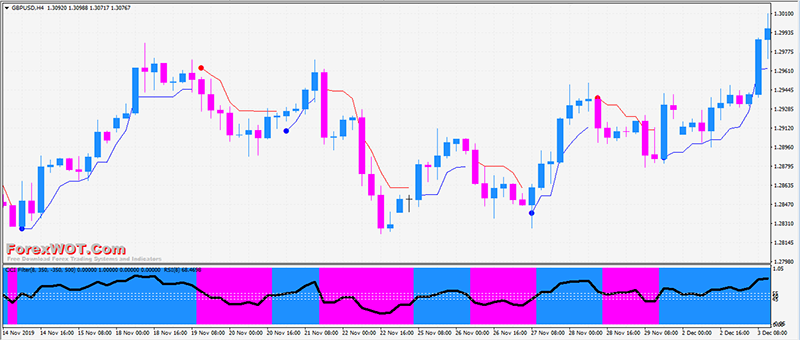

High accuracy Forex GBPUSD Volty Channel Stop “Daily Chart” Trading System with RSI and CCI Filter. One of the largest and most commonly traded currency crosses on the forex market is the British pound sterling to the United States dollar.

Today, we are going to review a simple Volty Channel Stop “Daily Chart” trading strategy to make consistent profits on the GBPUSD pair.

- Time Frame: Daily

- Currency Pair: GBPUSD

MetaTrader Trading Indicator

- Volty Channel Stop

- CCI Filter

- RSI

The Volty Channel Stop custom indicator is built on the Moving Average and the Average True Range (10) also known as the ATR MT4 indicators. This blend means this indicator is a perfect companion for a scalping strategy.

How to install “Forex GBPUSD Volty Channel Stop “Daily Chart” Trading System“

- Download “ForexWOT.Com-GBPUSDdailyChartSystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT.Com-GBPUSDdailyChartSystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT.Com-GBPUSDdailyChartSystem” trading system and strategy

- You will see “Forex GBPUSD Volty Channel Stop “Daily Chart” Trading System” is available on your Chart

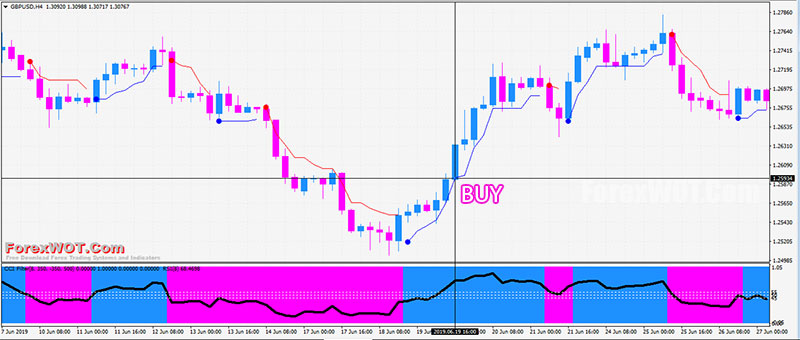

BUY Rules

- Volty Channel Stop: Blue line

- CCI Filter: Blue

- RSI: Upward and above level 55 line

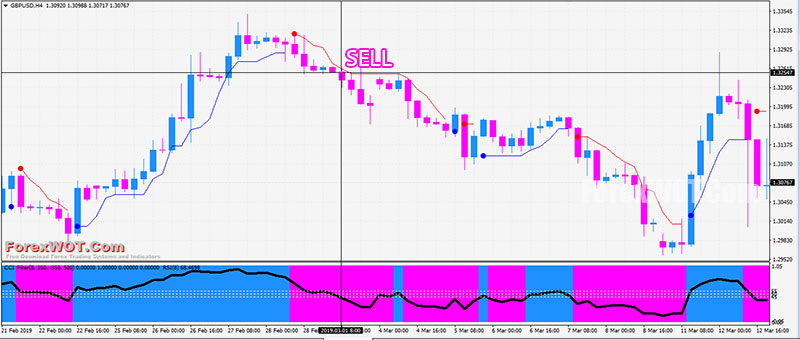

SELL Rules

- Volty Channel Stop: Magenta line

- CCI Filter: MAgenta

- RSI: Downward and below level 45 line

Trading NOTES

- Place stop loss ≥5-15 pips above or below the entry price.

- Risk to Reward Ratio = 1:2 or 1:3