Forex Consistent Profits – The CCI approach is a retracement strategy used primarily for trend trading strategy. It is therefore import to find the markets current direction.

One of the hardest steps a trader must take before scalping their favorite Forex pair is creating a strategy. While strategies can range from the complex to the mundane, creating a plan for trading the market does not have to be needlessly complicated.

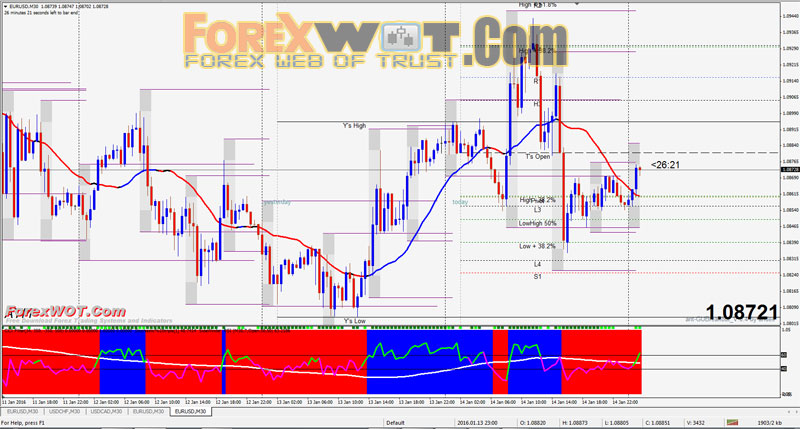

Today, we are going to review a simple Forex RSI and CCI Trading Strategy to Make Consistent Profits that can be used for scalping trending Forex currency pairs.

Forex RSI and CCI Trading Strategy is easy but high profits. I personally use blue (BUY) for Bulls and red (SELL) for Bears.

Best Time Frame : 15 minutes

Currency pairs : major.

We all know that a blue candle tells us that the Bulls have won those 15 minutes, and respectively a red candle tells us that the Bears have won.

So now looking back at the above chart, by using the 21 Simple Moving Average (SMA) we can establish that the directional momentum has turned in favor of the Bulls = going UP = inclining blue portion of the 21 SMA.

- Price above SMA 21 blue line,

- CCI Filter blue,

- Stochastic upward

- RSI green line and upward

- Price below SMA 21 red line,

- CCI Filter red,

- Stochastic downward,

- RSI magenta line and downward

I will now go over the Stop Loss (SL) and Take Profit (TP). Places the SL 2 pips below the lowest of the wicks of either the previous red candle (that was just eaten) or the blue candle you just entered on (regardless of what color it ended up closing as – useful to remember when back testing).

Generally though, I use and highly recommend a Script which I have hotkeys for to Enter trades with a 25 pip SL and a 50 pip TP already in place.

Note:

ONLY 1 or 2 TRADES are needed per trading session in order to achieve a 50 pip Target.

If you work like me, twice per day, then that gets you a nice 100 pips per day which is much more than most professionals have as their day target.

But I always say that anything over 30 pips is a good day. So if you have already secured 30 pips and no trades are showing up the way you want them to, you have nothing to worry about; even 30 pips per day adds up nicely in the long term especially when you start increasing your lot size per trade.