Advanced Forex Laguerre RSI and CCI Woodies Trading Strategy – The strategy is based on the EMA, Heiken Ashi, Laguerre RSI and CCI Woodies indicators, which is generally used to identify cyclical trends in the futures markets.

What is Laguerre RSI with Laguerre filter – indicator for MetaTrader 4 ?…This is a Laguerre RSI with an addition of Laguerre filter signal line.

So, it is a sort of “all Laguerre” indicator. As an addition, a “no trade zone” can be displayed (for cases of market ranging, when the trading should be avoided).

One more deviation is added: The “speed”.

It can vary from 0 to 6. The smaller that “speed” the “slower” the Laguerre is. And vice versa.

That can help in keeping the smoothness of the calculating but without adding significant lag. Some experimenting is advised for parameters for different symbols.

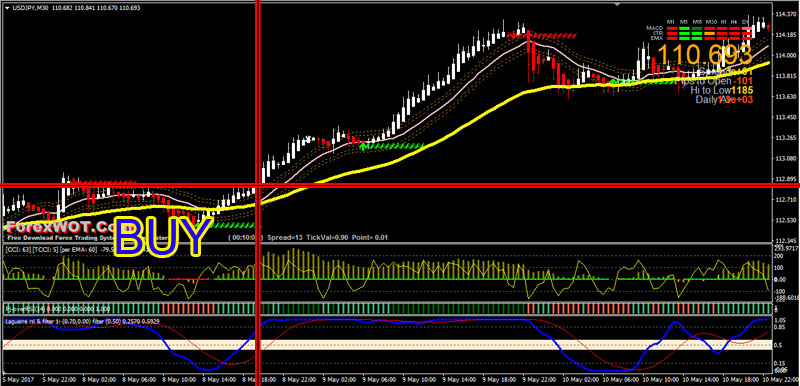

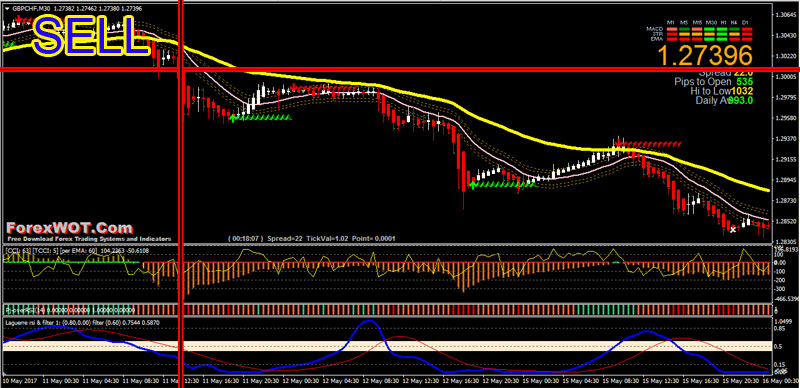

Forex Laguerre RSI and CCI Woodies Trading Rules

Forex Laguerre RSI and CCI Woodies Trading Strategy is a trend following strategy based on the Laguerre RSI with Laguerre filter, CCI Woodie, EMA, and Heiken AShi.

- Best Time Frame : 30 min or higher

- Recommended Currency Pairs : Major pairs.

Metatrader Trading Indicators

- Laguerre RSI with Laguerre filter

- CCI Woodies (63, 5 , 25, 60, 0)

- EMA 50

- Moving Average Weighted (20 periods, open with levels ( 60 -60, 90, 90)

- Heiken aschi

- PJ-Over RSI (28, levels 70, 30,)

- ArrZZX2

- Signal Trend

BUY Rules

- Laguerre RSI with Laguerre filter upward above “no trade zone”

- CCI Woodie green bars above 0 level

- CCI Woodie line (upward and above 0 level)

- P-J over green color

- Heiken Ashi white candles above the 20 Linear Weighted MA upper band channel

- 20 Linear Weighted MA band channel upward above EMA 50 line

- ArrZZx2 green stras below the candles

SELL Rules

- Laguerre RSI with Laguerre filter down below “no trade zone”

- CCI Woodie red bars below 0 level

- CCI Woodie line (downward and below 0 level)

- P-J over red color

- Heiken Ashi red candles below the 20 Linear Weighted MA lower band channel

- 20 Linear Weighted MA band channel downward below EMA 50 line

- ArrZZx2 red stras aove the candles

EXIT Rules

- Place stop loss on the previous swing

Use Stop Loss orders – Stop loss orders automatically close a trade that has lost a certain amount.

By putting stop-loss orders in place, you’re ensuring that, even if you don’t get to it in time, you won’t lose more than you can afford (or that your strategy can afford). These are called physical stop-loss orders.

Mental stop-loss orders are those you place when you get the “feeling” that things aren’t going your way.

There are some very intuitive traders whose feelings are always right.

But in general, unless you have very good evidence to back you up, stay away from making uncalculated judgements. They’re almost always emotional.