BEST High Profits Trading (How to Use Momentum Indicators to Confirm a Trend ) – Forex Multiple Momentum Trend Following Trading System Based Heiken Ashi, Momentum, Tenkan Sen – Kijun Sen, Bbands Stop and SS2009 indicators.

The Momentum indicator is regarded as an excellent gauge of market strength. A shorter period setting will create a more sensitive indicator, but will also increase choppiness and the potential for increased false signals.

Forex Multiple Momentum Trend Following Trading System

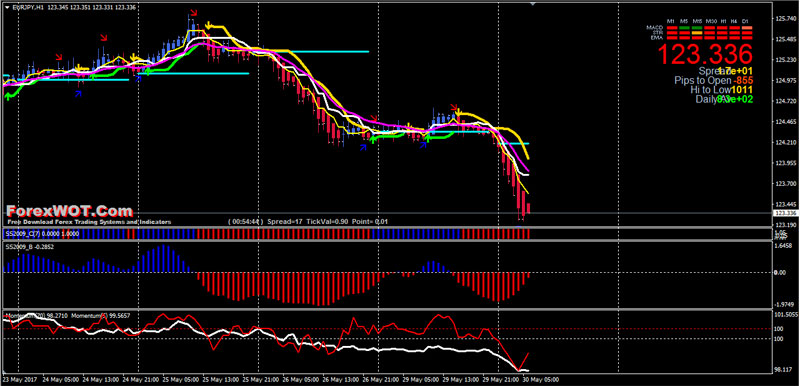

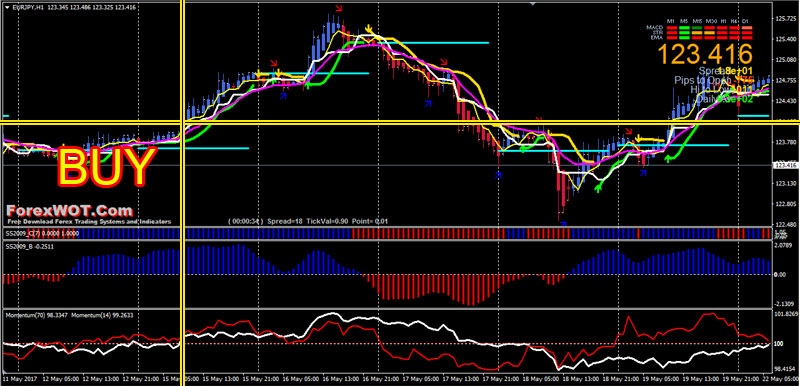

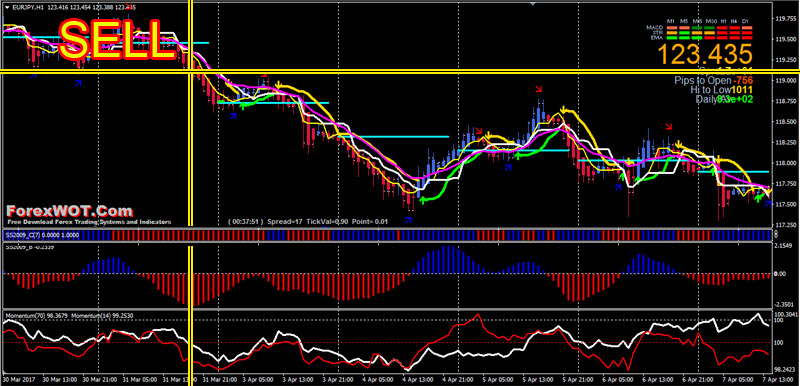

A shorter period setting will create a more sensitive indicator, but will also increase choppiness and the potential for increased false signals. The combination of the long period Momentum (70) and shorter period Momentum (14) is the success key of momentum trading strategy.

- Best Time Frame : 30 min or Higher

- Recommended Markets : any

Metatrader Trading Indicators

- Momentum (70) and Momentum (14)

- Heiken Ashi smoothed DM

- Ichimoku Tenkan-Sen and Kijun-Sen

- BBands Stop

- ExponentialMoving Average

- SHI Silvertrend sig alert (30, 9)

- SS2009 C (7- 50,6 )

- SS2009 B (period 15)

BUY Rules

- Momentum (70) and Momentum (14) upward and above 100 level

- Heiken Ashi Smooted DM blue bars

- Signal Trend green color

- Ichimoku Tenkan-Sen upward (yellow) above upward Kijun-Sen line (white)

- SHI Silvertrend sig alert arrows blue

- SS2009 B Blue bars

- SS2009 C Blue bars

SELL Rules

- Momentum (70) and Momentum (14) downward and below 100 level

- Heiken Ashi Smooted DM red bars

- Signal Trend red color

- Ichimoku Tenkan-Sen downward (yellow) below downward Kijun-Sen line (white)

- SHI Silvertrend sig alert arrows red

- SS2009 B red bars

- SS2009 C red bars

EXIT Rules and Positions

- Initial stop loss at the previous swing high/low

- Make profit is discretionary

Successful Money Management

Generally speaking, there are two ways to practice successful money management.

A trader can take many frequent small stops and try to harvest profits from the few large winning trades,

…..or a trader can choose to go for many small squirrel-like gains and take infrequent but large stops in the hope the many small profits will outweigh the few large losses.

The first method generates many minor instances of psychological pain, but it produces a few major moments of ecstasy.

On the other hand, the second strategy offers many minor instances of joy, but at the expense of experiencing a few very nasty psychological hits. With this wide-stop approach, it is not unusual to lose a week or even a month’s worth of profits in one or two trades.