Gaining a fundamental understanding of the U.S. economy is a critical part of being prepared fundamentally for forex trading. The U.S. economy is still the largest developed economy in the world, and therefore the U.S. dollar reflects this importance.

Much of the world’s trade is denominated in dollars, and global reserves of central banks hold over US$4 trillion, which is about 60 percent of all reserves, according to latest data. It is true that we are in a period when the world economy is growing, particularly with the growth of Asia. This growth may mean that in the coming years,the preeminence of the U.S. economy will diminish.

However, as the U.S. economy remains the critical pivot point of the world economy, forex trading will continue to pay close attention to U.S.-based economic events. In particular, the forex trader, in trading a currency pair involving the dollar, is actually making a judgment or a bet about the direction of the U.S. dollar with regard to the other pair.

This can be a five-minute bet or one that goes substantially longer in duration. But the fundamental question the trader has to answer is whether to be bullish or bearish on the dollar for his next trade.

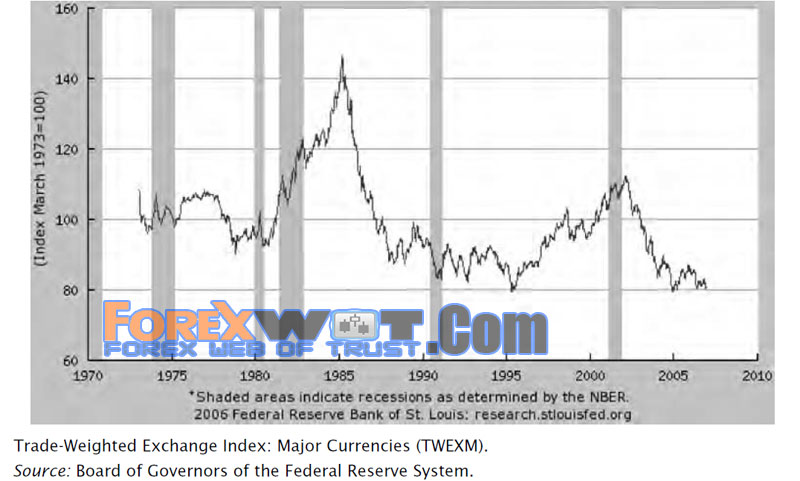

A first approach to getting a picture of the global position of the U.S. dollar and gauging whether it is strong or weak is by looking at the Trade-Weighted Index (TWI). In Figure below (Trade-Weighted Exchange Index: Major Currencies (TWEXM)) we can see that the “health” of the U.S. dollar has declined significantly. It is probing the lows of this index, and if it breaks below 80, the world, through global trading forces, will demonstrate an unprecedented decline in dollar values.

This 30-year chart certainly provides a perspective missing from day-to-day trading, but a forex trader can zoom in on the U.S. dollar performance by generating a nearerterm chart. For example, in Figure below (USDX Day Chart.), we see the U.S. Dollar Index–TWI recent patterns.

The trader can use this chart and generate strategies to prepare for future moves if they occur. The next time you are asked the question, “What do you think of the U.S. dollar?,” based on a review of Figure below (USDX Day Chart.), you can answer that the U.S. dollar is in a compressed triangle and that it is testing historic support near 80 on the TWI.

One can also go further and develop a trading strategy and state: “If it breaks below 80, I will be a seller of dollars, but if it stays above it, I will be a buyer.” This kind of strategy, which comes from a fundamental perspective but also reflects good technical strategy, is a recipe for success.

Gaining insight into the strength of the U.S. dollar can also be done by looking at the New York Board of Trade’s (NYBOT’s) U.S. Dollar Index (USDX). This index is traded at the NYBOT and is a weighted index. It is not trade weighted and therefore does not reflect the dollar’s strength or weakness in the context of global trading patterns. But the USDX is traded by major funds and is considered an important barometer of sentiment regarding the dollar. It can easily be tracked at www.ino.com. Let’s take a closer look.

The USDX has its own basket of currencies, just like the TWIs. But notice the differences in the weights between the USDX’s basket and the Federal Reserve’s in Table above (Trade-Weighted Exchange Index: Major Currencies (TWEXM)).

The question arises of which is better? The answer really depends on how you use it. The USDX is more popular and provides a trader an accepted way to track dollar sentiment, though it is less accurate from an economic point of view.

When the USDX is showing a dollar decline, it may be exaggerating the real decline from a global trading point of view. In Figure above (USDX Day Chart.), we can see that as 2006 ended, the dollar had retraced somewhat on better housing news and was testing a key 50-day moving average.The USDX chart provides a good way of checking dollar sentiment.

It should be clear that there are many ways to evaluate the dollar. In fact, new measures are always being introduced. Citigroup recently introduced its own dollar index called the Citigroup Flow-Weighted Index. This index scrutinizes international capital flows, which have become an important influence on forex.

Additionally, there is the J. P. Morgan Dollar Index, which looks at the dollar in terms of a basket of 18 currencies.The bottom line is that the forex trader has now an improved ability to answer the question of how well the dollar is doing in terms of its fundamentals by looking at the different TWIs of the dollar.

One of the fundamental variables that affect sentiment regarding the U.S. dollar is the fact that as a nation the United States has huge foreign debt. For example, economist David Levy said recently:

The current account deficit measures the difference between what U.S. residents spend abroad and what they earn abroad in a year. It now stands at almost six percent of GDP; total net foreign liabilities are approaching a quarter of GDP.

Sudden unwillingness by investors abroad to continue adding to their already large dollar assets, in this scenario, would set off a panic, causing the dollar to tank, interest rates to skyrocket, and the U.S. economy to descend into crisis, dragging the rest of the world down with it.

Another way to look at the current account deficit is that it reflects the excess of imports over exports. The question is: Why is there a current account deficit in the United States, and why do nations such as China have a current account surplus? The answer is that the fundamental personality of the U.S. economy is that it is the world’s greatest consumer economy.

The issue that is relevant for the forex trader is not the fact that there is a current account deficit; it’s the fact that it results in the U.S. Federal Reserve’s issuing notes to finance this deficit, and foreign ownership of these securities generates fear in the market. The fear is that if foreign investors of U.S. Treasury notes suddenly became unwilling to buy these notes, the U.S. economy would suffer. Here is what happened in 1997:

Foreign ownership of U.S. Treasury securities has often been the subject of considerable public debate. Discussion of this issue arises particularly at times of uncertainty about either the outlook for the exchange value of the dollar or the need for cash in countries holding large stocks of Treasury assets.

In June of 1997, for example, there was a flurry of activity in the U.S. financial markets when the Prime Minister of Japan, Ryutaro Hashimoto, suggested that Japan might find it necessary to sell some of its large Treasury holdings.

On the day following Mr. Hashimoto’s remarks, the Dow Jones industrial average fell by 192 points, its largest decline in a single day since the 508-point falloff on October 19, 1987. While the Prime Minster’s clarification of his remarks subsequently calmed the markets, it did nothing to alter the potential vulnerability of the U.S. financial markets to sudden decisions by foreign holders of U.S. debt to undertake large-scale sales of their dollar assets.

The U.S. Treasury issues a report called “Major Foreign Holders of U.S. TreasurySecurities (www.treas.gov/tic/mfh.txt). The fear that someday foreign ownership of U.S. Treasury securities will stop and cause interest rates to increase and destabilize the U.S. economy. The trader will find that this fear continues to resurface in newspaper headlines and will likely become part of the U.S. national political dialogue.

When the U.S. Treasury report comes out, it can move the forex market. We can see from the latest reports that the United States has over $2 trillion of foreign holders of U.S. securities (see Table below (Major Foreign Holders of Treasury Securities (Billions of Dollars)).

From a fundamental view, this is supportive of the dollar. We can see that the Organization of Petroleum Exporting Countries (OPEC) accumulates dollar surpluses from its petrodollars. It also purchased more U.S. treasuries.

Monitoring the levels of foreign owners of U.S. securities is an important part of sensing the true dollar sentiment in the world. Forex dollar bulls can point to the fact that essentially a consistent stream of buyers of U.S. treasuries has provided a floor against a steep and quick fall of the U.S. dollar.

Economists are in agreement that the effect of foreign purchasers of U.S. Treasury securities is to lower interest rates. Without such purchases, U.S. rates might be nearly 1 percent more. Here is how analysts at the U.S. Treasury Department portrayed risks to the United States related to foreign ownership of U.S. Treasury securities:

Treasury ownership by itself does not present a risk, but the “special” role of the dollar in private and official dealings has meant that:

- The dollar has been stronger.

- The trade balance has been weaker.

- Econometric evidence suggests that recent heavy central bank buying has helpedkeep interest rates low.

If the dollar’s role were to fade, interest rates would be pushed up and the dollardown:

- Central banks would diversify reserve currencies away from dollars.

- U.S. investors would increase exposure to foreign securities.

A decline in the role of the dollar, were it to occur, would likely be gradual . . .

- Central banks are very conservative by nature.

- The institutional structure of global trade payment system would change gradually.

. . . and thus does not present a risk of a sharp or destabilizing financialmarket event (www.treas.gov/offices/domestic-finance/debt-management/adv-com/minutes/mm-2005-q1.pdf).

In the long run, evidence exists that there is a trend toward diversification of foreign holders away from dollar assets. As other economies grow, the incentives to reallocate reserves away from U.S. dollar assets to more local assets will rise. Even rumors of such diversification lead to selling U.S. dollars in the market by traders who do not want to risk holding dollars. This has an effect of weakening support for the dollar.

Find the Top 10 Holders of U.S. Treasury Securities

Go towww.treas.gov/tic/mfh.txt and answer these questions:

- Has there been a change in the trend of foreign holders of U.S. Treasury securities?

- When is the next Treasury International Capital System report coming out?