Forex BULLISH BEARISH Price Action Candle Trading Strategy – Price action trading is most common among retail and institutional traders, although it’s becoming less popular with the rise of algorithmic and high-frequency trading.

Price action trading involves placing trades exclusively based on price action rather than fundamental or technical analysis.

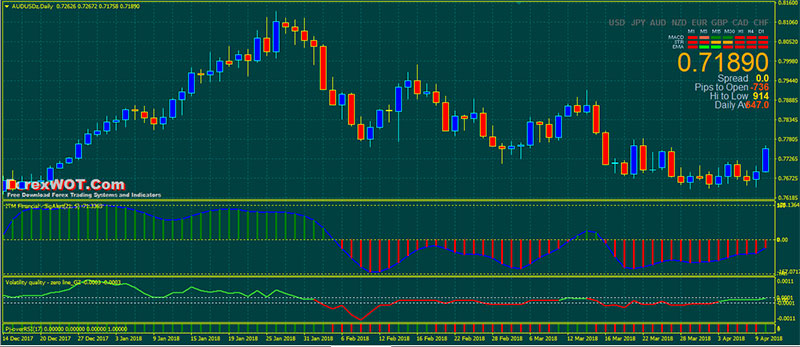

Best Time Frames: H4, and D1

Recommended Currency Pairs: Any

MetaTrader Trading Indicators

- Signal trend

- ++Power

- ITMF SigAlert

- Volatility Quality Zero Line GZ

- PJ Over RSI

BUY Rules

- BULLISH “Price Action” candle

- ITMF SigAlert green histogram

- Volatility Quality Zero Line GZ green line

- PJ Over RSI green bars

SELL Rules

- BEARISH “Price Action” candle

- ITMF SigAlert red histogram

- Volatility Quality Zero Line GZ red line

- PJ Over RSI red bars

Trading NOTES

- Put the initial stop loss above the previous BEARISH candle or below the previous BULLISH candle

- Risk Reward Ratio 1:2 or 1:3

- Move stop loss to break even when price moves by the amount your risked. But in my experience with this is that you tend to get easily stopped out with a loss