Super EASY and Highly EFFECTIVE Forex Binary Options Trend Following Trading System with MFI (Money Flow Index) and Double Bollinger Bands Stop Alert Indicator. The BBands Stop indicator (Bollinger Bands Stop line) is a trend indicator. When the price is over the green curve, the trend is bullish or bearish if the price is below its orange line.

It’s built with Bollinger bands phases and act pretty much like a Supertrend, the BBands stop line can also be used to determine stop-loss when you jump in a trend given by its signals (drawn with big “bullets” on chart).

In Forex and Binary Options trading, the BBands Stop binary indicator provides you with buy and sells areas.

- Look to buy Call options above the green BBands dots (bullish trend).

- Look to buy Put options below the orange BBands dots (bearish trend).

Bollinger Bands Stop Indicator for MT4 is best used on Higher timeframes but works on shorter TFs as well.

In Forex trading, Bollinger Bands Stop Indicator will show you where you should place your SL when entering the trade.

Additional to that it will show you how to use it as a trailing stop.

If following Bollinger Bands Stop Indicator with your SL then you have a greater chance to not get whipsawed and to take the most amount of profits before the trend reverses.

The Money Flow Index (MFI) is a momentum indicator that measures the inflow and outflow of money into a security over a specific period of time.

The MFI uses a currency price and volume to measure trading pressure. Because the MFI adds trading volume to the relative strength index (RSI), it’s sometimes referred to as volume-weighted RSI.

The value of the MFI is always between 0 and 100, and calculating it requires several steps. The developers of the MFI, Gene Quong, and Avrum Soudack, suggest using a 14-day period for calculations.

- Step one is to calculate the typical price.

- Second, the raw money flow is calculated.

- The third step is to calculate the money flow ratio using the positive and negative money flows for the previous 14 days.

The MFI (Money Flow Index) is a unique indicator that combines momentum and volume with an RSI formula. MFI momentum generally favors the Bulls when the indicator is above 50 and the Bears when below 50.

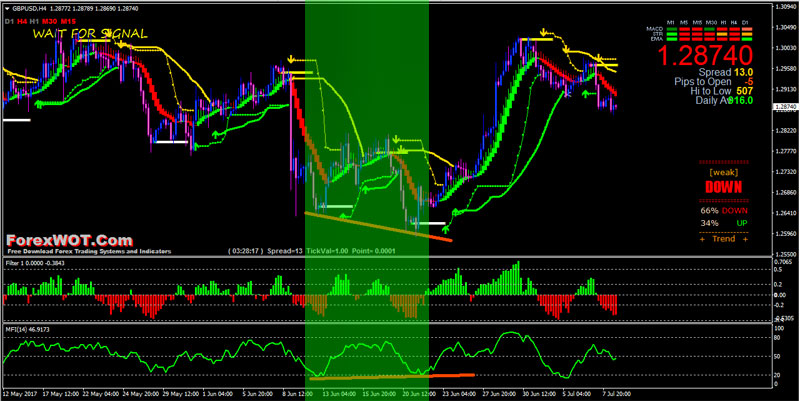

Forex & Binary Options MFI Trading System is a trend following trading system that Based on the MFI (Money Flow Index), Bollinger Bands Stop indicators and Filter indicators for filters the trading signals of Bollinger Bands Stop.

These SEFC10 and Filter 1 indicators repaint but MFI and Bollinger Band Stop alert indicator not repaint.

- Best Time Frames: 15 min, 30 min, 60 min, and higher

- Recommended Currency Pairs: EURUSD, GBPUSD, USDJPY

- MFI (Money Flow Index)

- Bollinger Band Stop alert indicator

- Mint Signal indicator

- SEFC 10 indicator

- Signal Trend

- EMA line upward and above 50 level

- Bollinger band stop alert indicator (buy arrow, green color)

- SEFC10 has formed a support line

- Filter 1 indicator, has green bars

- Signal Trend green bars

- EMA line upward and above 50 level

- Bollinger band stop alert indicator (buy arrow, green color)

- SEFC10 has formed a support line

- Filter 1 indicator, has green bars

- Signal Trend green bars

Using Money Flow Index Divergence Strategy

The MFI oscillator can be also be used to trade using divergences. The chart below shows the bullish and bearish divergences that are formed using the MFI oscillator and the buy/sell signals are taken accordingly.

Long positions can be taken when a bullish divergence is formed on the MFI with stops placed at the low and likewise, short positions can be taken when a bearish divergence is formed on the MFI with stops placed at the high.

Divergences are more easily spotted on the MFI as it also takes into account the volume which plays an important role.

While the setups are easy to spot, traders need to have enough practice in terms of spotting the divergences before they are able to trade with the MFI oscillator more effectively.