positive outcome.