Parabolic SAR Trading System and Strategy – How to use the Parabolic SAR in Forex trading. Although it is important to be able to identify new trends, it is equally important to be able to identify where a trend ends.

One indicator that can help us determine where a trend might be ending is the Parabolic SAR (Stop And Reversal).

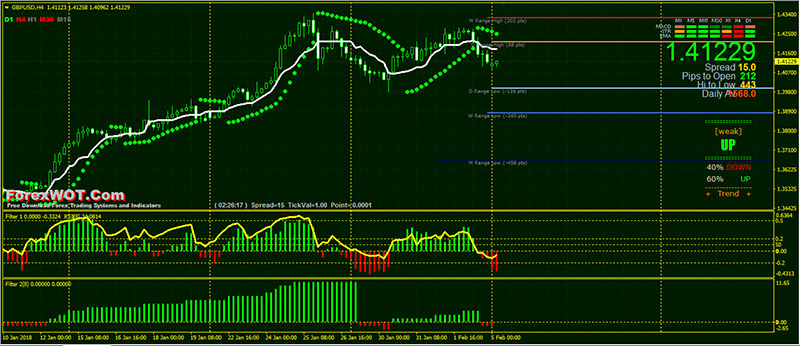

A Parabolic SAR places dots, or points, on a chart that indicate potential reversals in price movement.

The Parabolic SAR is not technically classified as an “oscillator”, but the indicator is often used with oscillators.

The parabolic “dots” are easy to interpret.

Each point represents a potential reversal in pricing behavior.

The dots appear BELOW price indicate an UPTREND and ABOVE them on a DOWNTREND.

The SAR indicator works best in trending markets but can give false signals in ranging sideways markets.

From the image below, you can see that the dots shift from being below the candles during the uptrend to above the candles when the trend reverses into a downtrend.

As with any technical indicator, a Parabolic SAR chart will never be 100% correct.

False signals can occur in ranging price behavior, but the positive signals are consistent enough to give a forex trader an “edge”.

Skill in interpreting and understanding SAR signals must be developed over time, and complementing the SAR tool with momentum indicators is always recommended for further confirmation of potential trend changes.

The combination of Parabolic SAR and Trend Momentum Filter indicators will give you accurate trend reversal setups.

This strategy can be used on any time frame on your chart.

So day traders, swing traders, and scalpers are all welcome to use this type of strategy.

- Parabolic SAR

- DWM Ranges

- Ichimoku Kinko Hyo

- Signal Trend

- Mint Signal 2

- Ferru FX Multi Info THV

- Filter 1

- Filter2

- RSI

- Price above Parabolic SAR and Thenkan-Sen Ichimoku Kinko Hyo

- Signal Trend and Mint Signal 2 green color

- Filter 1 and Filter2 green color bars

- RSI line upward and above 50

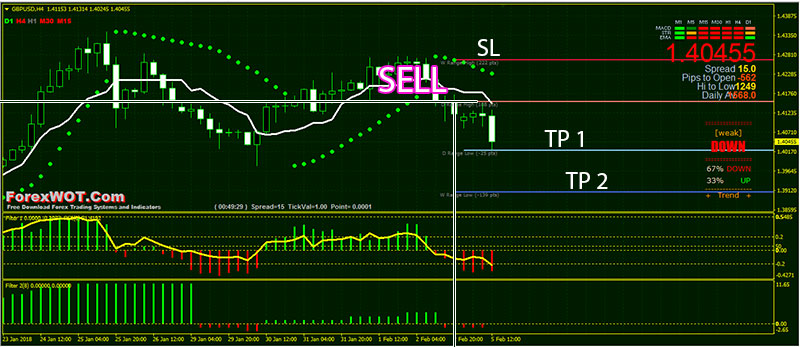

- Price below Parabolic SAR and Thenkan-Sen Ichimoku Kinko Hyo

- Signal Trend and Mint Signal 2 red color

- Filter 1 and Filter2 red color bars

- RSI line upward and below 50

As stated the ForexWOT Parabolic SAR Trading Strategy can be used on any time frame.

However, you should always check different time frames and look at what the market is currently doing.

No strategy can give you a 100% win ratio so always be placing your stops in the appropriate areas.

I would recommend practicing making both short and long trades with this trading strategy.