Head and Shoulders Trading System – The head and shoulders chart pattern is a reversal pattern and most often seen in uptrends.

Today I’m going to show you step-by-step how to trade the head and shoulders pattern.

This is not a guide for the advanced traders only. I’m a big believer in keeping things simple. So whether you’re just starting out or a seasoned pro, you’re going to love this guide.

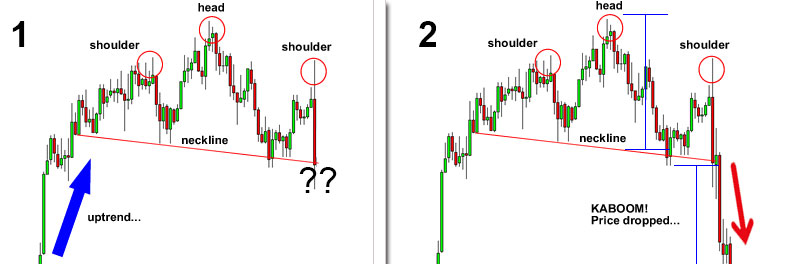

A “head and shoulders” pattern is also a trend reversal formation.

It is formed by a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder).

All price action carries with it a message. Some messages are easier to read than others, but they’re always present.

Concerning the head and shoulders pattern, the message is that buyers are tiring and that you’d best prepare for a potential reversal.

But what is it about the pattern that causes the market to reverse?

How can a few simple swing highs accomplish this?

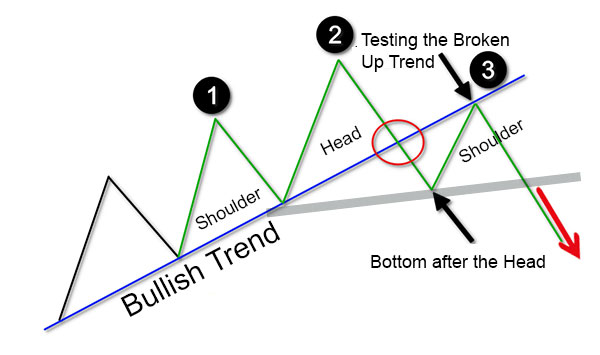

The head and shoulders reversal doesn’t work because of the pattern itself. It works because of the way in which the highs and lows develop and interact with each other at the top of an uptrend.

Always remember to keep it simple. All we’re doing here is identifying a potential shift in trend by focusing on the relationship between highs and lows.

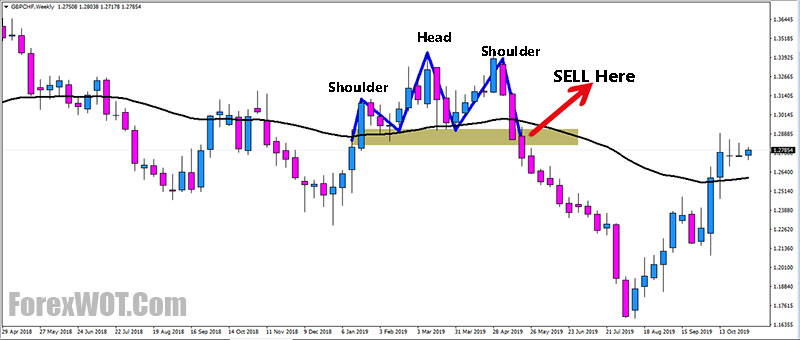

- The Head and Shoulders pattern is one of the most reliable chart patterns in Forex.

- It forms during a bullish trend and has the potential to reverse the uptrend.

- The name of the Head and Shoulders pattern comes from its visual structure – two tops with a higher top in between.

- The H&S pattern consists of three tops:

- The first top should be found in the context of a bullish trend.

- The second top should be higher than the first top.

- The third top should be lower than the second top and should be approximately on the same level as the first top.

- To trade the Head and Shoulders chart pattern you should apply the following rules:

-

- Identify a valid H&S pattern and draw each of the three tops that form the pattern.

- Apply a neckline through the two bottoms at the base of the head.

- Identify a Head and Shoulders breakout. Open a short trade when the price action breaks the neckline downwards.

- Put a stop loss above the second shoulder – the top prior to the neckline breakout.

- Stay in the trade for a minimum price move equal to the size of the pattern – the distance between the tip of the head and the neckline.

- You can stay in your trade longer and use price action clues to exit if you expect additional gains from your H&S trade.

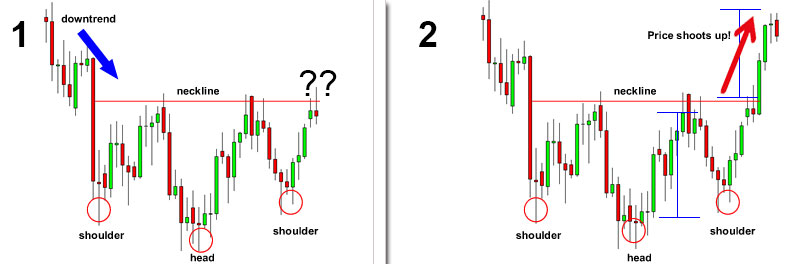

- The Head and Shoulders chart pattern has its opposite equivalent – the inverse Head and Shoulders pattern.

-

- The inverted H&S pattern could be found during a bearish trend and it is expected to reverse the downtrend.

- The Inverse H&S pattern requires analyzing bottoms to confirm the formation.

- The neckline should go through the two tops that are immediately before and after the head formation.

- The stop-loss order should be placed below the bottom, which corresponds to the second shoulder on the chart.

- Determine your price target using the Measured Move rule.